I could never do as good a job as Michael Kitces, so I’ll just link his article on this very same subject here. I won’t bother to repeat the points he already made. I’ll just share something I wish someone had told me when I got into the field of financial planning. The Job Description […]

Practice Management

Exit Planning Case Study: Ian Kutner

Continuing with the theme I’ve covered previously of interviewing professionals experienced in succession planning, I recently spoke with Ian Kutner. Now retired after having sold his financial planning practice to a San Diego wealth management firm, Ian shared some interesting details about how his transaction unfolded. Working within an acquiring wealth management firm Following a […]

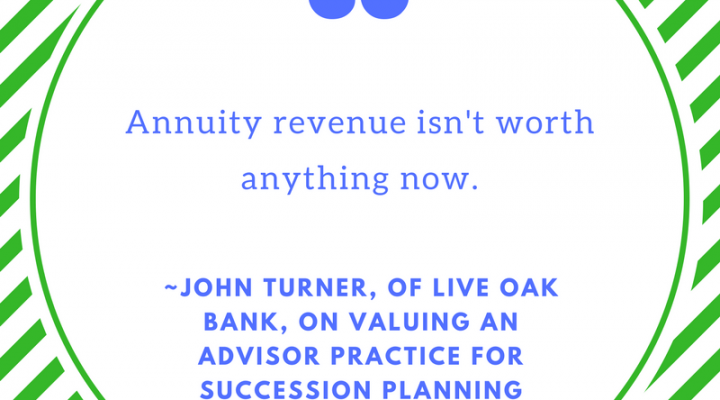

John Turner of Live Oak Bank on Succession & Exit Planning

What Is Live Oak Bank? John Turner is the senior lending advisor for Investment Advisory Vertical (Industry) at Live Oak Bank. (If you haven’t heard of Live Oak Bank, you’ve likely never used Succession Link, where Live Oak’s ads are plastered everywhere.) Live Oak bank specializes in financing financial advisory business succession plans. What quantifies specialization? Last […]

Annuity Rule of Thumb

As a fee-only financial adviser and fiduciary, much of what I do at Define Financial involves unwinding new clients from the garbage they were previously sold by commissioned salespeople. (Naturally, I have a strong opinion about this!) Sometimes, this means trying to figure out how to get a client out of a non-traded REIT. Other […]

Setting Fees for Financial Planning

Two recent episodes in setting financial planning fees merit sharing, and both have the same ultimate take-away: don’t think you’re not worth it – because the right clients think you are.

Continuity Planning for an Investment Advisory Firm

I can’t help but think of the parallels in the perceived complexity of creating a Continuity Plan with the perceived complexity of creating an investment portfolio.