Recently, we had a local financial planner solicit our financial planning services. We were honored by the request. You may be wondering:

Why would a financial planner outsource their personal financial planning?

Because Angie Herber told him to.

Working on a Complex Financial Plan

As you may imagine, the financial planner had quite a few pieces to his financial life. The advisor had IRA accounts (for he and his wife), solo K plans, a government retirement plan, his business, college planning requirements, etc.

Being numbers-driven, I wanted to make sure that I got the numbers right. For his plan, this was challenging because of the number of variables – and the complexity of each variable. Follow-up questions to the client-planner only created more questions.

During this process, the client-planner got frustrated by follow-up questions. Simply, he didn’t want to do the work needed to complete the “Get Organized” section of the financial planning process. Hence, he decided to quit. He was no longer interested in our firm providing him with financial planning services.

In his feedback, the client-planner cited his frustration with not opening the financial planning process with a life-planning conversation. (We have since updated our financial planning process to incorporate this).

Though the client-planner did not explicitly state his frustration with the rigor required of the “Get Organized” step as the catalyst for him throwing in the towel, I infer that it was the comprehensive nature of getting financially organized that turned him off. I say this because the client-planner didn’t terminate the financial planning process when we did not open with a life planning conversation. But, he did terminate the project amid the process of getting financially organized.

Managing the Data Gathering Process

Though we updated our financial planning process to incorporate a life-planning conversation, I think that there is another takeaway from this case study. And it is this: limit your data gathering.

We now do just that at Define Financial. That is, after spending some amount of time in the Getting Financially Organized process, we stop asking financial planning clients clarifying questions, especially if we have already asked a similar/related question.

As such, we end up making assumptions on the client’s financial plan. It is making assumptions that allows us to ultimately complete the financial planning. (We do disclose those assumptions made during the final review of the financial plan with the client, offering to update the financial plan if the client can provide more accurate information.)

Consider a few examples where it simply makes more sense to make assumptions and move on – than to ask the same/similar question repeatedly.

Budgeting

Clients only sometimes have an idea of how much they spend (aside from mortgage payments or property taxes). As such, it can be easier to make an assumption on a client’s spending – and move on with the financial planning process – than to wait in perpetuity for a client to supply a budget.

Fortunately, you can easily determine a client’s budget by doing the math. It’s as easy as:

Discretionary Spending = Income – Savings – Taxes

Our financial planning software, emX, can assume taxes on income. This makes the above calculation very easy. When presenting a financial plan to the client, we share how we arrived at their spending figures. Of course, we can update their financial plan with an updated spending figure if the clients provide one.

Employer Benefits

Employer benefits are another data point that can be elusive. This includes the fine print on an employer-provided long-term disability policy (own-occ for just two years or until SSNRA?), or the details on an employer match. Just like the spending puzzle, we can make assumptions on the financial plan and disclose those assumptions to the client. This allows us to keep the financial planning process moving.

For example, one common assumption on an employer-provided long-term disability policy is an own-occ definition of just two years.

Financial Planning Action Items that Are Just More Financial Planning

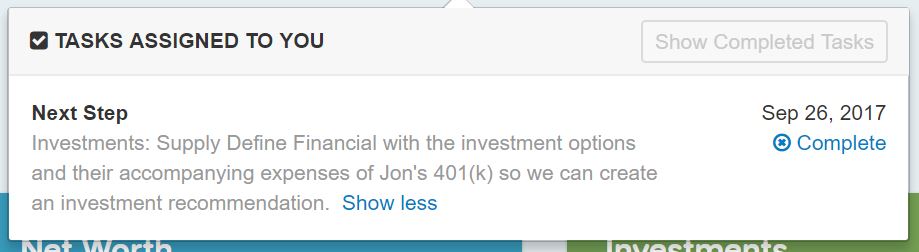

A final solution to the absence of client information is to simply add collecting that missing information to a client’s “To-Do” list. (Our financial planning process culminates with a To-Do list for the client.) This means adding something as simple as the below to keep the financial planning process from stalling.

Perfect is the Enemy of the Good

Is this the perfect way to do financial planning? Of course not, but an imperfect completed financial plan is better than a perfect financial plan that never gets completed.

Leave a Reply