EXECUTIVE SUMMARY

Investors in illiquid real estate should be compensated with investment returns above what U.S. stock market investors receive. This is because real estate is illiquid – whereas U.S. large cap stocks are highly liquid.

Historically, U.S. stocks market investors received an investment return of roughly 10% per year. Therefore, investors in illiquid real estate should receive a return of at least 12% per year. This gives investors in illiquid real estate a 2% premium over U.S. large cap stocks. This 2% premium also lines up with the 2% rule of real estate investing.

Unfortunately, the numbers behind California rental properties suggest that investors in California rental properties are not receiving a sufficient illiquidity premium – an investment return of 2% more than what U.S. stocks have offered historically. Not only that, but investors in California rental properties are not only not receiving a return of 12% per year, they’re not even receiving a return of 10% per year (what liquid U.S. large cap stocks have offered). As such, investors may consider passing on California real estate (for now) – or any illiquid investment not offering a positive illiquidity premium over what U.S. large cap stocks have provided historically.

More times than I can count, a client shows up with rental property on their balance sheet. And this being California, the result is always the same:

California rental property does not pencil out as a great investment.

Until recently, I never knew why this was the case.

In this post, I’ll dig into the why: why I’ve never seen a client with a California rental property that made sense as an investment.

But, before I get into that, let’s review some Investing 101. Reviewing Investing 101 will help us analyze rental property investing in California.

Investment Convenience & Investment Return

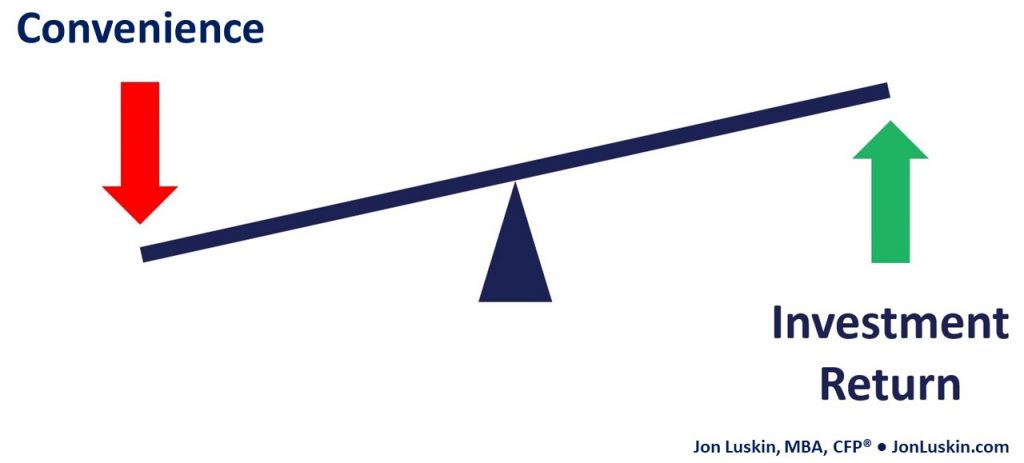

There is a relationship between an investment’s expected investment return and that same investment’s convenience. (Risk is inconvenient – and I’ll expand on that in a bit.)

Cash is a low-risk investment. This is quite convenient. As such, cash offers a relatively low investment return.

Stocks are risky. Risk is inconvenient. As such, stock market investors are rewarded for the inconvenience of investing in something risky; they are rewarded with an investment return above what cash provides.

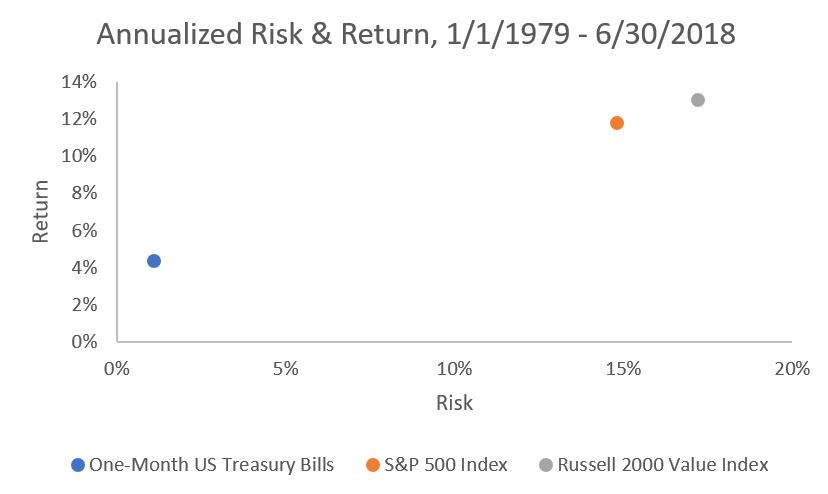

You can keep going with this same idea – the more inconvenient an investment, the greater that investment’s expected investment return. Consider small/value stocks. Small/value stocks are exceptionally inconvenient because of not only their outsized risk, but relatively greater illiquidity. (Small cap stocks are less liquid than large cap stocks. Liquidity is a measure of how easy it is to sell something.)

Increased risk and limited liquidity dictate a higher expected investment return for small cap stocks. Historically, this has been the case; on a long timeline, investors in small/value stocks have been rewarded in excess of what large cap investors received, and far above what cash investors received as their investment return. In short, investors are compensated as a function of an investments’ inconvenience – be that inconvenient volatility, inconvenient illiquidity, or both.

However, anything with dramatic price movement is by definition volatile.

high risk = high expected reward = high inconvenience = high illiquidity

Now, we’ve established that an investment’s convenience and that same investment’s expected investment return are related. Next, let’s discuss how investments provide their investment return.

How to Make Money on Rental Property

Real estate can offer an investment return in two distinct ways.

Appreciation

The first way to make money off rental property is via an increase in price (or appreciation, for all you nerds). This means that you can sell the property for more than you bought it for – after fees and taxes, of course. For example, you buy a house for $400,000 and sell it for $500,000. You’ve made money off the increase in price.

Income

The second way to make money from rental properties is via cash distributions from profitable rental income. For example, you buy that same house for $400,000. Then, you rent it out for $2,000/month. After expenses of $1,000/month, you get to pocket $1,000 each month as profit.

Total Return Investing

Of course, you can make money both ways – profitably rent out housing, and then later sell that housing for more than you bought it for. (Looking at both parts of investment return – income, and appreciation – is referred to as total return investing. And, it’s the idea of total return investing that makes dividend investing just plain silly.)

How to Make Money Investing in Stocks

If you’re reading this blog, you don’t need me to tell you that stocks offer investment returns similarly to real estate: via cash distributions from stocks (via dividends) and via an increase in the value of the stock (appreciation). Said another way, you collect cash (via dividend distributions) and then later sell the stock for more than you purchased it for.

Cash Dividend + Price Appreciation = Total Return

So, while stocks and bonds offer both income and appreciation (likes real estate), there is one extra feature of stocks and bonds that set them apart from real estate: securitization.

Securitization for Stocks and Bonds

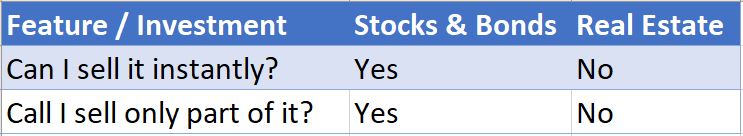

One great thing about stock and bond investing is their securitization. One feature of securitization is being able to sell part of your investment. For example, if you bought 1,000 shares of stocks or a stock mutual fund or ETF, you can always sell some of those 1,000 shares – at any time. (You could also call this feature partial liquidity, or that stocks and bonds are a divisible asset.)

Investing in securitized assets allows you to generate more cash than what the dividend from that investment alone provides for income. This is helpful if the investment return offered by the dividends alone (the cash that the stocks spit out) is not enough to cover an investor’s needs. (Income in retirement is one example of an investor’s needs.)

That’s a big advantage for stock market investing: not only can you sell your investments in literally a nano-second (liquidity), but you can sell a portion of your investments in a nano-second. You don’t have to commit to being all-in or all-out on a single holding.

Stocks, bonds, mutual funds and ETFs offer instant or daily liquidity, and partial liquidity. That’s not the case with real estate.

Challenges of Rental Property

One problem with rental property is that it’s illiquid. Not only that – but it’s wholly illiquid, and not just partially illiquid. Not only can you not sell your real estate holding in a nano-second (as you can with stocks or ETFs), but you must usually sell all of a particular holding. Usually, you can’t sell just a part of a real estate holding.

With real estate, you can’t sell part of your property. You must sell all of it. So, until you sell the entire property, you can only enjoy the cash distributions from rental income as your investment return. (Hopefully, the real estate holding is profitable, i.e. it cash flows.) With real estate, you cannot take advantage of the increase in price (appreciation) until you exit your investment entirely. (This is absent a cash-out refinance, discussed later.)

Just for fun – think of selling a piece of real estate as being pregnant. You’re either pregnant – or you’re not. There’s no such thing as being partially pregnant. And for the most part, there’s no such thing as partially selling a real estate holding.

Home Equity Line of Credit (HELOC) and Cash-Out Refinance

Taking out a line of credit on a property (HELOC) is not the same thing as selling part of your investment. With a line of credit, you get cash by paying debt service on something you still own.

Consider an analogy. With a margin account, you borrow money against your existing stocks holdings. If you own $1,000 worth of stocks, you can withdraw $500 worth of cash. If you did this, you would:

- own $1,000 worth of stocks,

- have $500 in cash,

- owe $500 to the broker,

- and have interest payments.

Without a margin account, you sell $500 worth of stock. Without a margin account, you have:

- $500 of stock

- $500 cash

The difference is the interest. And the interest can make a big difference. More than once I have seen an investor paying debt, after having taken out a line of credit on a property. The real estate investor did this to meet their cash flow requirement; the property was not generating sufficient income to meet the investor’s need for cash.

Illiquidity & Limited Cash Distributions

As a buy-and-hold rental property investor, you are entirely dependent on the profit (cash distributions) from your rental property as your investment return. That’s because you can’t access the investment return of the appreciation without paying interest via a HELOC, or refinance. Moreover, if you take enough cash out of a property via a refinance or HELOC, it is possible for the property to negative cash flow.

This is never the case with stocks, etc. With stocks, you can sell some of your investment (at any time) to generate more cash as needed. When you do this, you are never at risk that your investment will have negative cash flow. That’s because there is no debt service.

When Rental Property Makes Sense as an Investment

Yes, rental property has its challenges – such as illiquidity. But, just because an investment suffers from challenges doesn’t mean it’s not worth considering as a place to put your money. Stocks are inconvenient because they are risky. But, we still invest in stocks because the return premium is worth the risk/inconvenience. Said simply, one must examine the relative (dis)advantages of an investment relative to its potential investment return.

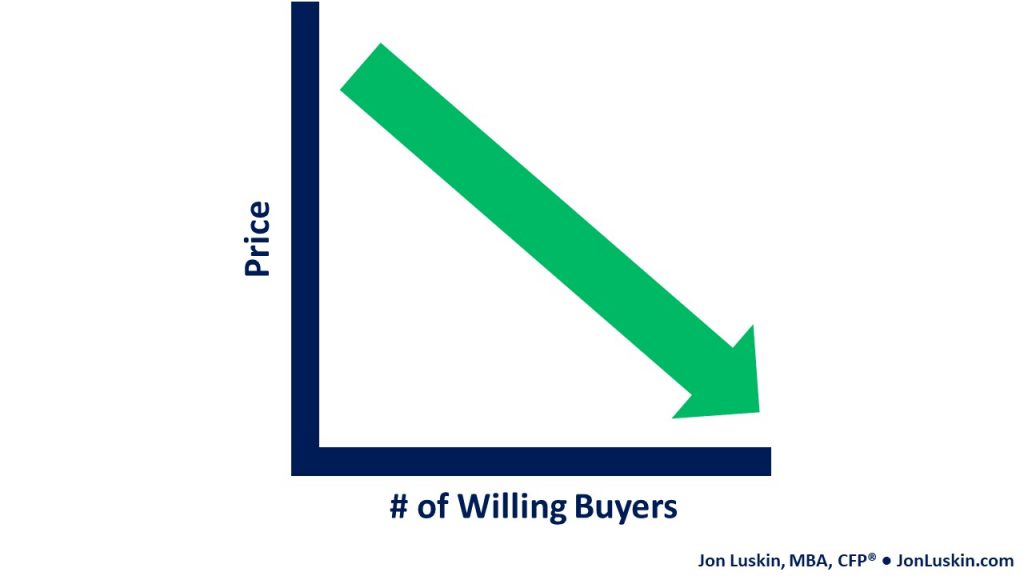

Since rental property is both illiquid and risky (and if you don’t think real estate is risky, do your best to recall the financial crisis), real estate investors should be compensated for that inconvenience. Moreover, real estate investors must be compensated over and above what liquid investments offer.

This begs question:

What is a sufficient illiquidity premium for real estate investors?

While I do not have the answer, I have an answer: 2%.

Real Estate’s Illiquidity Premium

The 2% rule of real estate investing suggests that the amount of gross monthly rent for a property should be 2% of the property’s purchase price. For example, if you purchase a property for $100,000, you should be able to charge $2,000 in gross monthly rent. Assuming half of that gross rent goes to expenses (i.e. the 50% rule of real estate investing), you’re left with $1,000/month of profit, or $12,000/year in profit. That’s $12,000 profit per year for an initial investment of $100,000. That’s a 12% return.

A 12% investment return is 2% more than what U.S. large cap stocks have averaged historically, roughly 10%. Thus, real estate investors earn 2% more than U.S. large cap stocks (if abiding by the 2% rule). This extra 2% is the real estate investor’s reward for the increased inconvenience (illiquidity included) of investing in real estate.

With real estate and stock market investing 101 out of the way, we are ready to discuss the problem of investing in real estate in California.

The Problem with California Rental Properties for Retirees

The first problem with California rental property is that you can’t earn a 12% annual return via rental income alone. Let’s use math to illustrate this. To math it out:

- Look up a California property on Zillow.

- Find’s its sale price.

- Find Zillow’s rent estimate, or use rentometer.com.

Using the results of the first property I Googled just now, I can buy a property for $649,000, and rent it for $3,000/month. With those figures, you’re looking at less than a 3% return (assuming 50% of rent goes to expenses).

But, that’s just a hypothetical example – since I don’t have the exact calculations for expenses. Enough with the hypotheticals. Let’s use a real-life example of California real estate investing (and the inspiration for this blog post):

A client owns a property worth $1,2200,000. They own it free and clear. (There is no mortgage, etc., on the property.) The client purchased the property for $880,000. Assuming a long-term capital gains rate of 20% and 6% seller’s fee, they could walk away with $1,093,440 – if they sold the property today.

But they’re not selling it. They’re renting it. Gross rent is $41,000 per year. Expenses are $24,809 per year. This makes net profit of $16,191 per year.

If you don’t know where this is going, consider this:

What’s $16,191 (their profit) divided by $1,093,440 (the amount of capital tied up in the property)?

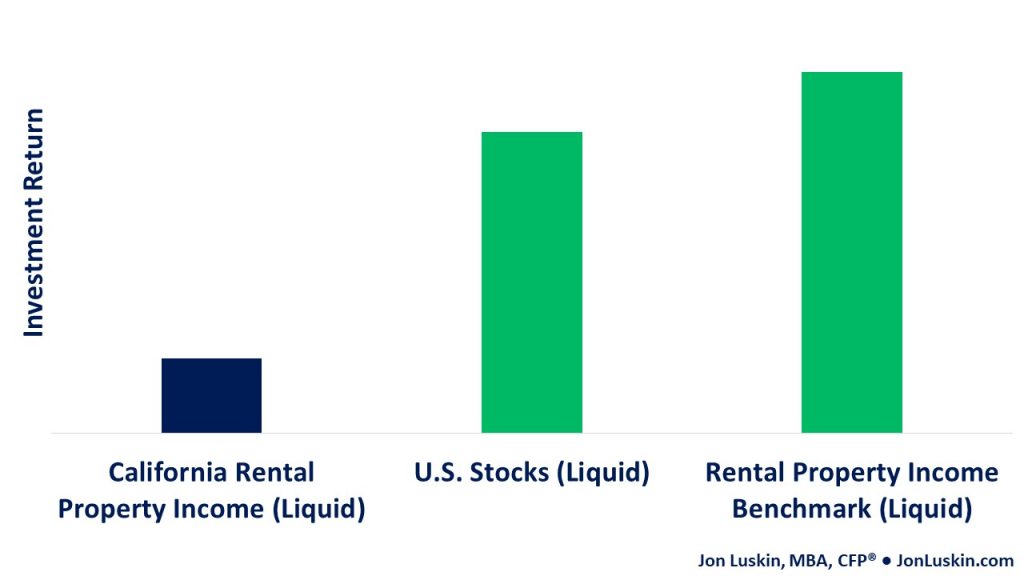

It’s 1.48%. That’s the investment return available to a California rental real estate investor. (Of course, this ignores appreciation – which I will get to in a minute.)

Given that limited return, the clients would be better off with their money in an online high-yield savings account. Even if the client did manage to increase rental income and lower their expenses to an abnormally low level, the returns are still stark: less than 3%. And remember, our benchmark for rental property income is 12%. And liquid U.S. large cap stocks have offered a (volatile) 10% return historically.

Cash Flow For Retirees Using California Rental Properties

Of course, this example doesn’t include appreciation. (But, appreciation on California real estate has averaged less than 5% per year anyway.) But if you’re keeping a property for the rental income (because you’re a retiree who needs income), you obviously can’t eat the property’s appreciation. You can only eat the property’s net income.

But, what if you are a retiree who does need cash? This is a big problem – especially if your investment return is dominated not by rental income, but by property appreciation. (This is the case with California rental properties.) If your rental is not spitting out sufficient cash – and you need cash – you’re stuck.

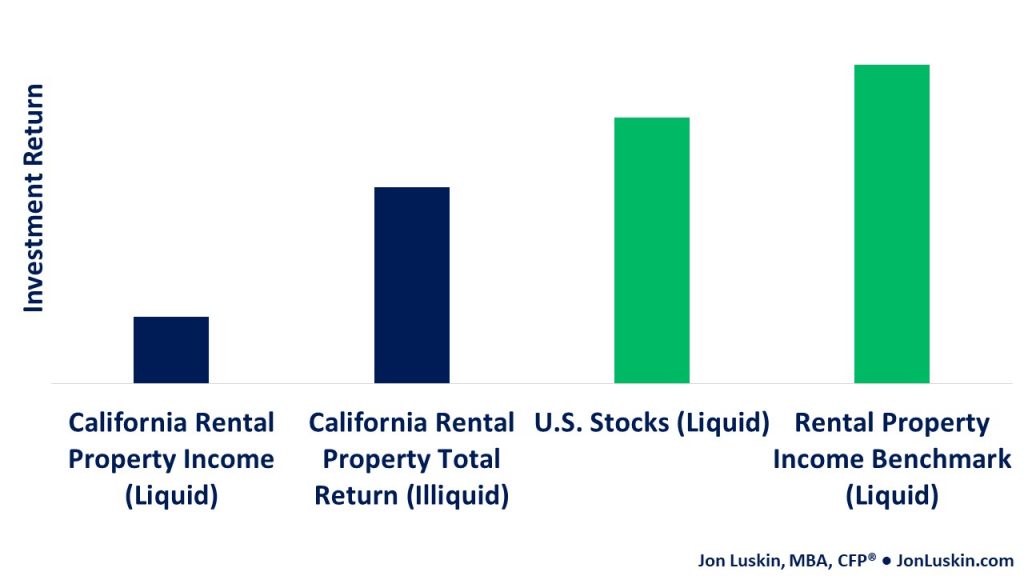

Of course, real estate that appreciates greatly in the absence of cash flow may be a good investment – but only if you don’t need your investment to generate cash. However, California real estate – while it does appreciate a little more than the national average – still shows a smaller total return than what U.S. large cap stocks have historically offered.

Rental Properties Outside of California

The title of this blog suggests that California rental properties are not a great investment for retirees. What I don’t say is that real estate or all rental properties are a bad investment.

Being a landlord can certainly make sense – in certain parts of the country. There are rental properties in parts of the United States where investments are available that meet the 2% rule. (Moreover, these properties can be had with 1/20th of the capital needed to be a landlord in California. For what it takes to make a down payment in California, you can purchase an entire property in other parts of the country.) Properties that meet the 2% rule – those that produce ample cash flow – could be a logical choice for retirees – or any investor.

It is tough in California; you have to put around 25% down just to break even. However, if you bought a $400,000 property with 5% appreciation per year, after 30 years the $300,000 would be paid off and I think you would have more wealth then an investment of $100,000 at 10 % per year (of course over 30 years rents would be going up with inflation, while the loan payments are fixed).

Hello Chris,

Thanks for your message.

There’s definitely unverifiable assumptions that have to be made when it comes to this sort of analysis.

But, using historical figures, you’re better off with U.S. stocks (over CALIFORNIA rental property) because the numbers on California rental property are so bad – EVEN WITH LEVERAGE!

Assuming California marketable rent ($2,000/month) with rent increasing with inflation annually (3%) on a $400,000 property, using a 30-year fixed mortgage at 6%, and property appreciation at 4.9% (historical figures) and 50% of gross rent going towards expenses – you’re still about 2% short of the 10% figure offered by U.S. large cap stocks. That is, you might get ~8% per year on the California rental strategy.

And that’s with UNLEVERAGED stocks vs. leveraged rental property!!

And if you went after the small value premium, you could earn perhaps 12% per year – resulting in your LEVERAGED California rental property strategy providing 50% LESS of a return relative to UNLEVERAGED stocks!