Wes Crill answers questions about factor investing: pursuing the small & value premiums for the chance to earn a higher investment return.

Blog

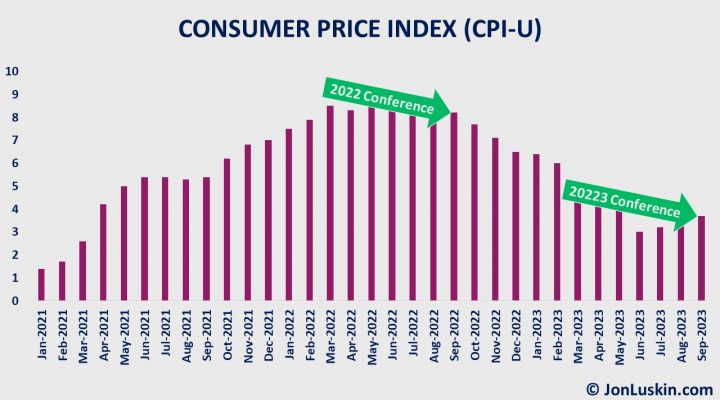

‘TIPS Ladder Mania at the 2023 Bogleheads Conference’ or ‘Stay the Course’

Though a TIPS ladder may be fine, it can be a distraction for the long-term investor. Generally, you’ll want to ‘stay the course.’

Bogleheads on Investing 62: Steve Chen on DIY Retirement Planning Tech

Steven Chen answers questions from the Bogleheads® community about do-it-yourself retirement planning technology.

Bogleheads on Investing 61: Cody Garrett on Early Retirement

Cody Garrett answers questions about early retirement.

Bogleheads on Investing 60: Jonathan Clements on “My Money Journey”

Jonathan Clements is the founder and editor of HumbleDollar. He’s also the author of a fistful of personal finance books, including ‘My Money Journey.’

Bogleheads on Investing 59: Dr. William Sharpe

Nobel laureate Dr. William Sharpe answers questions on investing.