Tax-loss harvesting Treasury bond index funds is possible given losses over the last 12 months; Vanguard’s Intermediate-Term Treasury fund (VGIT) has lost more than eight percent (8%+) of its value. Long-term investors not phased by this short-term volatility can benefit from tax-loss harvesting. By selling an investment at a loss, these investors earn a tax deduction. To avoid market timing, they can purchase a similar investment to what they sold.

In deciding to tax-loss harvest, investors should consider current and (possible) future tax brackets. That can help them consider if it makes sense to not tax-loss harvest at all.

T>Tax-Loss Harvesting Best Practices

Any replacement investment cannot be “substantially identical.” Otherwise, investors risk running afoul of the wash sale rule, and no longer qualify for a tax deduction.

For example, investors looking to tax-loss harvest cannot sell the Vanguard Intermediate-Term Treasury ETF (VGIT) and immediately repurchase it within 31 days. Similarly, those investors cannot purchase the mutual fund version—the Vanguard Intermediate-Term Treasury Index Fund Admiral Shares (VSIGX). For those consistently making new purchases, know that “the wash-sale period is 61 days, consisting of the 30 days before to 30 days after the date of sale.”

To avoid a replacement investment qualifying as substantially identical, Rick Ferri makes two suggestions:

- Use a replacement fund from a different fund company (i.e., if selling VGIT, buy a replacement fund that is not from Vanguard).

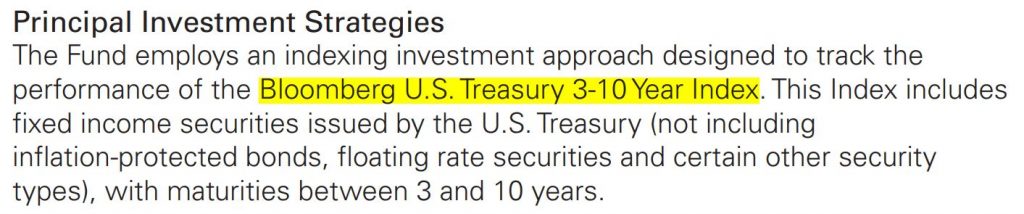

- Use a replacement fund that tracks an index from a different index provider (i.e., if selling VGIT, buy a replacement fund not using the Bloomberg Barclays U.S. Treasury 3-10 Year Bond Index, or any Bloomberg Barclays U.S. Treasury Bond Index).

Also, consider that nothing is guaranteed. Even if abiding by the above, you may still find yourself tripping the wash sale rule given the facts and circumstances.

Treasury Fu>Treasury Funds for Tax-Loss Harvesting

llowing Rick Ferri’s advice, investors looking to tax-loss harvest VGIT may wish to avoid purchasing the following as replacements:- Schwab Intermediate-Term U.S. Treasury ETF (SCHR)

- SPDR® Portfolio Intermediate-Term Treasury ETF (SPTI)

- Fidelity® Intermediate Treasury Bond Index Fund (FUAMX)

Both SCHR and SPTI track the same Bloomberg Barclays U.S. Treasury 3-10 Year Bond Index as VGIT.

FUAMX tracks a variation of the Bloomberg Barclays index—the 5-10 Year U.S. Treasury Bond Index. Another strike against FUAMX is that it is a mutual fund. Holding a mutual fund in a taxable account means forfeiting the greater tax efficiency of ETFs.

In short, the three funds above aren’t ideal as replacement positions if tax-loss harvesting VGIT or each other. That leaves one remaining candidate for tax-loss harvesting Treasury index funds—iShares® ETFs by BlackRock.

iShares Treasury Bond >iShares Treasury Bond Index ETFs

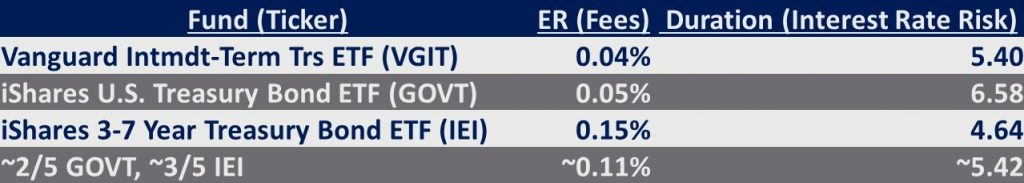

sury ETFs track different indices from the other Treasury index funds listed above. The iShares Treasury Bond Index ETFs use the ICE U.S. Treasury Bond Index Series.IShares has multiple Treasury index funds, each targeting a different maturity. Three iShares Treasury index ETFs, in particular, are candidates for tax-loss harvesting VGIT (or the Treasury index funds by Schwab, SPDR, and Fidelity listed above):

Interest Rate Risk Whe>Interest Rate Risk When Tax-Loss Harvesting Treasury Bond Index Funds

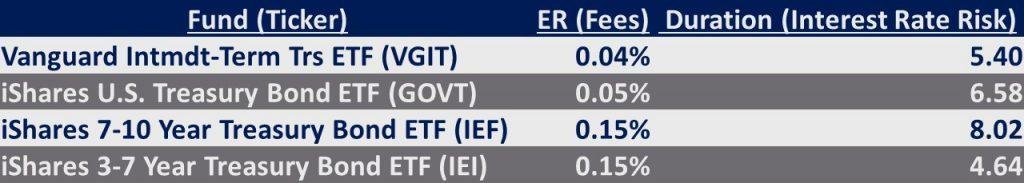

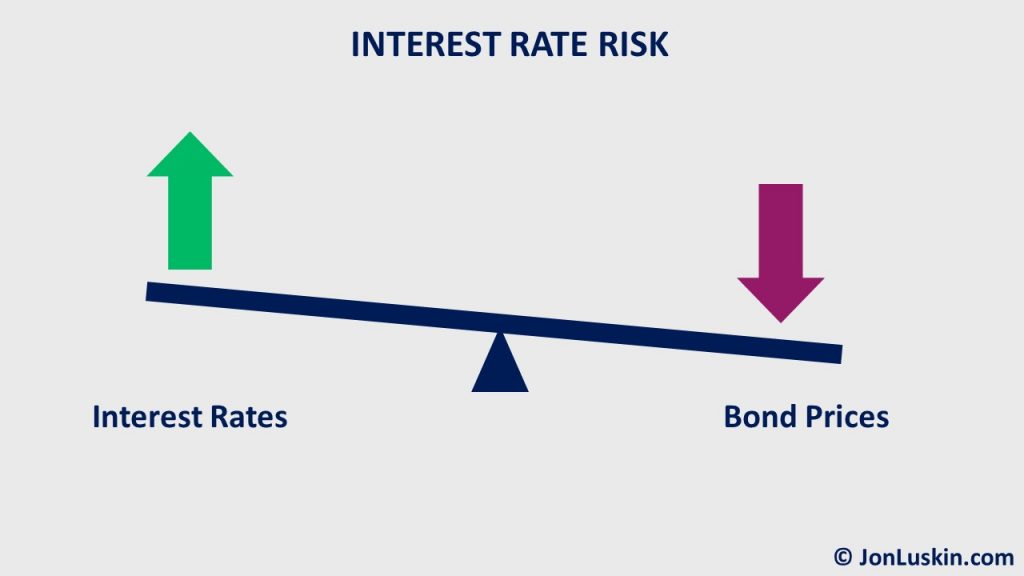

about bonds would be complete without considering duration, a measure of interest rate risk. Duration tells bond investors how much they stand to lose in the short-term, when interest rates increase.

Investors holding relatively longer maturity bonds stand to lose more money in the short term when interest rates rise. However, in the long term, they may make that money back and then some, by earning more interest.

As measured by duration, using the iShares U.S. Treasury Bond ETF (GOVT) as a replacement fund for VGIT means greater interest rate risk. On the other side of the interest rate sensitivity spectrum is the iShares 3-7 Year Treasury Bond ETF (IEI). With a smaller duration than even VGIT, IEI is less sensitive to interest rates.

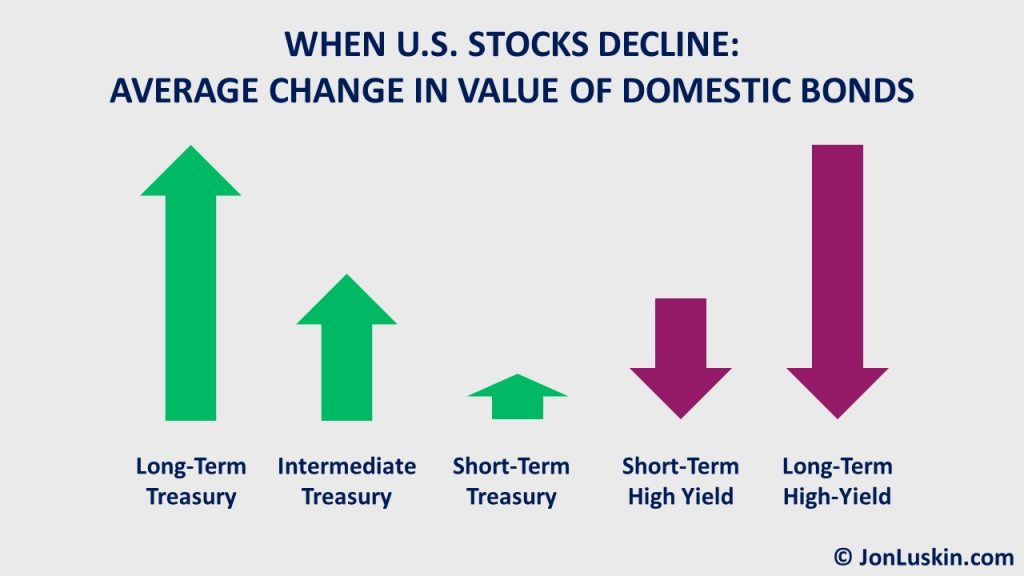

In the short term, IEI will do better if rates rise. (Yet, the shorter maturity likely means less portfolio protection during the next inevitable market correction). Also, IEI has an expense ratio of 0.15%. That’s pricey relative to VGIT and GOVT.

There’s another reason to consider longer-maturity Treasuries—they have historically done better during market panics. This makes longer-term Treasuries a valuable portfolio diversifier.

Moving from VGIT to IEI now is market timing, as that move would mean going from a relatively longer to a relatively shorter bond fund after interest rates have increased. Any good Boglehead knows that market timing is a fool’s errand. (The sin of market timing applies to not just the stock market, but the bond market and interest rates, too.)

As a final and more complicated option, investors can hold a combination of two funds to replicate better a previous holding of VGIT or similar fund using the 3-10 Year Bloomberg Treasury Index. Unfortunately, that solution is more complicated than simply holding GOVT alone. In addition to that complexity, investors would pay a higher expense ratio for those two funds, more than twice that of simply holding GOVT exclusively.

o o o

With increasing interest rates pushing bond prices down over the last 12 months, investors can tax-loss harvest their bonds. Those opting for the highest quality bonds available (Treasuries) can swap from the iShares series of funds to another line of funds and vice versa. With the iShares series of Treasury funds using a unique bond index (compared to every other low-cost Treasury bond index fund), tax-loss harvesting from or into the iShares funds may be an investor’s best option for complying with the substantially identical provision to avoid the wash sale rule.

Originally published on February 14th, 2022 – this post was updated on April 11th, 2022.

Disclaimer: For education and entertainment purposes only. Not specific investment advice. Confer with your tax and investment professionals before making any investment decisions.

Nice article. Curious if you considered partnering VSIGX with VFIUX. To my mind they are substantially identical Int-Term Treasury funds, even though the latter is actively managed and the former is passive. Or is that a substantial enough difference?

Greetings DW,

Thanks for a great question.

While those two funds have similar maturities/duration, the catch is that VFIUX is a mutual fund without an ETF sibling. That means it may end up distributing more capital gains than a tax-efficient ETF, or mutual fund with ETF sibling – as is the case with VSIGX, and it’s sibling being VGIT.

That is to say, tax-loss harvesting from VSIGX/VGIT into VFIUX – while it would likely avoid the substantially identical rule, as one fund is active while the other is passive – can mean end up paying more in lifetime taxes, given the tax-inefficient structure of a conventional mutual fund.

I hope that helps. 🙂

Best wishes,

Jon