Below is a list of current presentations that Jon has available for your event. You should contact Jon directly if you wish to discuss having him speak on a topic not listed.

WHICH BONDS ARE BEST?

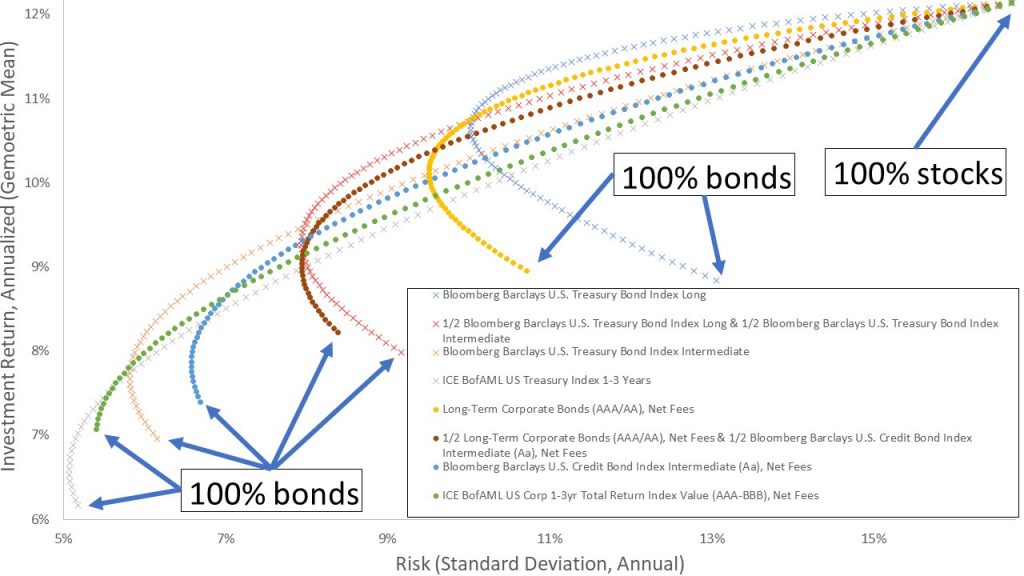

Short-term junk bonds? Long-term high-grade corporates? Intermediate municipals? How does one decide which bonds are best with so many maturities and different types of issuers to choose from? By comparing every type of bond! And, include stocks in the comparisons to create diversified portfolios of stocks and bonds. That’s important because investors invest via diversified portfolios of stocks and bonds – and not either in isolation.

WHAT’S THE RIGHT BOND MATURITY?

Choosing the percent of stocks versus bonds is one of the first decisions an investor (or an investor’s investment advisor) makes. From there, they must determine the maturity of bonds in the portfolio: how long will the investor lend money? Should short-term bonds be used to hedge rising interest rates? Or should long-term bonds be used to hedge stock market risk?

Examining the historical performance of a portfolio of stocks and bonds – with bonds being of distinct maturities – may tell us the answer. And like all good questions, the answer is, “it depends.” It depends on the size of the portfolio’s bond allocation; the ideal bond maturity varies with the portfolio’s weighting to bonds!

- Amid rising interest rates, portfolios holding intermediate-term bonds performed similarly to portfolios holding short-term bonds; portfolios holding long-term bonds underperformed.

- The optimum risk/return profile is achieved by decreasing a portfolio’s aggregate bond maturity as that portfolio’s bond allocation increases.

- A portfolio best balances the volatility of long-term bonds with high equity allocations.

This presentation was made to the Financial Planning Association annual conference in Chicago, on Wednesday, October 3rd, 2018.

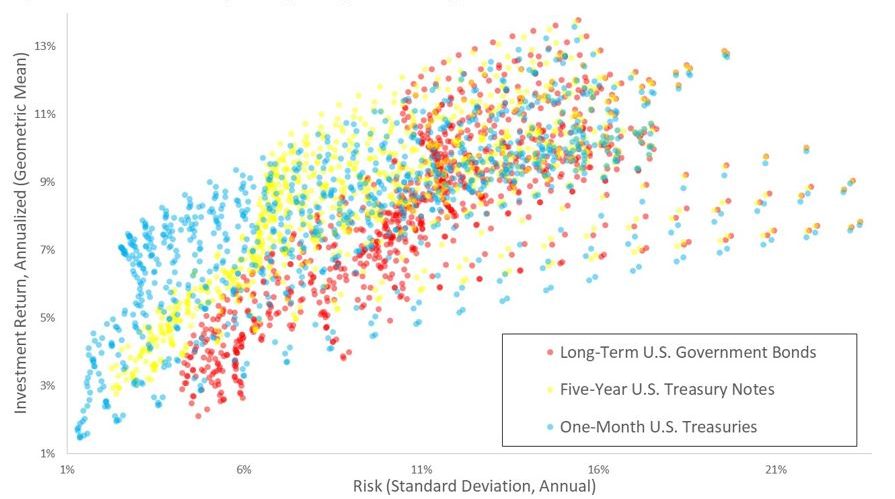

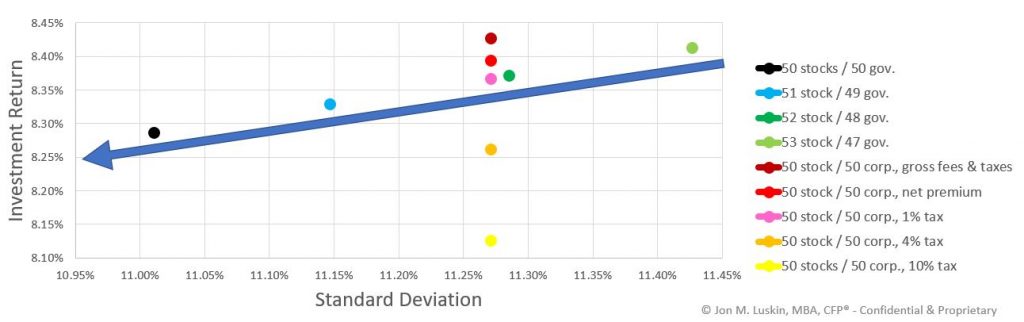

THE SUPER DIVERSIFIER

U.S. government-backed debt has been noted and advocated as the superior portfolio diversifier. This presentation quantifies the value of U.S. government debt relative to U.S corporate debt in a portfolio alongside stocks. This will better enable advisers to produce the optimum portfolio allocation for their clients.

This presentation is based on a paper featured in the Financial Planning Association’s Journal of Financial Planning. This presentation has been approved for CEs for the CFP® designation and NAPFA CE in C – Investments.

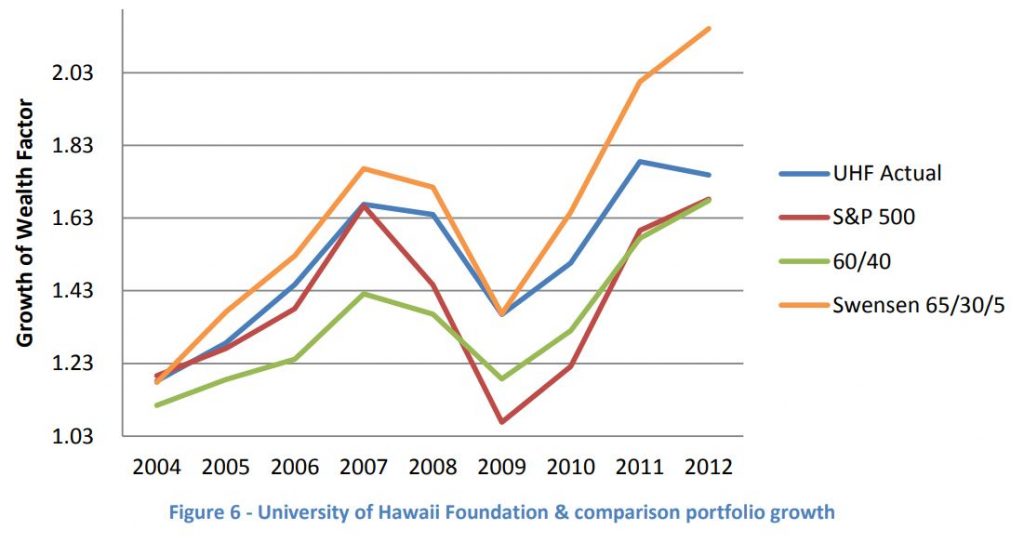

ARE ENDOWMENTS DOING IT RIGHT?

Previous studies have demonstrated that university endowments can often yield higher investment returns through index-based investing strategies as opposed to actively-managed alternative investments. Put simply, low-cost indexing produces higher returns. Only the largest institution can afford to retain the best money managers. Therefore, the best investment strategy is to retain those managers. The second-best strategy is to hold an inexpensive index fund. The worst strategy is active management by a pedestrian money manager.

These studies omit one critical variable: risk. A basic tenet of investing that is higher investment return can only be realized by subjecting principal to higher risk. While the index fund may post a higher a return, it may also subject the investment to higher risk. This presentation examines the value of holding alternative assets without management by elite professionals. Metrics for consideration include not just total return, but volatility (standard deviation), risk-adjusted performance (Sharpe Ratio), risk-adjusted performance above a minimum threshold (Sortino Ratio), and investment performance in years of market shock – including the bursting of the tech bubble and the sub-prime crisis. Eight case studies are considered, measuring the value of alternative assets.

This presentation is based on my master’s thesis.

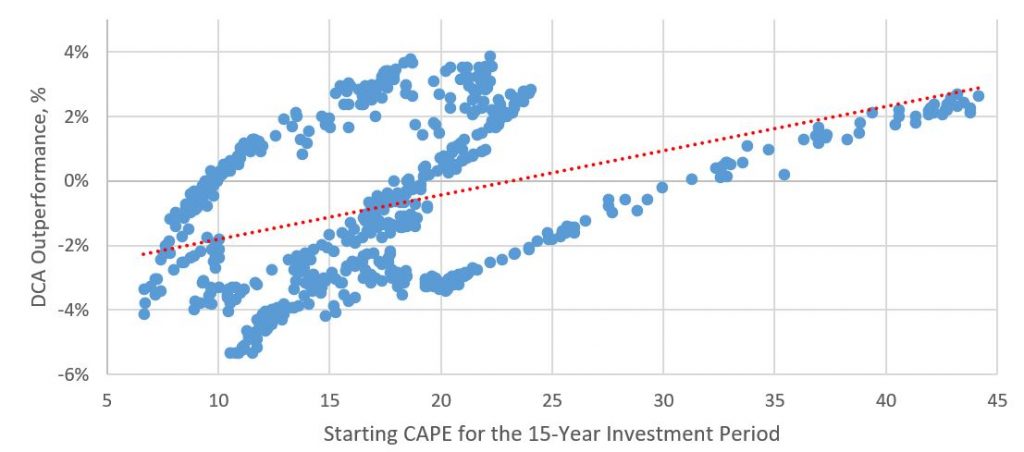

DOLLAR-COST AVERAGING USING THE CAPE RATIO

Investment advisers have continued to practice dollar-cost averaging despite its demonstrated inferior returns compared to lump-sum investing. However, lump-sum investing has not conclusively eclipsed dollar-cost averaging; it has outperformed dollar-cost averaging only two-thirds of the time. Certain periods of flat stock market performance, and downward-trending markets point to the superior nominal investment return with dollar-cost averaging. This presents the research question: is there a common underlying factor that influences dollar-cost averaging outperformance of lump-sum investing?

This presentation is based on a paper featured in the Financial Planning Association’s Journal of Financial Planning. Presentation slides are available here. This presentation has been approved for CEs for the CFP® designation.