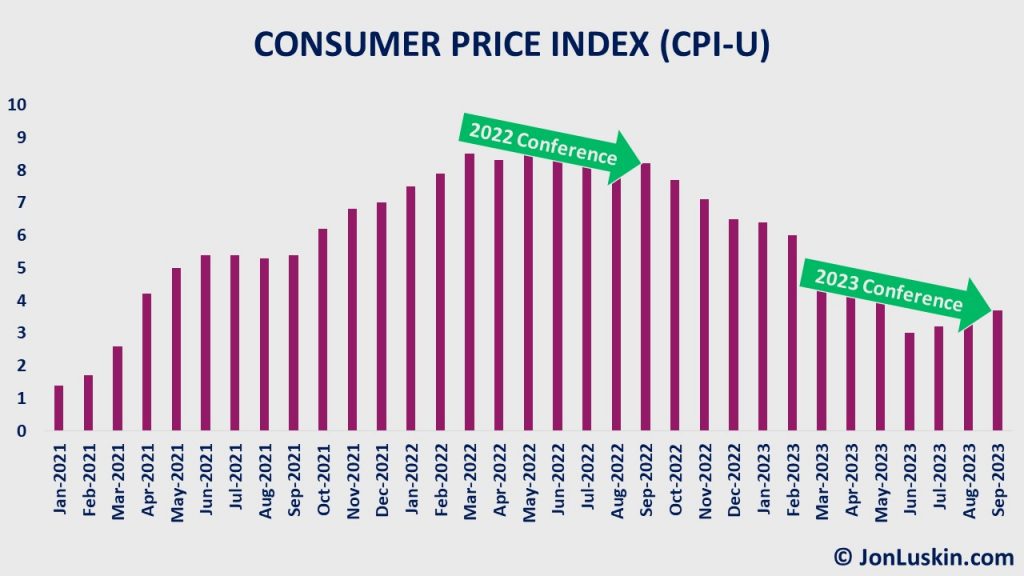

The 2022 Bogleheads conference occurred just over one year ago. At the time, inflation was high.

Given the rising prices of goods, conference attendees were rightly concerned – and looking for solutions at last year’s conference. Naturally, Treasury-Inflation Protected Securities (TIPS) and I-bonds were a much-discussed topic in 2022. Those relatively safer investments offered the promise of protection against eroding the purchasing power of one’s wealth.

Fast forward one year later to the present day. The Federal Reserve’s aggressive interest rate-raising campaign wreaked havoc on the bond market. This includes all bonds (anything liquid, traded on the secondary market). Therefore, the TIPS so loved at last year’s conference were now uttered in disdain – in 2023. Also not repeatedly mentioned in 2023 were I-bonds – now that those bonds were no longer paying near double-digit interest rates.

With TIPS funds and I-Bonds out, there was a new topic of interest: income ladders. Suggestions for income ladders included rungs of individual TIPS, Treasuries, CDs, and even (heaven forbid) municipal bonds.

Attendees and speakers alike were hopeful of the value of holding an income ladder to maturity, helping ensure that investors would lose no principal value. (Holding individual bonds to maturity may help protect investors from interest rate increases – which we’ve had a lot of late.)

Said a little bit differently, collectively, investors were emotionally scarred from interest rate increases – and were looking to make a change.

How am I so sure that income ladders were the topic du jour? Conference speakers brought it up during their presentations; audience members asked about it during the Q&A sessions. And, on three different occasions at the conference – and once shortly before the conference in an email from a client, I was asked about bond ladders. (Late last night while scrolling the forums, there were no less than five posts about TIPS ladders on the homepage.)

Often, I was asked about selling out of an existing, ultra-low-cost high-quality bond fund(s) to create a bond ladder instead. I’ll share (a version of) what I shared with those folks:

Table of Contents

Higher Interest Rates Can Be Good

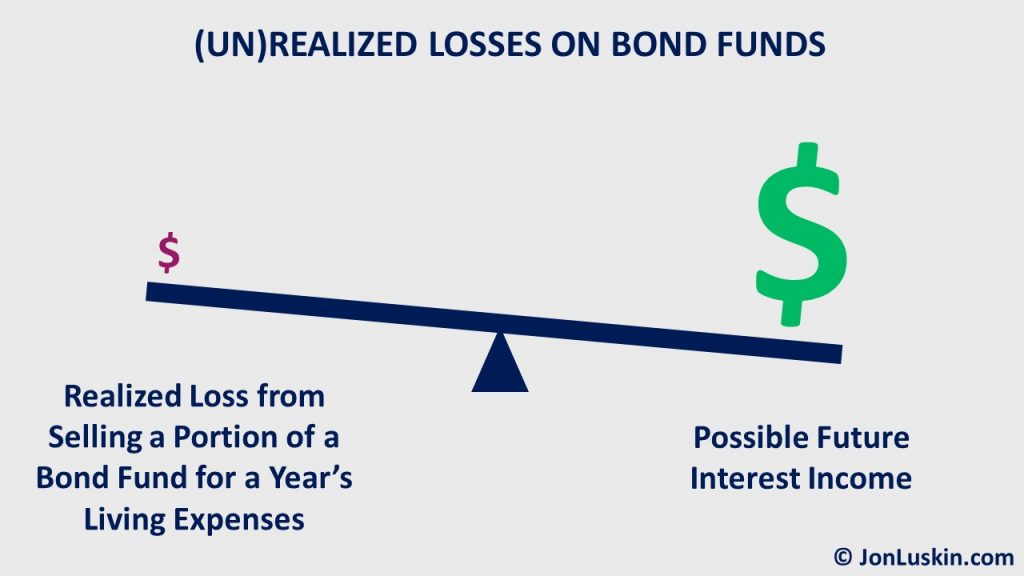

Any short-term losses on a bond fund today may be modest – especially since long-term investors won’t be realizing all the losses on their bond funds today anyway.

That’s to say, “yes, your bond fund is down. But you’re likely not going to be realizing the entire loss.” Generally, any prudent long-term investing plan doesn’t call for selling out of the entire position in your bond fund. Instead, long-term investors will likely be selling just a portion of their bond fund – alongside stock funds – to provide for annual living expenses in retirement.

What are you going to do with the rest of the money in your downtrodden bond fund? You’ll be leaving it as is, earning back any losses as higher interest rates translate to more wealth over time. That’s to say, you’ll certainly make that money back eventually – by waiting. To paraphrase Rick Ferri, bonds are self-healing.

Consider it one step backward, two steps forward. Bonds have been beaten down by higher interest rates (the backward step). Yet, going forward, you’re going to earn more money than before with higher interest rates (the two steps forward).

A TIPS Ladder is Fine

Let’s start with one of my favorite quotes about investing:

There’s no perfect portfolio. There’s plenty of perfectly fine portfolios.

~Mike Piper

A TIPS ladder is fine (albeit a lot more work than using a low-cost bond fund or a single balanced fund). And, if I was working with someone for the first time – creating an investment plan from scratch – then a TIPS ladder could be something worth considering. Of course, that’s only if that person was particularly drawn to the pros (despite the cons) of such a strategy – discussed next.

Protection (Predictability) of Principal – Pro

It may go without saying that the benefit of an income ladder is that you know exactly how much money you will get from your investments and when. That’s some undeniable value.

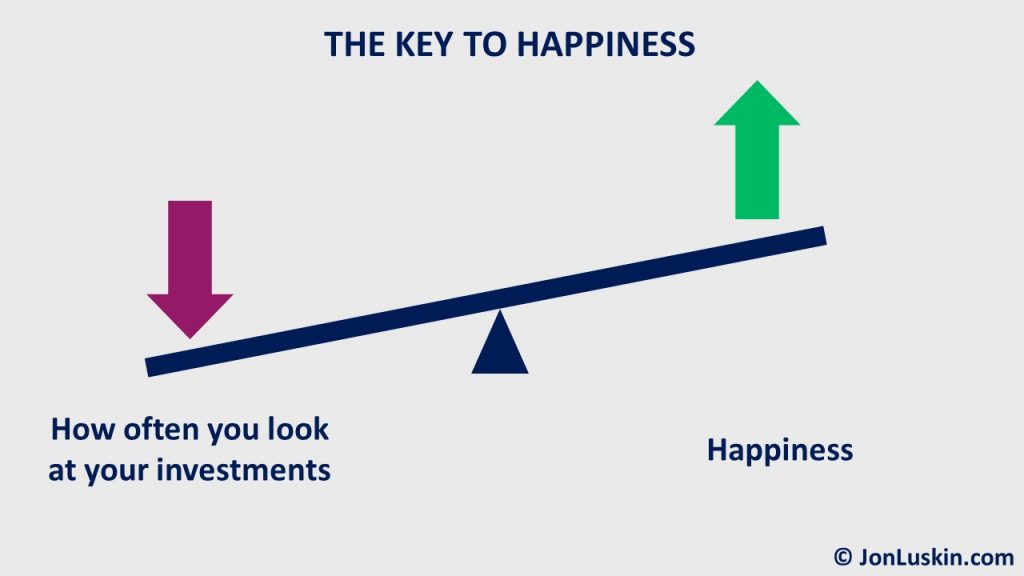

Yet, that value might be a bit more behavioral than anything else. It’s just a matter of how you look at it. If you looked at the daily value of an income ladder, you’d likely be just as displeased as if looking at the daily value of a bond fund.

Cost – Con

While you won’t have to pay a low expense ratio when using a low-cost bond fund or balanced fund, you’ll still have to pay the spread (cost) when buying the individual rungs of your TIPS ladder. And, if you need to redeem a rung on your ladder before maturity, you’ll be paying that spread twice.

Moreover, since you’ll almost certainly being buying a small or odd lot, you’ll be paying a larger spread than any mutual fund manager would when buying bonds for you on your behalf. It’s difficult to say if buying bonds at a (large) markup yourself is better or worse than paying a low expense ratio for a fund.

Complexity – Con

Certainly, there are many who argue that a TIPS ladder isn’t complicated. And, perhaps they’re right.

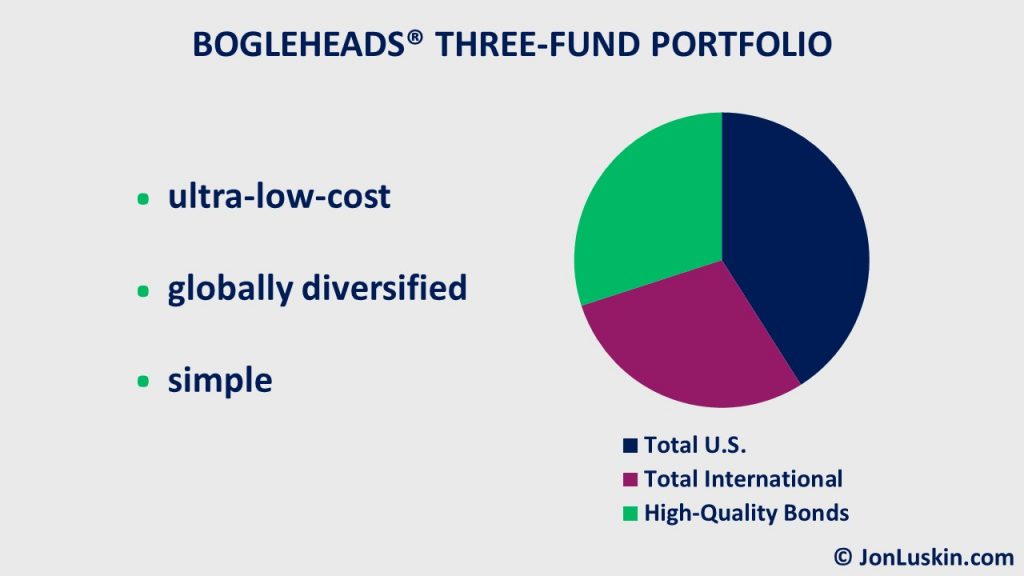

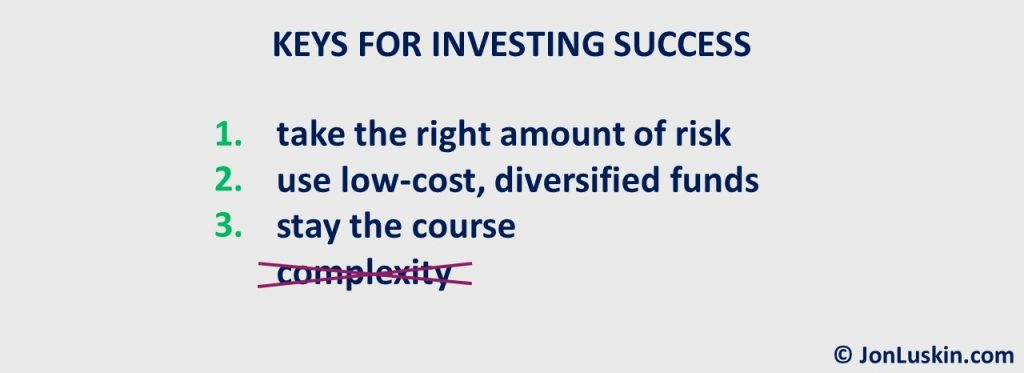

It’s just that any income ladder is more complicated than the (much) simpler investing solutions available. That’s to say, a TIPS ladder is relatively complicated. Consider my (frequent) investing benchmark: a single balanced fund, or even a low-cost three-fund portfolio.

I’ve worked with over 350 investors over the last two years, most of whom are do-it-yourselfers. And, I’ve never once had anyone lament making their investments too simple. Yet, I’ve lost count of the number of times they’ve confided regret in making their investments too complicated.

Investing Can Be Simpler

Mike Piper has written about the value of investing using a single balanced fund; he makes an excellent point. With one single fund, you can get global diversification, low cost, and zero-maintenance.

Unsaid by Mike is that there are even relatively tax-efficient options for taxable accounts – with iShares offering a line of balanced (allocation) ETFs.

Legacy Planning

Moreover, it’s not just the complexity today that’s the issue; it’s future complexity, too. Perhaps creating a TIPS ladder today is a piece of cake.

But, what about redeeming a bond early 30 years from now? And, if you’re not alive 30 years from now (which you may not be), is redeeming a bond early something that your less-interested-in-financial-stuff spouse wants to do? If you’re unsure, I invite you to ask your spouse if they think a 30-year TIPS ladder is complicated.

Distraction from Important & Urgent Projects – Con

In the long run, opting for an income ladder versus a low-cost, high-quality, intermediate-term bond fund likely won’t make a big difference. Yet, there can be much more important financial planning projects than can make a big difference.

For most folks, that means getting the right type of insurance in the right amounts (such as umbrella insurance and long-term disability insurance – for younger earners). It also means getting your estate planning done and creating an Emergency Letter for those (eventual) worst-case scenarios.

So, if you must add some (arguably) unnecessary complexity to your investing plan, I ask that you make sure you’ve already done those much more important projects first.

There’s no right or wrong here; just pros and cons. I make these points to help you decide if this strategy (and its accompanying additional complexity and costs) is right for you. Consider that this is an investing approach that will (likely) last decades, potentially your lifetime.

Stay the Course!

Certainly, you can do a lot worse than a TIPS ladder. Yet, making changes to a portfolio is one of the cardinal sins for long-term investors.

Therefore, if you’re already invested in a risk-appropriate, low-cost portfolio today, there is a very important reason why you may not want to consider a TIPS ladder. And, that reason has nothing to do with the merit of a TIPS ladder. Instead, it has to do with making changes to an investment plan.

Generally, we want to avoid changes when investing. Now, if we have a life event (birth, death, marriage, divorce, retirement, etc.), then perhaps a change makes sense. But, if our life really hasn’t changed, making a portfolio change probably isn’t a good idea.

Investing takes time. And if we’re constantly tinkering with our investments – changing them, we’re not giving our investments the time they need.

The Costs of Changes

Why stay the course? There’s the additional cost that come with making portfolio changes. That includes transaction fees (spread) and possibly taxes (for taxable accounts).

Market Timing

Moreover, if you do make a change, you’ll probably get the timing wrong. There are countless examples of just this.

Recently, Morningstar showed data of investors buying high and selling low on bond funds, losing money. Not coincidentally, the asset class involved is TIPS.

I don’t know which approach will do better in the future – a low-cost, high-quality bond fund or a TIPS ladder. (The difference will be small, anyway.)

But, I do know that making the change means paying those costs already described, and likely getting the timing wrong. Since making that change has a definite downside with an unknown benefit, that suggests not making that change.

I can’t help but wonder what next year’s market returns will mean for investors maintaining (or not) their approach.

- Will those implementing TIPS ladders today become disenchanted with the strategy over the next year?

- Will some investors be frustrated (paralyzed?) with the decision of what to do with maturing bonds from their ladder? (Spend it, invest proceeds elsewhere or something else?)

- Will inflation come in much lower than expected, (TIPS underperforming), with those invested in TIPS to lament not investing in plain-vanilla Treasuries, CDs, or even a total bond market fund instead?

I can’t know. Yet, I can only hope that next year I will continue to give the same (boring) tried-and-true investing advice, the same wisdom that Jack Bogle has said countless times before:

Stay the course!

I LOVED this post. I just retired early. I was very fortunate and rolled my bond allocation into a stable value fund in 2022 and back into a high yielding very short term etf in 2023 SGOV. (I timed the Fed). I just built a 10 year brokered CD ladder that will likely be a rolling ladder. I will now stay the course. Tips worry me because the Fed seems very dedicated to lower inflation. I’m so glad to hear I wasn’t alone in thinking about ladders. I saw what happened to Bond funds in 2022 and don’t want or fortunately need the worry. Thanks!

Thank you, JV!

I can’t know what the future holds for TIPS – or anything else. So, for me, I’ll stick with the same tried-and-true boring approach to investing.

🤓

30 years of guaranteed inflation-adjusted cash flow sounds like a nice, worry-free retirement to me. You just need to plan for year 31 and beyond. Who needs to spend their retirement fretting about markets?

Thanks for your comment, Smiley.

I think you said it well – speaking to how investors can feel better knowing that they have the guaranteed income (for at least as long as they create their particular income ladder for).

My only concern is that emotions come and go. And, I can’t help but worry that there may be another shiny object in the future that may help one feel better about investing. And of course, making changes to your investment plan means costs, taxes, etc.

*MAYBE* (emphasis on the maybe – not investment advice) a one-time switch to an income ladder might make sense to help some people feel better. Yet, investors will have to take themselves seriously that it’s an only-this-one-time-and-never-again change. That can help avoid the challenges that come with not staying the course.

Lots of good points here but for retirees without major legacy goals – or indeed any retiree with modest assets needing to guarantee basic income – you’re not offering a compelling alternative to a TIPS ladder with a guaranteed ~4.5% real SWR over 30 years. I don’t see how a major allocation to TIPS supplemented with a modest chunk of equities (say 30%) isn’t a far better choice than rolling the dice with a “conservative” three fund portfolio or LIfeStrategy fund.

John Reckenthaler makes the case here. An interestingly what he recommends is very much like DFA’s Retirement Income Fund, which unlike Vanguard’s offerings is about guaranteed income.

https://www.morningstar.com/bonds/high-tips-yields-are-retirees-best-friend

TIPS, or a TIPS ladder, is generally fine. It’s making changes that I generally try to avoid when investing.

Good luck!