If you haven’t already, please go ahead and put yourself to sleep by reviewing my latest paper in the Journal of Financial Planning. In it, I discuss bond investing – specifically what happens when you pit United States government bonds against corporate bonds. Don’t want to read the paper? I don’t blame you. Here are the cliff notes:

- Before taxes, there may be little difference in the performance of either bond when paired with stocks to create a diversified portfolio.

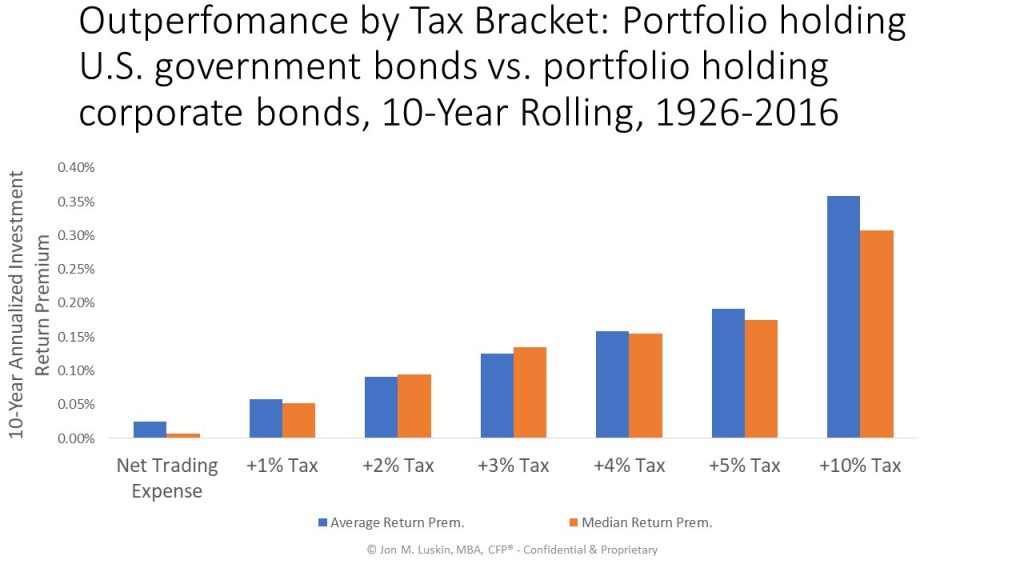

- As tax rates increase, a portfolio holding United States government bonds increasingly outperforms.

- A portfolio holding U.S. government bonds outperforms a portfolio holding corporate bonds during U.S. equity market drawdowns.

- As the severity of the U.S. equity market drawdown increases, the degree that a portfolio holding U.S. government bonds outperforming a portfolio holding corporate bonds increases.

Is the above too wordy for you? Me too! Allow me to supply pictures. Let’s start with:

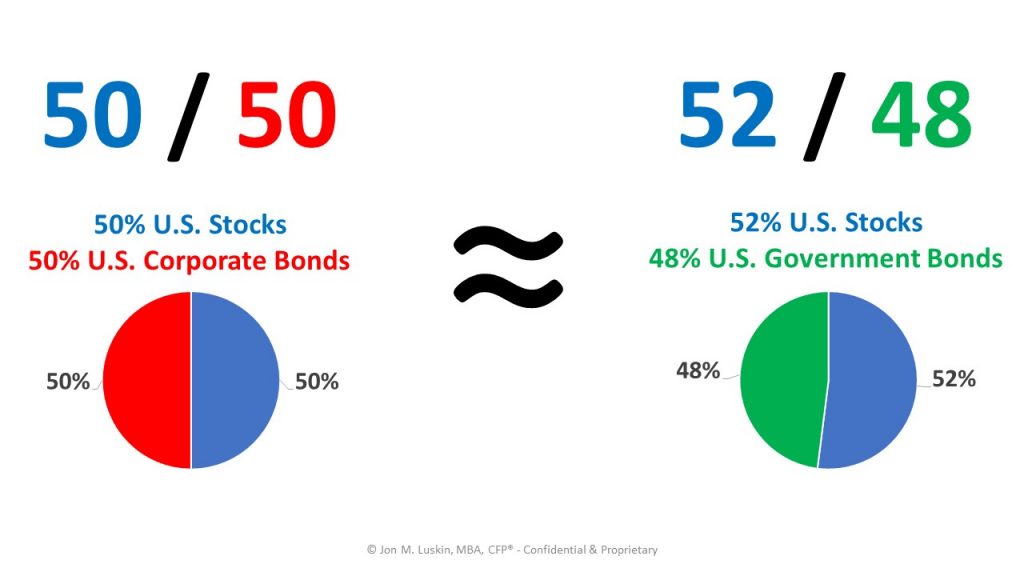

Before taxes, there may be little difference in the performance of either bond when paired with stocks to create a diversified portfolio.

And here’s the picture:

And onto the next point:

As tax rates increase, a portfolio holding United States government bonds increasingly outperforms.

And, combining the last two points:

A portfolio holding U.S. government bonds outperforms a portfolio holding corporate bonds during U.S. equity market drawdowns. As the severity of the U.S. equity market drawdown increases, the degree that a portfolio holding U.S. government bonds outperforms a portfolio holding corporate bonds increases.

If you’re completely enthralled with the above and can’t wait to learn more, you can always sign up for NAPFA’s upcoming webinar or read the original paper. Enjoy!

Thank you for this analysis. Do you advise buying corporate bonds after a significant market decline when spreads widen? I would think when paired with stocks you might get a better risk-adjusted return net of tax. Corporate bonds provided a better risk-adjusted return over stocks in the ten years following the financial crisis…

Hello Kenny,

Thanks for your comment!

Buy corporate bonds after a significant market decline when spreads widen?

I’m not a (corporate bond) market timer, so my answer is no. I’m not sure what the results have been historically with respect to risk-adjusted performance. However, given previous analysis, my hunch is 1.) it would depend on the tax bracket 2.) why not just hold more stocks instead of buying corporates? Surely stocks would appreciate more than corporate bonds.

While I’ve never run the numbers, I certainly believe that corporate bonds provided a better risk-adjusted return over stocks in the ten years following the financial crisis. But – and perhaps a point made inadequately by the original paper – is that you need to look at stocks and bonds together in the context of total portfolio performance. It doesn’t make sense to look at an asset class in isolation if you’re going to invest outside that outside class when you construct your portfolio. If the only investment you make is in corporate bonds, and invest in nothing else (i.e. stocks), then the data point, “corporate bonds provided a better risk-adjusted return over stocks in the ten years following the financial crisis” is highly relevant. But, if you pair corporate bonds with stocks, you may find that on average there is little case for opting for corporate debt over Treasuries.

Hey John,

Enjoyed the paper. I ran some quick sims with short-term (1-5 year) gov’t and corporate bonds since 1976 using DFA Returns Web. CRSP 1-10 for stocks and Barclays 1-5 year gov’t and corporate indexes for bonds. Monthly rebalancing.

60/40 with gov’t = +9.9% with 9.3SD

60/40 with corporates = +10.2% with 9.5SD

62/38 with gov’t = +10.0% with 9.5SD

Worst 12mo return was -26.2%, -28.5%, and -27.1% respectively. A rounding error in my book.

FWIW, I use this data in allocation decisions. I split the difference in client portfolios, using AA/AAA corporate and gov’t bonds via DFGBX. It’s better diversified than a US-only allocation, has a variable-maturity approach, and doesn’t go too far into credit risk (A/BBB or less).

EN

Hello Eric,

Thanks for your comment!

I leaned on the index data available on Returns Web. It’s indeed a great resource!

I’d be curious what the results would be with annual rebalancing. That’s something I would imagine would be closer to real life. I’m unaware of any advisors who practice monthly rebalancing. Also, I would imagine that transaction fees would become quite impactful given monthly rebalancing.

As you know, I looked at a 50/50 (as opposed to 60/40) in the original paper. That’s because the focus of the paper was bond selection. I wanted the bond portion of the portfolio to be more impactful. Naturally, the smaller the allocation to bonds, the smaller difference bonds make in terms of total portfolio performance.

I’d be curious to see how much of a difference that makes. i.e. if a 62/38 w/ gov’t bonds outperforms by 1.4%, what would a 52/48 w/ gov’t bonds outperform by?

Also, is 1.4% a rounding error? That’s $14,000 on a million dollar portfolio. For some advisors that’s (more than) their annual fee. Of course, on a $10,000,000 portfolio, that’s $140,000.

Finally, the financial crisis drawdown lasted more than just 12 calendar months – spanning from November 2007 to March of 2009. I wonder how much more of a difference that makes in terms of gov’t bond outperformance – i.e. how much more than 1.4%?

We were originally using DFGBX too, but then shifted to exclusive use of Treasury bonds, a mix of Fidelity, Vanguard and DFA funds.