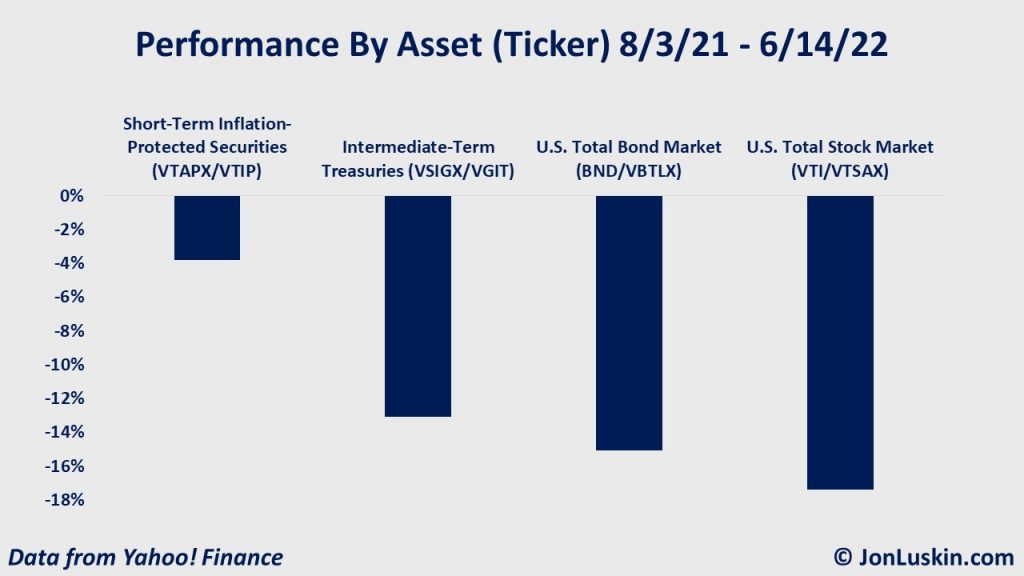

From roughly a peak in August to the time of this writing, Vanguard’s Intermediate-Term Treasury Fund (VSIGX/VGIT) lost more than 10%. Other bond funds performed similarly. (Going back just a few days shows bonds performing even worse, with VGIT losing more than 13%. Yet, bonds have recovered some in recent weeks.)

This loss has been unprecedented for bonds over such a short period. Given these losses, I’ve been getting questions from folks about bonds. Should investors reduce the amount invested in bonds – or sell off bonds entirely?

Table of Contents

Market Timing Is Hard

Why invest in bonds during a period of rising interest rates?

This question suggests the ability to predict two things:

- When interest rates will begin to rise, and

- When interest rates will cease to rise.

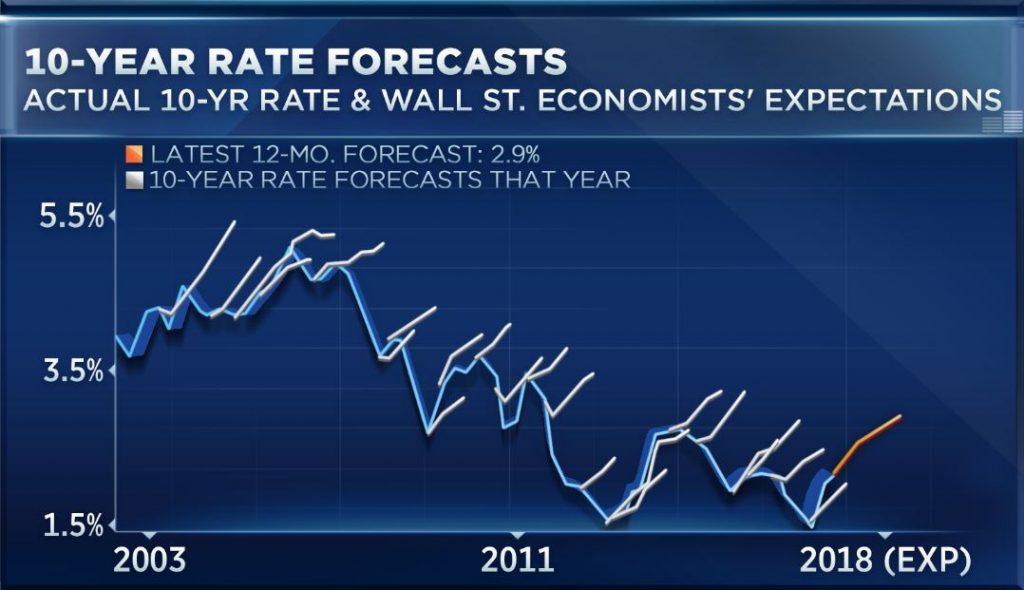

If an investor could reliably and accurately predict the bond market, their portfolio would – in theory – perform quite well. The problem is that predicting the future is difficult. In the last couple of decades, experts consistently guessed wrong about rising rates.

Yet, that won’t stop folks from trying. Market timers may consider any number of alternative strategies:

- Moving to cash

- Moving to short-term bonds

- Moving to (dividend) stocks

Moving to Short-Term Bonds in Anticipation of Rising Interest Rates

Moving to cash or short-term bonds is a similar play – with moving to cash a more extreme version than moving to short-term bonds. Let’s explore that approach – and how it’s turned out for investors in the past.

Consider an article by Rick Ferri in 2014. The opening paragraph summarizes Rick’s point well:

Did you miss returns from intermediate-term bond funds because you sat in a short-term bond fund waiting for interest rates to rise? A lot of people did. This strategy has backfired as the opportunity cost of not being in intermediate-term bonds has been more costly than whatever damage rising interest rates might have taken away.

Rick wrote that eight years ago. At that time (and ever since), investors were concerned about rising interest rates. (This was after rates were cut due to the Great Financial Crisis of 2007.) Rick goes on:

My view has been to remain in intermediate-term bonds even though interest rates are low, assuming you don’t need all the money in the short term. This is the case for most. Staying intermediate-term has worked best most of the time, and the past five years (2009-2014) are no exception.

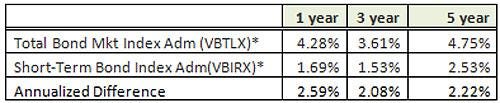

In that article from 2014, Rick shows the impact of “timing” the bond market; he illustrated how moving from intermediate-term to short-term bonds before 2014 lost money. And it wasn’t a small loss: 2%+ per year, over five years.

Now, percentages don’t mean much to anyone. To illustrate that value in real terms, consider how it would impact a $2MM portfolio with a 40% allocation to intermediate-term bonds. Over five years, investors moving from intermediate-term to short-term bonds would have given up $100,000+.

In short, the consequences of “timing” the bond market are significant.

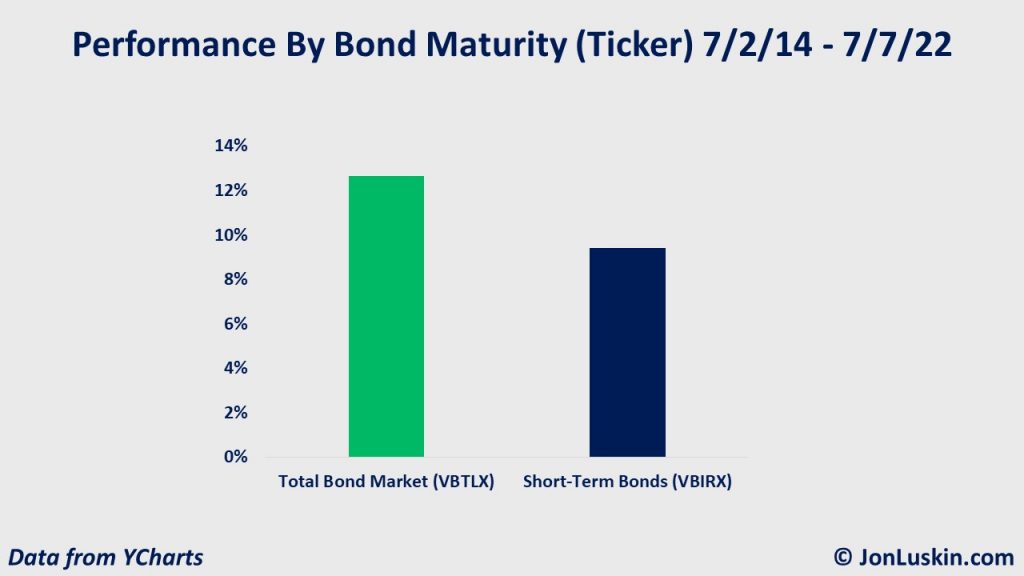

Of course, the past is no guarantee of the future. So, let’s say that someone in July, 2014 read Rick’s article and wasn’t convinced. This investor decided to opt out of intermediate-term bonds – opting instead for short-term bonds. How would they have fared through today?

Using the same funds referenced in Rick’s 2014 article, Vanguard’s Total Bond Market Index (VBTLX) and Short-Term Bond Index (VBIRX), you may not be surprised to learn that the result is the same: you would have lost money between July 2014 and today by “going short.” And that remains the case despite having now gone through the current long-awaited rising interest rate environment. In summary, that intermediate-term bond fund would still be ahead.

Intermediate-Term Bonds Outperform in the Long-Run

Regardless of the period, that’s generally going to be the case. Eventually, investors come out ahead with intermediate-term bonds – even when investing at the beginning of a rising interest rate environment.

That’s because intermediate-term bonds – on average – pay more money than shorter-term bonds or cash. Long-term investors come out ahead by collecting those larger interest payments. And they come out ahead despite bearing greater short-term losses due to a rising interest rate environment.

Said differently: intermediate-term bonds may start out at a loss from rising interest rates, but eventually, they more than make up for it.

Consider a silly analogy: the Kentucky Derby in May, 2022. Contender Rick Strike starts far back. But, he eventually charges to the front, emerging the winner. Rich Strike is the intermediate-term bond in a field of short-term bonds.

To be clear, investing in intermediate-term bonds – compared to short-term bonds – isn’t a free lunch. Risk and reward are connected. To get those higher returns, you’ll have to stomach more severe drawdowns along the way.

Using Dividend Stocks Instead of Bonds Means Taking Even More Risk

Now, let’s talk about why invest in bonds at all. Above, I’ve considered short-term bonds as an alternative to intermediate-term bonds – to blunt the loss from a rising interest rate environment. What if we moved our investments out of bonds and into stocks instead? Here, we’ll see that the drawdowns of intermediate bonds are child’s play compared to stock drawdowns.

I once again turn to Rick. I had Rick as my co-host for the first episode of the Bogleheads® Live series. Rick said something that I’ll soon not forget:

Bonds are not stocks. So even though now is probably the worst time to invest in bonds, it’s still a place to put money that isn’t stocks.

As mentioned at the opening, bonds have lost more money over a short period than at any other time in recent history. Those unprecedented losses are in the low double-digits. Over the same period, stocks lost almost twice that.

- A couple of years back, stocks lost ~30% during the coronavirus-inspired crash.

- During the Great Financial Crisis, stocks lost ~50%.

- And, during the market crash that set off the Great Depression, stocks lost ~90%.

Which is to say: you can – and sometimes will – lose money in bonds. But, investors often lose a lot more in stocks.

Stay the Course

As long-term investors, we’re in it forever. So, while we might lose some money in the short-term, whether from rising interest rates, Putin’s aggression, global pandemics, sub-prime lending, or anything else, we’ll make that loss back – and then some.

To do that, we need to be patient, and stick with our investment plan. Historically, not reacting to the crisis of the day has worked. With diversification and low-cost, a steady approach can come out ahead. Yet, it takes time.

Stay the course!

Jack Bogle, founder of Vanguard

An Investor’s Best Bet

Why should I invest in bonds during a period of rising interest rates?

Firstly, market-timing is hard. Not even the pros can do it successfully.

Secondly, as long-term investors, it doesn’t matter if we’re investing in a rising rate environment or anything else. That’s because – as long-term investors – we can eventually come out ahead no matter the environment. We do that by collecting bigger interest payments.

Lastly, although bonds aren’t foolproof, they manage risk differently – and often better- than stocks. That makes them a valuable diversifier.

That’s not to say that a low-cost, risk-appropriate, broadly-diversified portfolio of stocks and bonds will be the best option 100% of the time. Sometimes, investing in gold, commodities, dividend stocks, holding cash, or anything else might do better in the short term. But knowing when to switch to which sort of alternative – and for how long to do so – is very difficult. That’s why sticking with a low-cost, diversified approach is an investor’s best bet.

Disclaimer: For education and entertainment purposes only. Not specific investment advice. Confer with your tax and investment professionals before making any investment decisions.

Leave a Reply