Any thought on the use and safety of stable value funds in a 401(k)?

I’ve gotten a couple of questions about stable value funds recently. That’s likely because investors may be lured to them with interest rates increasing.

Also, conservative investors are drawn to the predictability of a stable value fund. After all, the up-and-down movements of stock funds—and even bond funds—are enough for some folks to want something ‘stable.’

Table of Contents

What is a Stable Value Fund?

On the outside, a stable value fund looks like (and generally acts like) a money market fund, or even a savings account. Generally, your initial contribution never loses value. From there, you collect an interest payment.

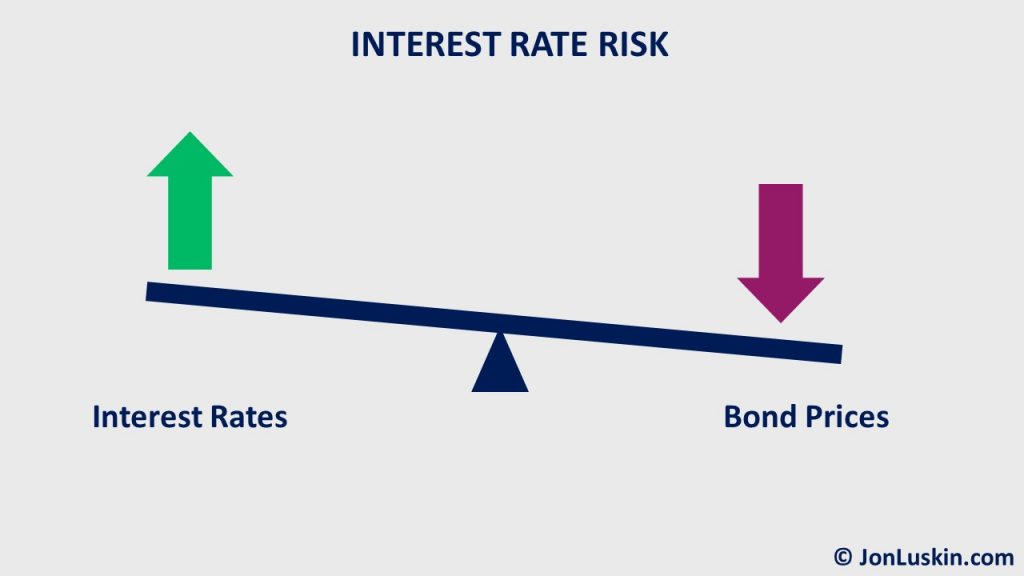

Compare that to a bond fund that, even though relatively safer than a stock fund, can lose value if interest rates increase. That’s called interest rate risk.

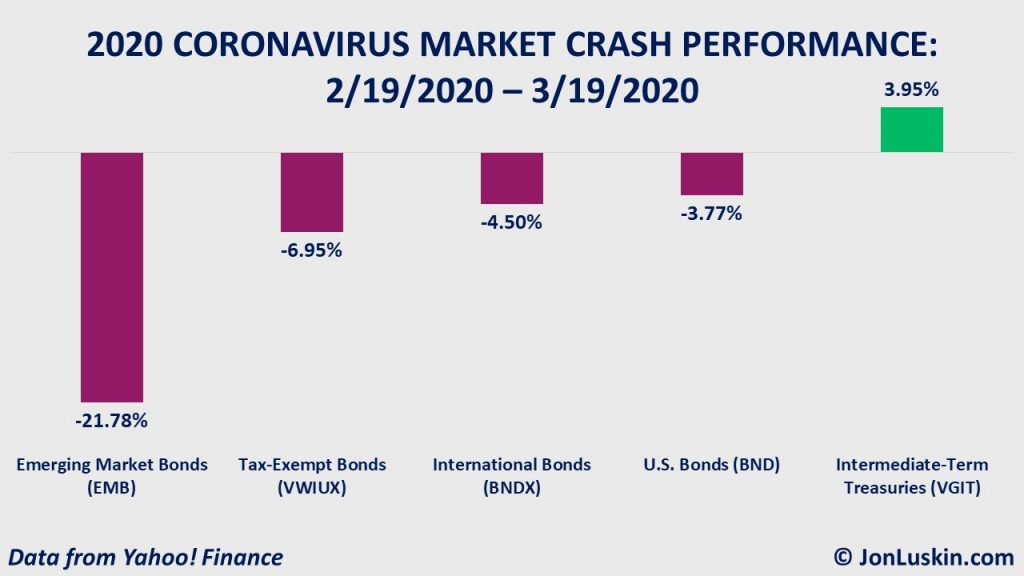

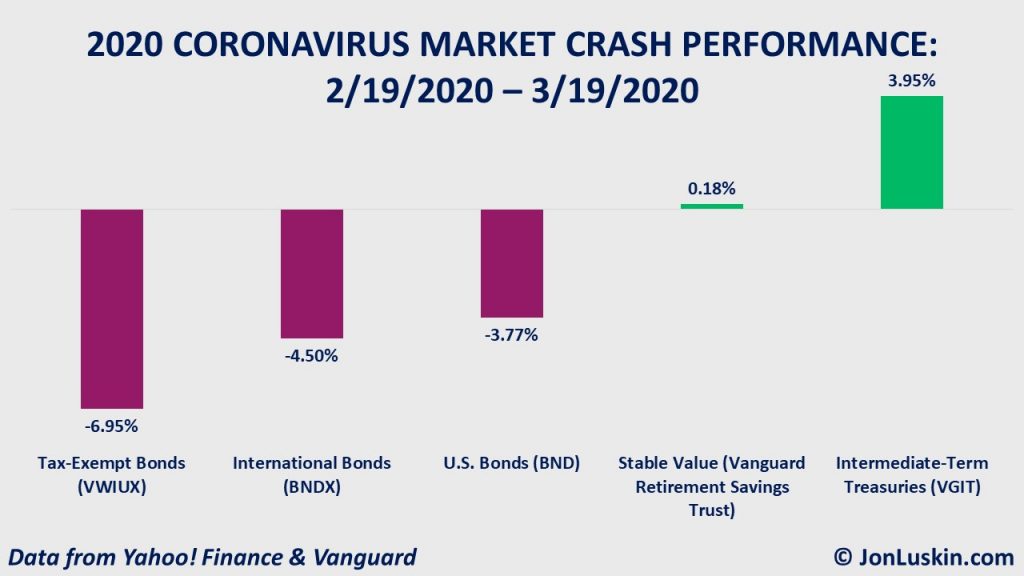

Sometimes, bonds lose value when stocks do – especially lower-quality bonds. We saw this recently during the coronavirus-inspired stock market crash in early 2020.

In short, stable value funds are generally immune from interest rate risk and correlation to stocks during market panics; hence stable value. However, a stable value fund isn’t all rainbows and gumdrops.

Cons of Stable Value Funds

As with much of investing, there’s no perfect answer. Every approach has pros and cons.

The pro for stable value funds, as already mentioned, is that they’re generally safe from decreases in price regardless of interest rates or stock market panics. However, that stability comes with additional costs and unique risks not generally found with bond funds.

Higher Costs

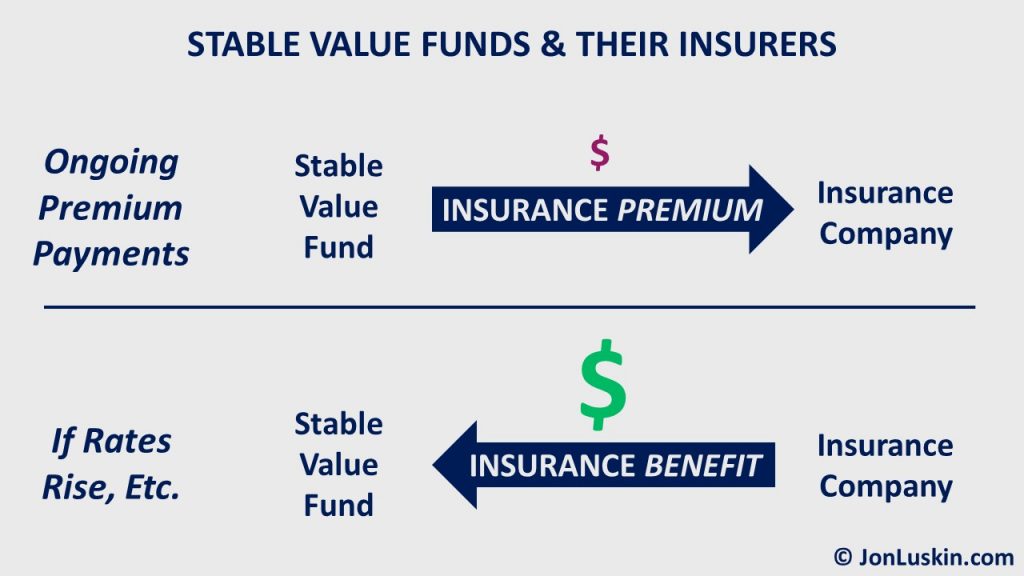

A stable value fund can protect against loss by purchasing insurance. The additional cost of insurance shows up in the fees of stable value funds, which start at ~0.20%, but frequently can be higher.

Those fees are several times that of a low-cost total bond index fund; in a workplace retirement plan, you can invest in a total bond index fund for low single-digit basis points (~0.04%). I’ve even seen 401(k)s offering a total bond fund at zero cost.

That difference is important because cost matters a lot; cost is one of the major drivers of investment returns. On average, paying higher costs means investments underperform.

Nerd note: A fund buying insurance is one type of stable value fund (a synthetic guaranteed interest contract.) Learn about other stable value fund structures here.

Default Risk: Stable Value, Not Guaranteed Value

It’s a stable value fund and not a guaranteed value fund. Instead of the risk of losing money from increasing interest rates, stock market panics, etc., risk is tied to the insuring company’s financial health—their solvency.

To recap, stable value funds purchase ‘stability’ with insurance company contracts. If the underlying bond investments of a stable value fund decrease in value, that fund can receive a benefit payment from the insurance company. That benefit payment cancels out any investment loss of the stable value fund.

Yet, what happens if interest rates increase, etc., and the insuring company cannot pay up? In that case, a stable value fund could lose money. That’s called default risk; the insurance company defaults on its obligation to the stable value fund.

However, interest rate risk is arguably more likely than default risk. So, exchanging interest rate risk for insurance company solvency risk might be worth the additional cost of insurance. However, solvency risk does sometimes show up, with investors in a stable value fund losing money.

Liquidity Risk of Redemption Restrictions

Lastly, problematic is that stable value funds may restrict withdrawals. (That’s liquidity risk.) Fund companies may call these redemption restrictions a transfer restriction or equity wash rule.

That means during a market panic, you may not be able to rebalance. This is in contrast to a conventional bond fund, where you can generally sell a portion of the bond fund whenever you like.

Are Stable Value Funds Worth the Risks?

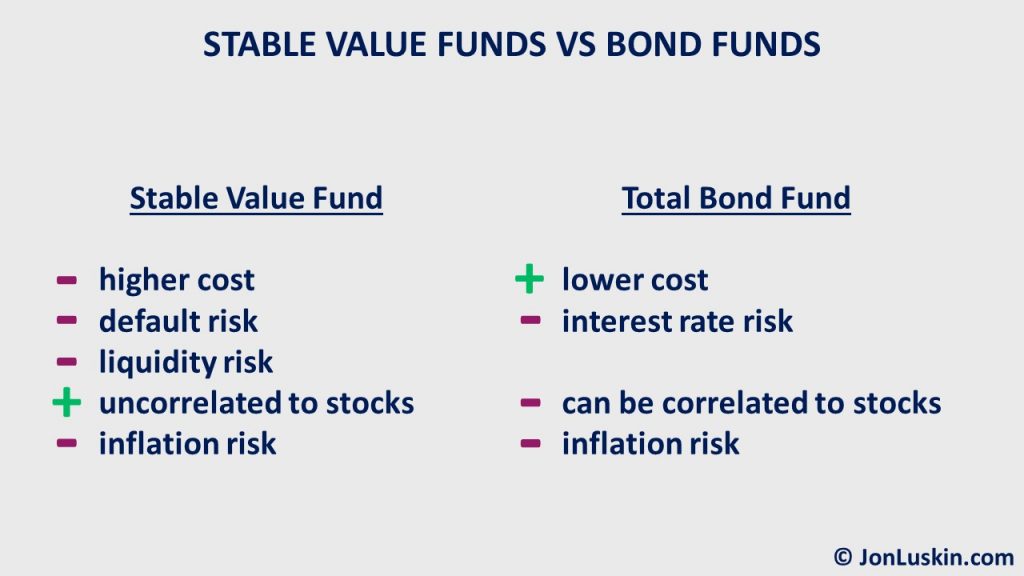

When using a stable value fund, you haven’t decreased risk so much as traded one risk for other risks—exchanging interest rate risk for insurance company default and liquidity risk (redemption restrictions). Moreover, you’ve added a cost: the cost of insurance.

In the end, nothing is without risk; there are only different types of risk. Even cash has the significant risk of inflation. Consider the various risks when opting for a stable value fund.

Performance of Stable Value Funds

Depending upon the particular stable value fund, you might have earned ~2% annually over the last ~10 years. That’s similar to the return of an intermediate-term Treasury fund (VGIT) over the same period. (For comparison, a globally diversified portfolio of stocks earned ~12% annually over the last ~10 years.)

Yet, that Treasury fund experienced more declines (and increases) over that same period. (In nerdspeak, the Treasury fund is more ‘volatile.’) In fact, VGIT is down more than 8% year-to-date (providing the opportunity for tax-loss harvesting that Treasury bond fund). That’s not the case with a stable value fund; they generally won’t lose value.

However, that comparison of a stable value fund to a high-quality bond fund ignores an important consideration: volatility works both ways. While a stable value fund may have done better than a high-quality bond fund during periods of interest rate increases, stable value funds underperformed during certain market panics.

Stable Value Funds During Stock Market Panics

Compared to other bond funds, the performance of a stable value fund during a stock market panic has varied. Sometimes a stable value fund will do better. Other times, a Treasury fund will outperform.

During the current bout of market volatility, stable value funds are performing best, as they are immune from the interest rate increases now negatively impacting bonds. During the great financial crisis of 2007+, intermediate-term Treasury and stable value funds outperformed total bond funds.

Yet, during the coronavirus-inspired stock market crash of early 2020, a stable value fund did better than a total bond fund, but not as good as a Treasury fund. That’s because a stable value fund would have provided a small interest payment, while Treasury bond funds increased in price during that same period (rallying from investor demand). Using a Treasury fund would have provided the ideal opportunity to rebalance: the chance to sell high and buy low.

Above, we’re comparing a stable value fund (generally only available in a 401(k)) to a Treasury fund (frequently not available in a 401(k)). However, even a total bond fund may be preferred over a stable value fund, given the option to rebalance.

Remember, there are often limits on when you can sell out of a stable value fund (AKA redemption restrictions). Yet, there are generally no restrictions with a total bond fund. Said differently, because of redemption restrictions on stable value funds, investing 100% of one’s bond portfolio in a stable value fund might mean not being able to rebalance during the next stock market panic.

Is a Stable Value Fund Right for You?

As with much of investing, it’s a trade-off. When opting for a stable value fund over a high-quality bond fund, investors no longer have interest rate risk. Instead, they have insurance company solvency risk (default risk), higher costs, and they might lose the superior performance offered by high-quality bonds during stock market panics—especially if redemption restrictions prevent them from rebalancing.

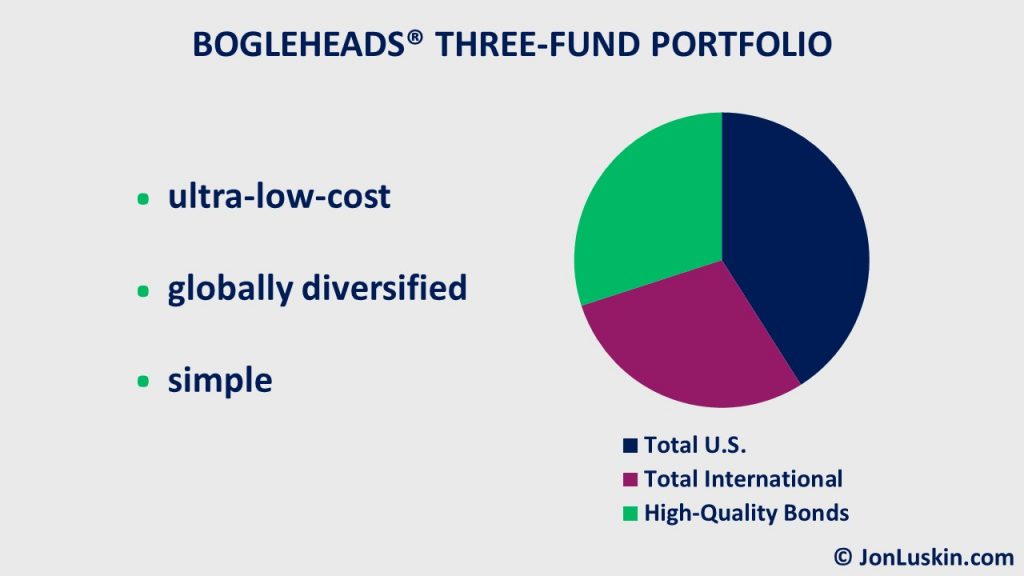

Whether opting for stable value or high-quality bond funds, investors are subject to inflation risk. That’s why having a low-cost, broadly diversified portfolio of stocks and bonds almost always makes sense.

One Boglehead’s Approach to Using Stable Value Funds in a 401(k)

If available in a workplace retirement plan, as Rick Ferri, CFA notes, splitting a bond portfolio between a low-cost total bond fund and a low-cost stable value fund is reasonable. That’s diversification. Since we can’t know which types of investments will do better in the future, we invest in all of them—or at least those that make sense (high-quality bonds, and not junk bonds) and those investments that accessible at low cost.

Picking a Stable Value Fund

Pension consultant Christopher B. Tobe, CFA cautions that not all stable value funds are created equal – with those offered by Prudential, Principal, Lincoln, TIAA, MetLife, NYLife, MassMutual, John Hancock, the Standard, Great West and Transamerica being the “bad” ones. Hidden fees can mean paying more than two percent for these funds – more than 50 times the fee for a low-cost total bond fund.

The gold standard in stable value is the Vanguard Retirement Trust. Other solid stable value funds include Fidelity, T. Rowe Price, State Street, Invesco, Galliard, Goldman, and Morely, says Tobe.

Unfortunately, most don’t get to pick which stable value fund is offered in their workplace retirement plan. There is generally only one option available. However, if you’re getting a lousy deal given high-fee investment options, you can campaign for a better 401(k) plan.

Avoid Market-Timing the Bond Market and Interest Rates

When investing, remember one of the tried-and-true tenets of success: stay the course. This means not reacting to the latest market movements, interest rates, global events, or anything else. Generally, only a change in your life circumstances (approaching retirement, etc.) warrants changing your investment portfolio.

You might be considering stable value funds because of recent losses to bonds (and bond funds)—from increasing interest rates. Yet, that’s a reactionary market-timing move: moving to shorter-term bonds after rates have increased. As long-term investors, we generally want to avoid market timing.

Of course, rates are scheduled to increase more. So, moving to short-term bonds could work out.

Yet, that market timing is still speculative. Remember: the future is unpredictable. Consider that no one expected interest rates to decrease in 2020. And, for years, interest rates were anticipated to increase. In short, we can’t know what will happen with future interest rates—especially given yet another COVID variant (BA2).

Therefore, consider any investment in a stable value fund as a relatively permanent decision. (The same applies to any portfolio decision.) If opting for a stable value fund, it likely makes sense to stick with it for the long term. Otherwise, you’ll end up switching at the worst possible time—which is usually what market timing results in, and what any good Boglehead avoids. Also, be sure to update your investment policy statement given any change to your portfolio.

Jon Luskin:

Excellent article. I copied it on the Bogleheads Forum!

Taylor Larimore

Miami, Florida

Thank you, Taylor!

Yes, thanks Taylor ! I am hebell over there.

The risk of breaking the buck is not entirely encompassed by a default of the insurance company. All of the contracts contain escape clauses for situations where there may be mass liquidations, such as company takeover, a decision by the company to change 401k provider, or company liquidation or bankruptcy, or even a mass layoff.

All of these are much more likely than an insurance company default, which is fairly uncommon.