Rick Ferri, CFA, fields live audience questions on asset allocation, discussing the difference between one’s investing philosophy and their strategy, and more.

Blog

Bogleheads® Live Ep 1: Introducing the Bogleheads®

Rick Ferri, CFA, fields live audience questions on asset allocation, discussing the difference between one’s investing philosophy and their strategy, and more.

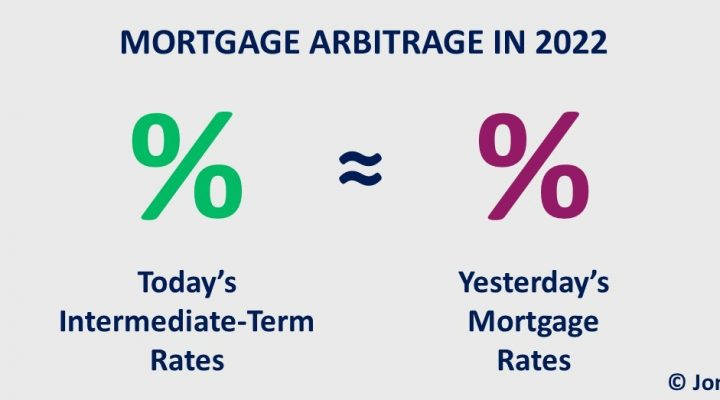

Should I Prepay My Mortgage If Interest Rates Are Increasing?

Calculations are needed to find out if making money by not prepaying a mortgage, but using cash to invest instead – would be profitable.

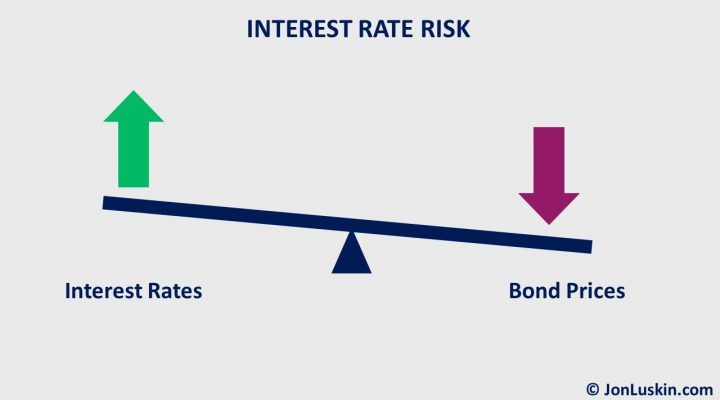

Tax-Loss Harvesting Treasury Bond Index Funds in 2022

Over the last 12 months, Vanguard’s Intermediate-Term Treasury fund (VGIT) has lost more than five percent (5%+) of its value. Long-term investors not phased by this short-term volatility can benefit from tax-loss harvesting.

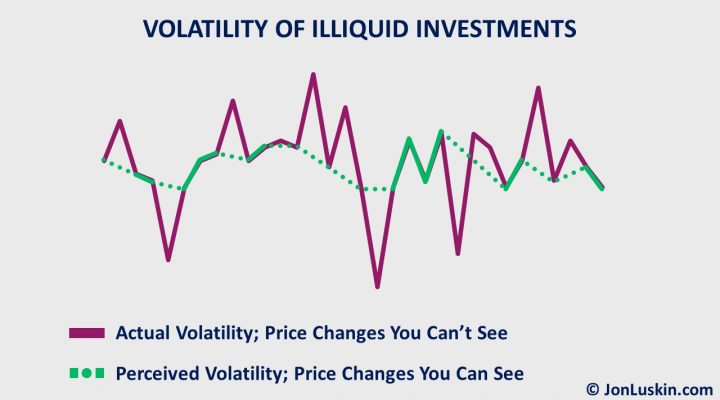

The Diversification Myth of Alternative Investments: How Illiquidity is Mistaken for Low Correlation

Alternative investments are investments that are not stocks, bonds, or cash. The list of alternatives is endless: real estate, hedge funds, private equity, venture capital, timberland, fine art, farmland, reinsurance, private lending, and more. Alternatives are often pitched as a magical way to diversify an investment portfolio. They are said to be immune from the […]

Everything is Correlated: Debunking the Sales Pitch of Private REITs, Syndicates, and Other High-Fee Real Estate Funds

Twice now, clients have shown up for a portfolio review when holding Blackstone’s REIT fund. Depending on which version of this fund you have, you may pay between 1.25% and 1.50% in annual fees. That outrageous fee is in addition to a 12.5% performance fee for returns over five percent. Said simply: it’s expensive. Given […]