Jonathan Clements is the founder and editor of HumbleDollar. He’s also the author of a fistful of personal finance books, including ‘My Money Journey.’

Real Estate Investing

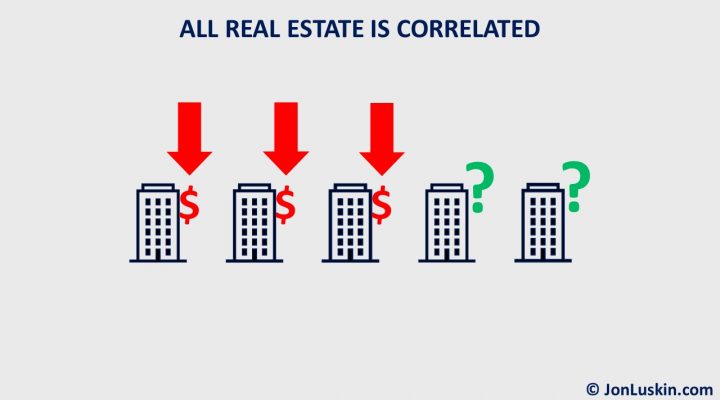

Everything is Correlated: Debunking the Sales Pitch of Private REITs, Syndicates, and Other High-Fee Real Estate Funds

Twice now, clients have shown up for a portfolio review when holding Blackstone’s REIT fund. Depending on which version of this fund you have, you may pay between 1.25% and 1.50% in annual fees. That outrageous fee is in addition to a 12.5% performance fee for returns over five percent. Said simply: it’s expensive. Given […]

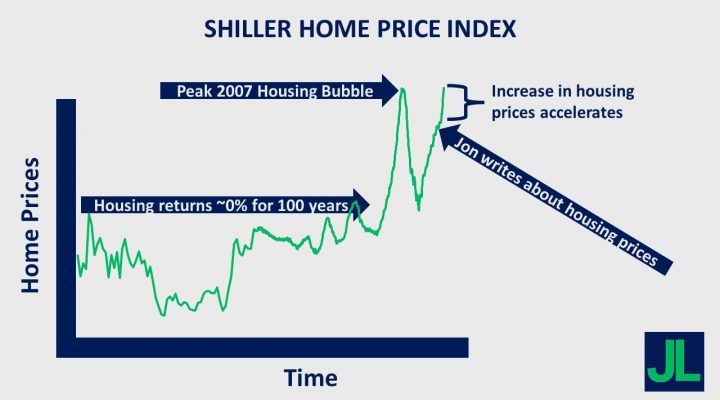

Future Housing Returns are Stark

In the June 2021 issue of the Financial Planning Association’s Journal of Financial Planning, I wrote a short piece on housing. In the article, I pointed to the rise in prices. I argued that while housing has done well over the last couple of decades, that trend may not continue. Given that uncertainty, funding retirement […]

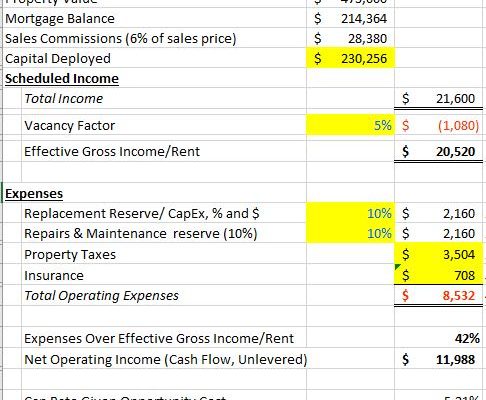

Is My California Rental Property Good for Retirement Income?

Here’s Nabeel’s question about his California rental property: I need some advice on my real estate investment. I have a rental property in a Los Angeles suburb with the following information: Metric $ / Date Original Loan Amount $249,000 Current Principal Balance $214,363 Interest Rate 4.25% Loan Origination Date 12/20/2017 Maturity Date 01/20/2033 Gross Rent, […]

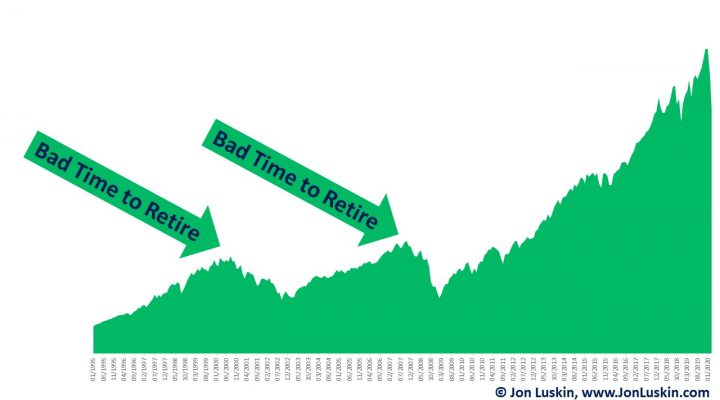

Direct Real Estate for Cash Flow in Retirement

In a previous post, I discussed how stock market investing was superior to California real estate investing. This conclusion was based on the investment returns available with each strategy; in a flat out annualized returns vs. annualized returns comparison, the stock market outperformed. (Even in a successive analysis that considered leverage, stock market investing was […]

Rental Real Estate Investing Across the United States

Previously, I wrote that stock market investing has historically outperformed rental real estate investing in California. (This is even the case when considering leverage: California rental property underperforms the stock market.) This conclusion applies not just to real estate in California, but anywhere with dense populations. This is because high population density creates a high […]