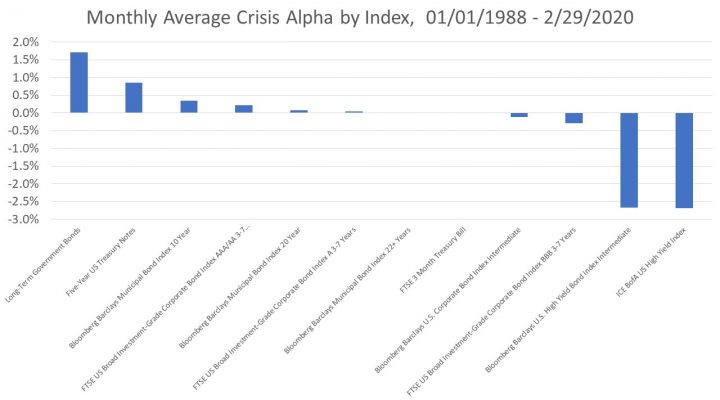

Ah, bonds. They’re quite the investment instrument. In a world of volatile stocks, bonds offer safety of principal – at least if you’re doing it right. That means shunning corporate bonds in favor of Treasury bonds, which includes shunning high-yield bonds. Yes, Treasury bonds are where the safe portion of your investments should lay – […]

Blog

Don’t Buy a House; Take a Sabbatical Instead

I’m writing this just a few feet from the beach – from the comfort our little self-converted recreational vehicle (RV). This is roughly our seventh month on the road – and almost one year since I’ve left the office. As I’ve enjoyed learning a whole new skillset in the van-building process (electronic schematics, electrical soldering), […]

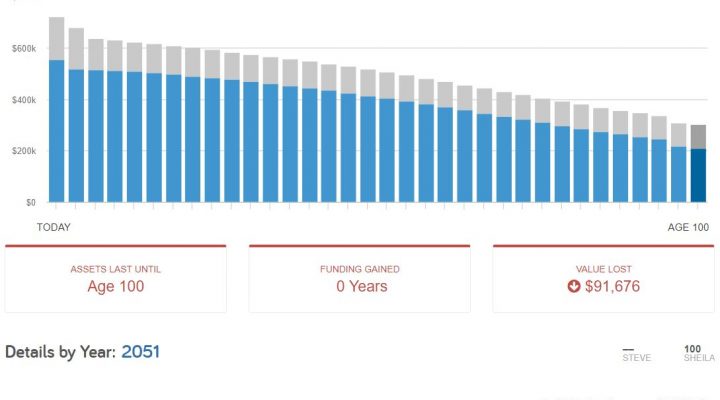

The Cruel Math of Inflation on Stagnant Wage Growth for Late-Stage Earners

I’ve come across two distinct clients recently who were experiencing identical issues. Both clients were single women on the cusp of retirement. And, as with almost every middle-class American, these two distinct clients faced an identical situation: They had not saved enough money. The simple (obvious?) solution to their savings shortfall was to downgrade their […]

Case Study: Account Distribution Hierarchy for Mortgage Paydown in Retirement

Imagine a retired client. Being 68 years old, he’s managed to save a bit of money over his lifetime. Whatsmore, that money is spread across different types of accounts: His tax-deferred traditional IRA His tax-free Roth IRA The family’s taxable investment account Being that the client is retired – and a good portion of his […]

How to Save on Taxes

No one likes taxes. So, why not strategize on how to save on them? Listen up for a few strategies to decrease your tax bill.

Do I Even Need Life Insurance?

Life Insurance comes in so many flavors! Which one makes the most sense? Or, do you even need it? Listen to our latest episode of the Stay Wealthy podcast to find out!