Six strategies for investing in a rising interest rate environment – sorted from Absolutely Terrible to My Personal Favorite.

Blog

Bogleheads® Live ep. 12: Robin Wigglesworth on the history of index funds

Robin Wigglesworth discusses the history of index fund investing.

Bogleheads® Live ep. 11: #FIRE Taxes; Tax Planning for Early Retirees

Sean Mullaney and Cody Garrett answer audience questions about taxes in early retirement.

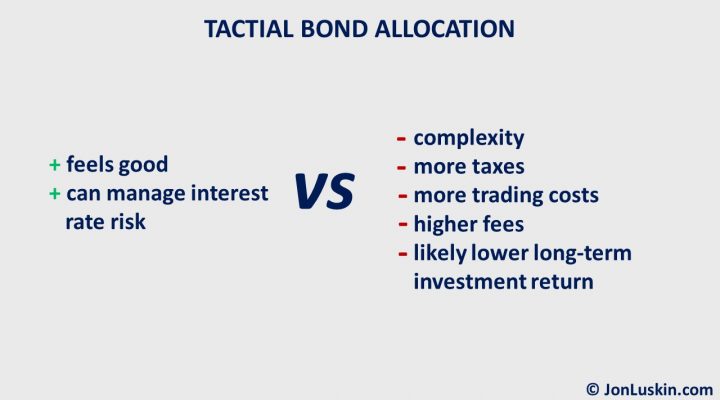

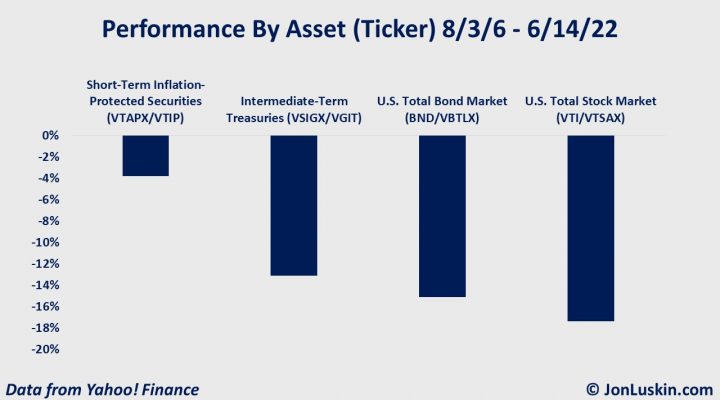

Should I Invest in Bonds When Interest Rates Are Rising?

Given losses in the bond market, should investors reduce the amount invested in bonds – or sell off bonds entirely?

Bogleheads® Live ep. 10: Paul Merriman on small-cap value investing

Paul Merriman answers questions about small-cap value investing.

Bogleheads® Live ep. 9: Mike Piper on Social Security

Mike Piper, CPA answers questions from the Bogleheads ® on Social Security, investing, and more.