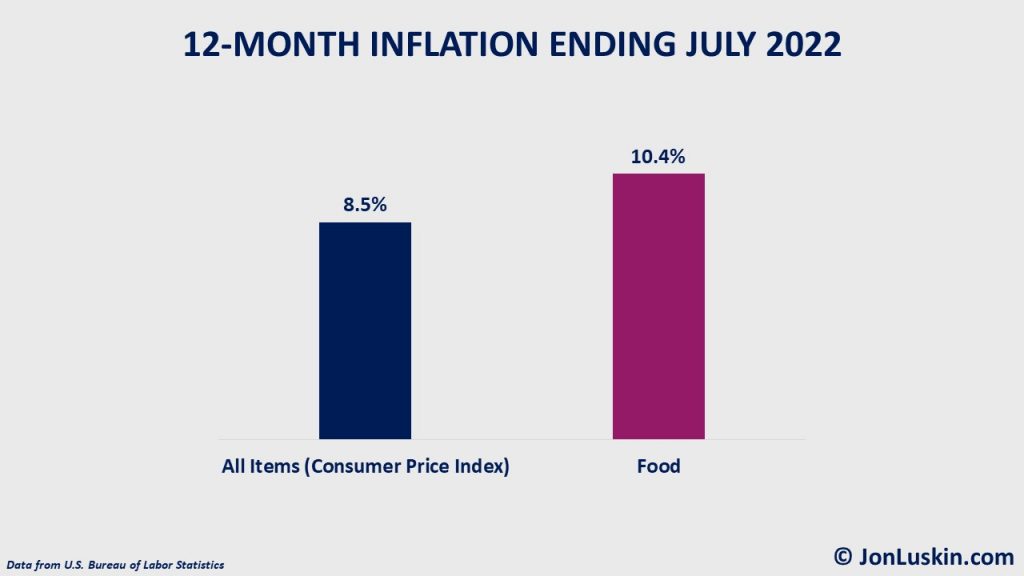

For months, folks have been asking about Treasury Inflation-Protected Securities (TIPS) bonds. It’s no wonder, with inflation hitting 8.5% over the last 12 months, the highest inflation in years.

<>What are TIPS?

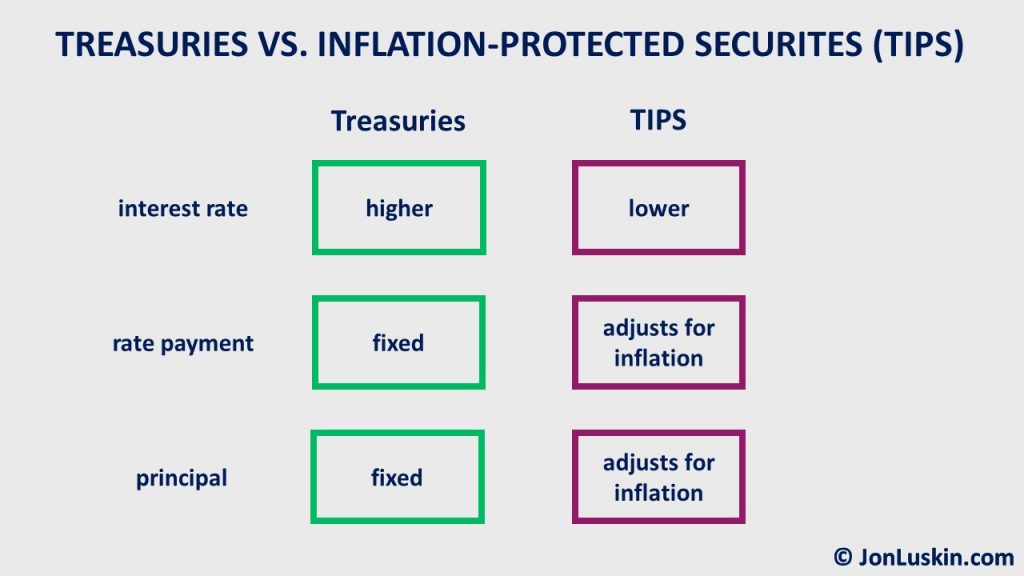

TIPS are a type of Treasury bond, debt issued by the U.S. government. Like plain-vanilla Treasury bonds (regular or nominal), TIPS bonds make interest payments. Yet, unlike regular Treasury bonds, TIPS bonds don’t make fixed payments. Instead, the amount you collect varies with (one measure of) inflation. If inflation is higher, you collect a higher payment; when inflation is lower, you collect less.

Not only does the interest payment increase with inflation, but so does the value of the TIPS bond itself. (The nerdy term for the bond’s value is principal value.)

Compare those changing TIPS payments and the changing value of a TIPS bond to a regular Treasury. The value of a regular Treasury bond doesn’t adjust for inflation. With a regular Treasury, you collect fixed interest payments.

Of course, it’s no free lunch. In exchange for that additional benefit of (some) inflation protection, TIPS investors earn a lower interest rate (before any inflation adjustments).

Yet, if you understand inflation (the value of a dollar generally decreases with time), you understand the appeal of TIPS. Amidst today’s high inflation, collecting those higher TIPS payments – and benefiting from a higher TIPS principal value – sure sounds nice.

His>Historical Performance of TIPS, Regular Treasuries & Inflation

er, we must always consider the alternative when it comes to investing. (Investment nerds call this the opportunity cost.) That is to say, if we are investing in TIPS, there’s something else we’re not investing in. (Or, we’re investing fewer dollars in something else.)In this case, the missed alternative is likely something similar – such as regular Treasury bonds or another high-quality bond.

How did these different types of bonds – regular Treasuries and TIPS – perform against inflation? We can look at their past performance to see what has happened. (Of course, that’s not to say we can expect the same thing to happen in the future; past performance is no guarantee of future investment returns.)

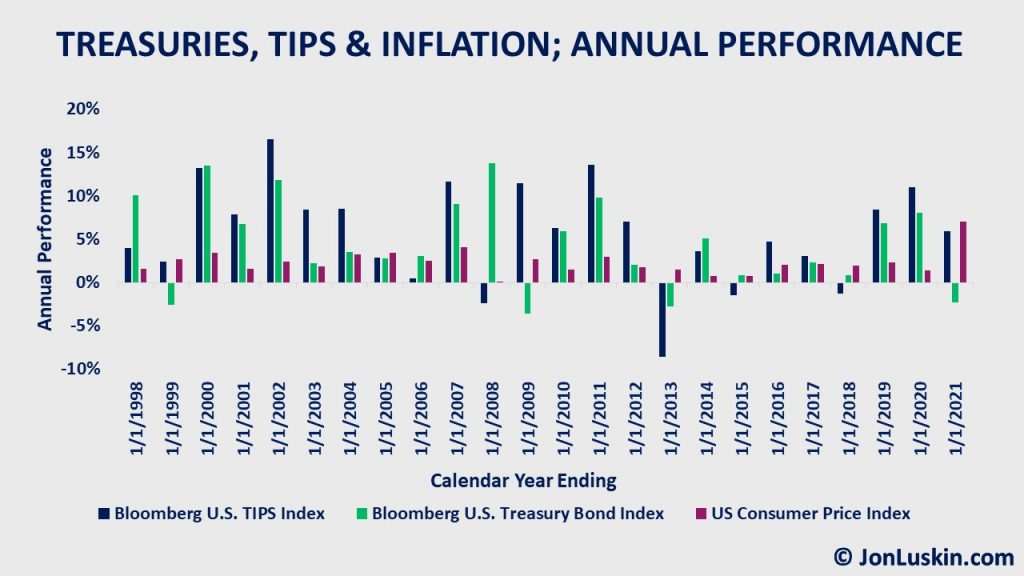

TIPS bonds were first offered in 1997. The first full calendar year begins in 1998, giving us 24 calendar years of investment returns. Over that 24-year period, we can compare TIPS against regular Treasuries – and compare both types of bonds against inflation.

Bonds vs. Inflation>Bonds vs. Inflation

Treasury index (not TIPS) outperformed inflation (as measured by the Consumer Price Index, CPI) 71% of the time. That outperformance averaged 2.2% per year. That’s to say: even regular Treasuries – those without any special feature to make increased payments for inflation – did modestly well at protecting investors from inflation.

How about TIPS – with their baked-in protection against inflation? The TIPS index outperformed inflation – dramatic pause – 71% of the time. That outperformance averaged 3.4% per year. Therefore, TIPS (like regular Treasuries) did a modest – but not perfect – job of protecting investors from inflation.

Nerd note: At this point, the investment nerds among us are likely clamoring:

“But that’s the return of an index. And if I hold an individual TIPS bond to maturity, I won’t have losses from interest rate risk. So, I’ll always keep up with inflation.”

That’s a subject worthy of an entire blog post – the mental accounting that comes with holding a bond to maturity. For now, we can leave it at: the returns of the indexes above are comparable to what most investors can expect to earn by holding low-cost index Treasury/TIPS funds. And, that’s how many investors invest in bonds: by using (hopefully low-cost) funds.

As mentioned: the TIPS and regular Treasury indexes both outperformed inflation 71% of the time. Yet, what’s interesting is that the years that each index outperformed inflation aren’t identical. There are years where TIPS do better than inflation – and regular Treasuries don’t. And there are years when regular Treasuries do better than inflation and TIPS don’t. And, of course, there are years when both regular Treasuries and TIPS underperformed inflation – such as 2005, 2013, 2018, and 2021.

Shorter-Term Bonds Against Inflation

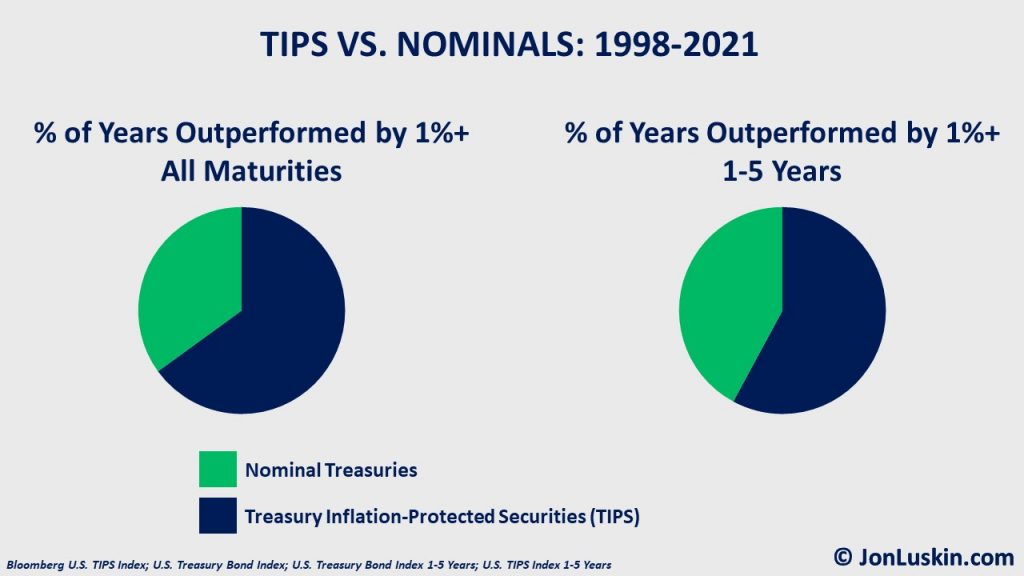

For shorter-term debt (1-5 years), the results were similar. Shorter-term TIPS outperformed inflation in 15 out of 24 years (~63% of the time). Regular shorter-term Treasuries performed similarly, doing better than inflation in 14 of 24 years. Like the broader bond indexes, the amount of outperformance over inflation was greater for shorter-term TIPS than for regular Treasuries: 1.9% for TIPS vs. 1.1% for regular Treasuries.

Nerd Note: That last data point shouldn’t be a surprise. That’s because (assuming a normal upward-sloping yield curve) you should expect to earn a higher interest rate by holding a longer-maturity bond. All else being equal, a higher interest payment means more money.

TIPS vs. Regular Treasuries

The above compared >TIPS vs. Regular Treasuriesuries and TIPS – to inflation. How did TIPS do against regular Treasuries – regardless of inflation?

About half the time, TIPS did better than regular Treasuries by 1% or more per year. (The results are similar for bonds of all maturities.) All that is to say “yes, historically, you would have been better off with TIPS.”

Are TIPS Better than Other Bonds?

Given the relatively short period and similar results, concluding much from the above is challenging; it’s hard to say if one type of bond is definitively better than the other.

Nerd note: 24 years is an arguably short period for evaluating an investment (asset class). Consider that we have over 100 years of data for stock market returns.

Downsides of TIPS

And with that, we’ve already covered th>Downsides of TIPSy cost. In the past, compared to regular Treasuries, TIPS weren’t always the better bet. Moreover, TIPS weren’t even always the better bet for outperforming inflation; sometimes, regular Treasuries outperformed inflation when TIPS didn’t (2006, 2008, 2014 & 2015). Yet, there are other downsides to investing in TIPS.

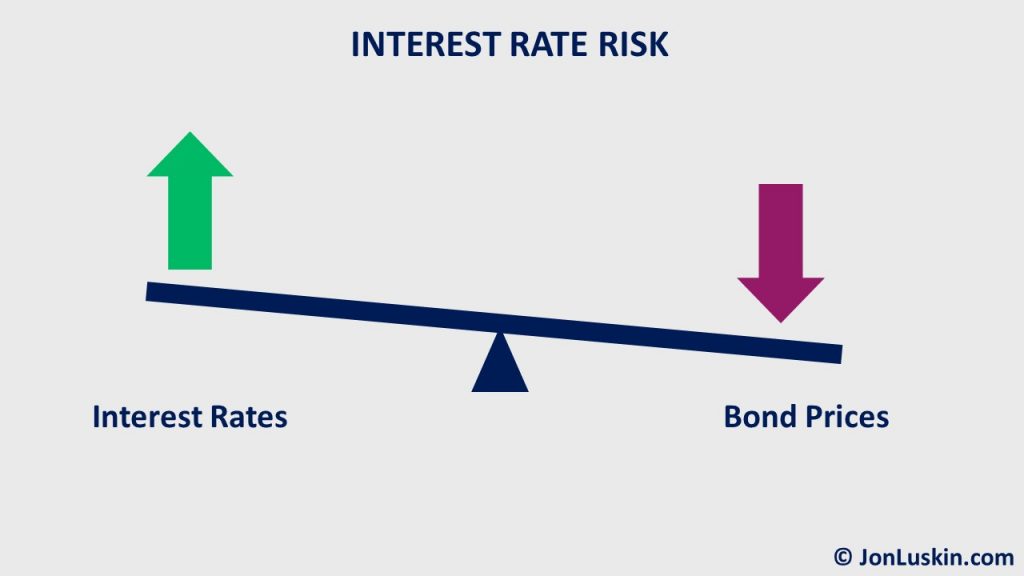

Interest Rate Risk

Interest Rate Riskf="https://www.morningstar.com/articles/1106125/tips-can-help-with-inflation-but-are-you-courting-other-risk" target="_blank" rel="noreferrer noopener">TIPS investors ignore interest-rate risk at their peril. ~Amy C. Arnott, CFA

TIPS are bonds. That means they’re subject to the same risks as other bonds. If interest rates increase, TIPS bonds can lose value.

Looking at 2021, we see that a portfolio of TIPS bonds (i.e., a TIPS index) didn’t necessarily offer bulletproof inflation protection. That’s because the additional payment for inflation is just one part that determines an investor’s return – the other part being adjustments to principal value, and any changes in the (secondary market) value of an interest-paying bond.

Consider an example. Your TIPS bond makes an interest payment of 1%. You then receive an adjustment to that interest payment and an adjustment to the bond’s value (principal value), increasing your return by another 1%. You’re up two percent!

Yet, that’s before considering the impact of interest rates – which pushes down the value of your bond by 3%. So, even though you were up before the impact of rising rates, you still lost money.

Nerd note: That’s going to be the case whether you’re in a bond fund or looking at the prices of your individual TIPS bond on the secondary market. Whether you decide to hold your individual bond to maturity or not, you’ve still lost value today.

TIPS Don’t Fully Protect You from Inflation

So far, we’ve been using CPI as a measure of >TIPS Don’t Fully Protect You from Inflation101532/how-worried-should-you-be-about-inflation" target="_blank" rel="noreferrer noopener">isn’t the best measure for cost-of-living increases. Generally, you can expect your own cost of living to increase faster than CPI. That means the adjusted payments of TIPS won’t necessarily increase at the same rate as your expenses.

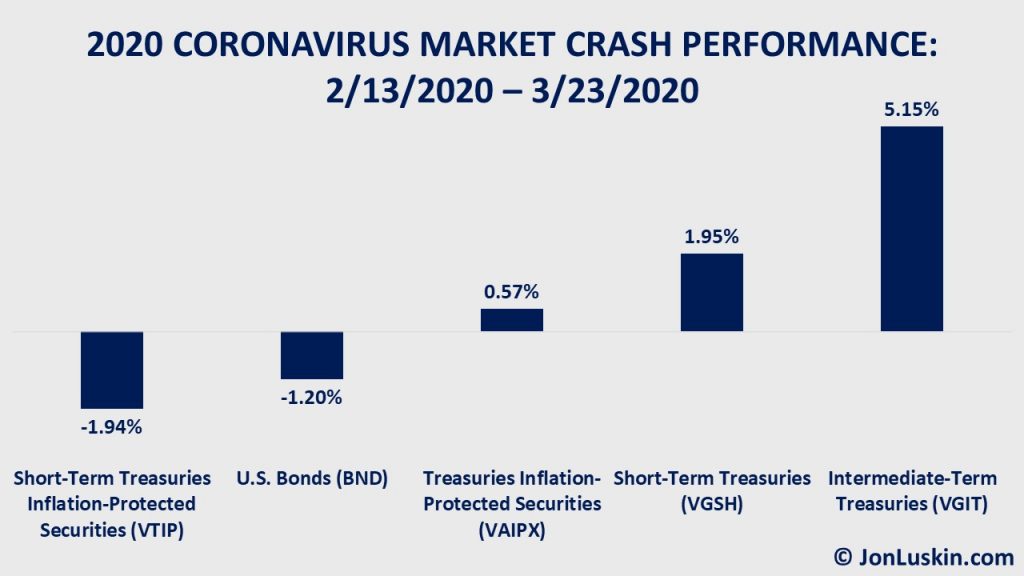

Poorer Performance During Panics

On average, TIPS don’t do as well as regular Treasuries during mar>Poorer Performance During Panicsttps://www.morningstar.com/articles/1084962/which-bond-types-provide-the-most-diversification-for-stock-investors" target="_blank" rel="noreferrer noopener">perform better than lower-quality bonds.

How Much TIPS Do I Need In My Portfolio?

There are several strategies to consider.

How Much TIPS Do I Need In My Portfolio?avy Portfolios

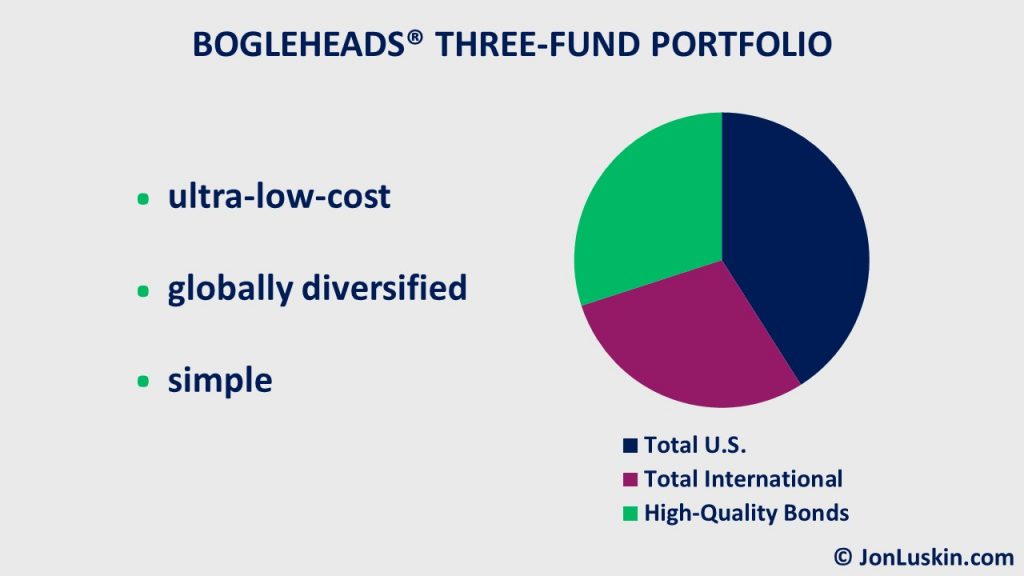

When there are multiple solutions to a problem, choose the simplest one.

~Jack Bogle

The Boglehead® three-fund portfolio doesn’t hold any TIPS – opting for a low-cost total bond fund instead. I similarly have a bias for simplicity. That means not adding an additional bond fund to my portfolio.

Nerd note: I prefer Treasuries over the total bond market.

Why don’t you need TIPS? Perhaps one doesn’t need inflation-protected bonds when stocks are in the portfolio. (There is an exception – which I’ll get to shortly.)

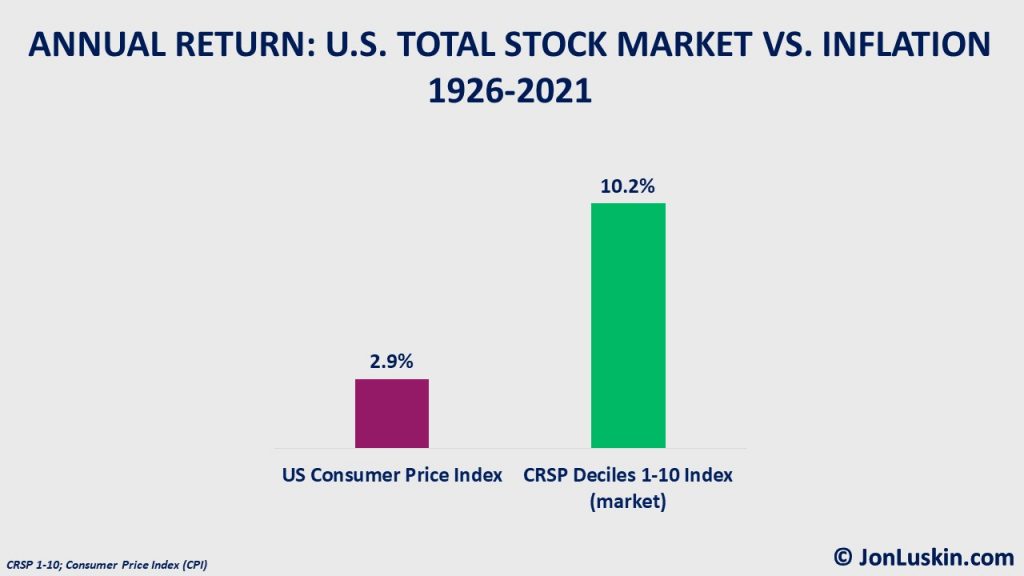

In the past, the investment return on stocks has outpaced inflation – by a lot. That means investors holding a diversified portfolio of stocks already had long-term inflation protection.

The challenge is that it can take time for the stock market to perform. Certainly, there have been many (shorter) periods when inflation was higher than the investment return provided by a diversified portfolio of stocks.

So, at least in the long term, investors didn’t necessarily need TIPS to manage inflation risk. And, we are all long-term investors. Therefore, why not hold regular Treasuries instead of TIPS, thereby helping your portfolio do better during market panics?

Managing Inflation Risk for Conservative Investors

I’ll add a caveat to my bias for simplicity: at a certain point, some additional complexity may make sense.

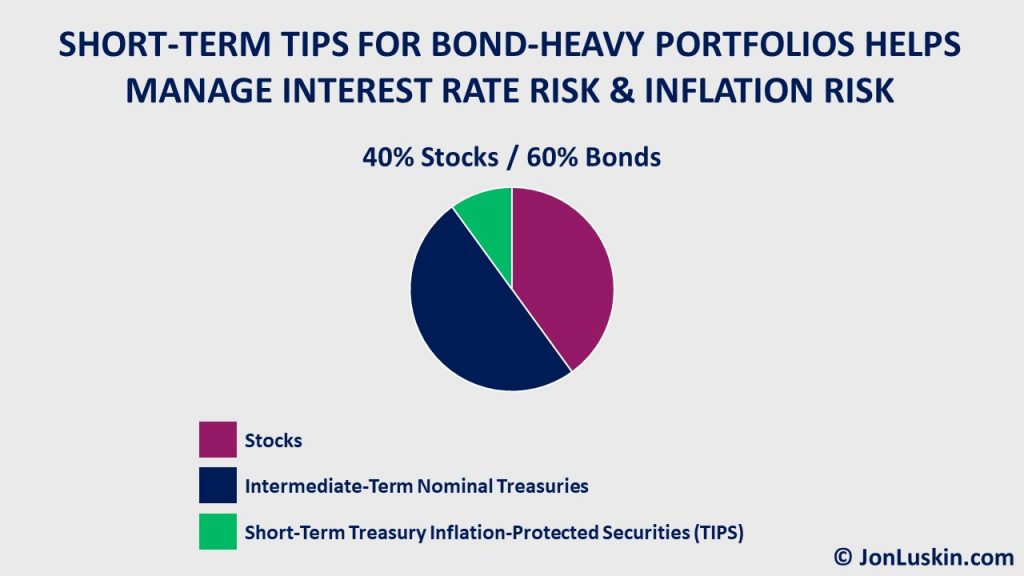

Once a portfolio contains less than 50% in stocks – with the rest in bonds – investors may want to consider adding inflation protection via TIPS. Said differently: if a portfolio’s allocation of stocks dips below that 50% mark, the difference can be made up with TIPS.

Nerd note: Certain asset classes – such as commodities and real estate (via real estate investment trusts, REITs) – may offer inflation protection. Generally, I’d avoid commodities, and lump REITs into the stock portion of a portfolio.

Let’s take an investor with a portfolio of 40% stocks and 60% bonds. At that point, at least 10% of the entire portfolio should be in TIPS. Using more than just that 10% is also reasonable.

Yet, you’ll want at least 10% since only 40% will be invested in stocks – subjecting what would otherwise be half of the portfolio to inflation risk (had not 10% of the portfolio been invested in TIPS).

Using Short-Term Bonds to Manage Interest Rate Risk in Bond-Heavy Portfolios

Then there’s the issue of interest rate risk – already touched on. To help manage interest rate risk from a bond-heavy portfolio, investors can consider short-term bonds whenever their portfolio has over 50% bonds.

We’ve just discussed how TIPS may make sense for portfolios of less than 50% stocks. Considering that those additional bonds should also be short-term means adding a short-term TIPS fund to any portion of a portfolio with more than 50% bonds.

100% TIPS

Another approach is going all-in on TIPS. That’s not unreasonable. After all, TIPS are U.S. government bonds. The downside to >100% TIPS poorer average performance during market panics and the opportunity cost of investing in regular Treasuries, which sometimes outperformed TIPS in the past.

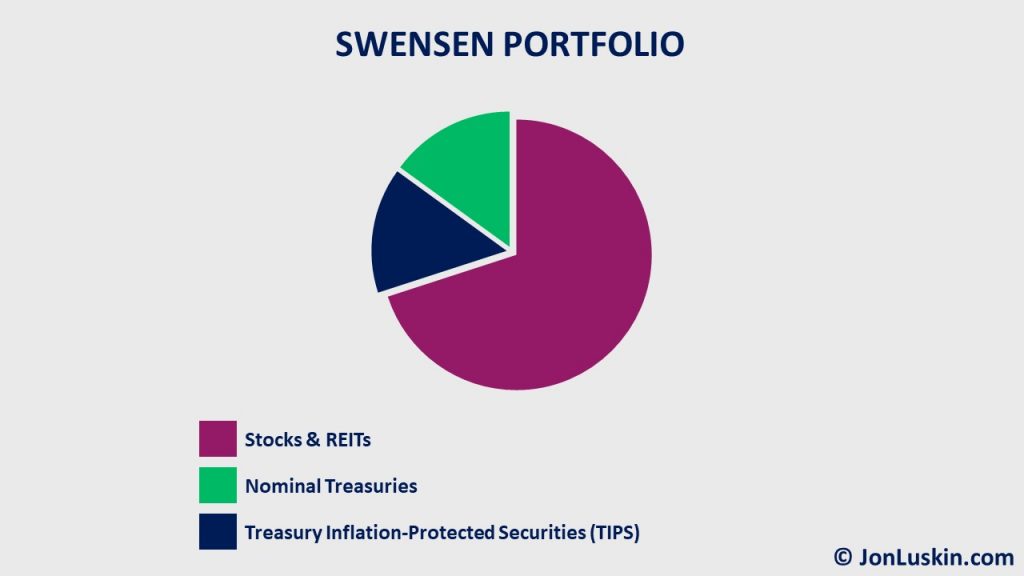

50/50 Split: The Swensen Portfolio

Can’t make a decision? Consider a compromise.

David Swensen, the late Chief Investment Officer of Yale>50/50 Split: The Swensen Portfoliomazon.com/Unconventional-Success-Fundamental-Approach-Investment/dp/0743228383" target="_blank" rel="noreferrer noopener">suggests a 50/50 split between regular Treasuries and TIPS. (This is also the approach used by Boglehead® Dr. Jim Dahle, of White Coat Investor fame.)

With the 50/50 approach, if inflation is higher than expected, TIPS could do better. If inflation turns out to be lower than expected, regular Treasuries should outperform. Given that we can’t know which type of bond will do better going forward, this split approach isn’t unreasonable – if you’re up for the additional complexity of managing two bond funds.

How to Buy TIPS

Individual Bonds vs. Funds

In an earlier section, we looked at the performance of a coup>How >Individual Bonds vs. Fundsnd"> the returns of those indexes were comparable to what you could expect from a low-cost TIPS index fund.

You can purchase both individual TIPS and TIPS funds on the secondary market via a brokerage custodian. Compared to buying individual TIPS bonds, purchasing shares of a low-cost TIPS index fund offers two advantages: flexibility and simplicity.

- Flexibility: You can buy or sell as much of a TIPS bond fund as you want. Unlike buying individual bonds on the secondary market, you’re not limited to making trades in $1,000 increments.

- Simplicity: Any payments from the funds can be automatically re-invested back into the fund. You can’t do that with individual bonds on the secondary market.

Investors can also purchase TIPS directly from the U.S. government. If you’re buying TIPS from Treasury Direct, selling TIPS to buy stocks (during an annual rebalance) will be more complicated – requiring you to transfer funds from Treasury Direct to your investment custodian (Charles Schwab, etc.).

What Is the Best TIPS Bond Fund?

One of the lowest-cost TIPS funds is Charles Schwab’s TIPS ETF (SCHP). It has an ultra-low expense ratio, just 0.04%. That means paying $400 in fees for every $1,000,000 invested. As with most TIPS funds, SCHR holds a mix of long-, intermediate-, and short-term TIPS.

For tax-advantaged accounts – and for those who don’t want to bother with the additional work of trading ETFs, there is Fidelity’s low-cost TIPS index fund, Fidelity® Inflation-Protected Bond Index Fund (FIPDX). The Fidelity fund is one basis point (0.01%) more expensive than Schwab’s fund. At 0.10%, Vanguard’s Inflation-Protected Securities Fund Admiral Shares (VAIPX) is twice as expensive!

(Generally, you want to avoid using a mutual fund in a regular taxable account, given their tax inefficiency. Also, you may want to avoid buying that Fidelity fund anywhere but Fidelity, avoid buying that Vanguard mutual fund anywhere but Vanguard, etc., to save you on trade fees.)

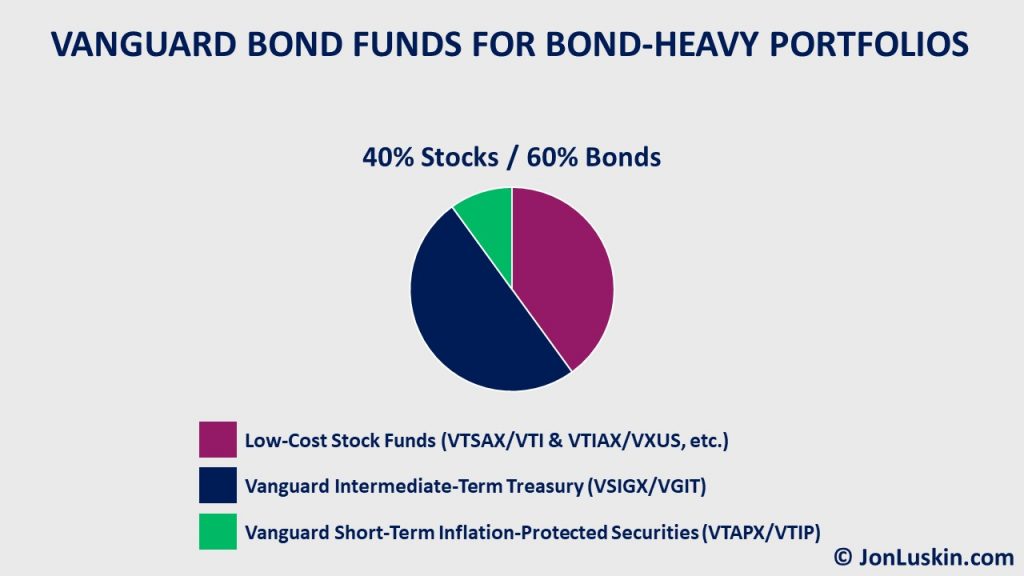

Those investing less than 50% of their portfolio in stocks can consider a short-term TIPS fund to help manage interest rate risk. Vanguard’s Short-Term Inflation-Protected Securities Fund (VTAPX/VTIP) remains a popular choice.

Market Timing

Generally, the best time to make a change to your portfolio is when you have a significant change in your life: marriage, birth, death, divorce, entering retirement, c>Market Timingike all investments, the value of adding TIPS to your overall investment portfolio is subject to the risk of market timing.

By purchasing TIPS after an unexpected rise in inflation (such as we’ve recently experienced), we risk paying a premium for that investment. That is, it’s possible that by paying more – because of poor timing – we could lose any benefits of adding TIPS to the portfolio in the first place!

This reinforces a basic principle of investing: stick to your long-term plan, and ride the market’s ups and downs without reacting.

Stay the course!

~Jack Bogle

That is to say, if your long-term plan didn’t call for TIPS before, does it make sense to add them now?

Whatever you decide, remember: when investing in anything – including TIPS – you should generally be investing for life. For example, if investing in TIPS for 50% of your bond portfolio, always make your bond portfolio 50% TIPS.

Are TIPS Right for Me?

The real value of adding a TIPS fund is unknowable – because we don’t know today how TIPS bonds will do compared to regular Treasuries in the future.

For those inve>Are TIPS Right for Me?concerned about inflation,

… adding a low-cost TIPS fund to their portfolio is just fine. Moreover, for those conservative investors with less than 50% of their portfolio in stocks, TIPS can help manage inflation risk.

But regardless of when you begin investing in TIPS, or how much you devote to that investment, remember to avoid the risks of market timing by picking a plan and, like Jack Bogle loved to say, stay the course.

Disclaimer: For education and entertainment purposes only. Not specific investment advice. Confer with your tax and investment professionals before making any investment decisions.

Leave a Reply