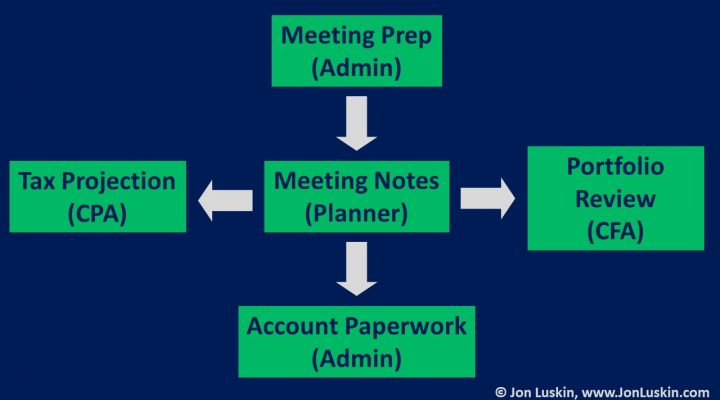

Recently, I was able to connect with a fellow advisor. Our topic of conversation was managing firm processes. “What is the best way to stay on top of a client task?” he asked. That’s an easy answer: a well-implemented customer relationship management (CRM) tool. It doesn’t matter if you’re using JunXure Cloud, Redtail, or even […]

Practice Management

Review: Kitces.com Member Section for Continuing Education (CE) Credit for Financial Advisors

In a pre-pandemic world, continuing education (CE) credits were easy to acquire. If you attend enough events, conferences, etc., it was impossible to not collect sufficient CE to renew your various certifications. That’s because CE credits to maintain one’s CERTIFIED FINANCIAL PLANNERTM (or other) designation were available at local and national Financial Planning Association (FPA) […]

FPA NexGen Gathering is a Must

All young financial planners need to go to the Financial Planning Association (FPA) NexGen Gathering. That’s just my opinion. But, bear in mind, I’ve been to a handful of conferences: Bogleheads® Conference Ritholtz’s Evidence-Based Investing (EBI) West FinCon FPA Minnesota Symposium JunXure’s conference many Dimensional Fund Advisors (DFA) events a handful of Fidelity events the […]

Buying Four Books of Business: Interview with Richard Fogg

Richard Fogg is President of Pacific Coast Financial Planning Group, an Ameriprise Advisor firm. In his 20 years of experience in the financial services industry, Richard has purchased four distinct financial advisor client books – and has even sold a portion of his own client book as well. In my interview with Fogg, I learned […]

Succession Planning Case Study: Bradley Shammas

Bradley Shammas’s began his career at Conaway & Conaway. There, he worked for six years as a paraplanner. Conaway & Conaway sold a variety of commissioned financial products. They also charged financial planning for a fee. The firm hit an issue with compliance that required a break-up of the company. As part of that break-up, Shammas launched […]

Onboarding New Clients from an Exit Plan

If buying a book of business from retiring advisor interests you, know that there are many stages in the Exit planning process: Prospecting for your target acquisition (i.e. go find an advisor looking to retire!) Agreeing to the terms of the sale structure Executing the terms of the deal (i.e. bringing the new clients into […]