Previously, I wrote that stock market investing has historically outperformed rental real estate investing in California. (This is even the case when considering leverage: California rental property underperforms the stock market.) This conclusion applies not just to real estate in California, but anywhere with dense populations. This is because high population density creates a high demand for real estate (relative to less densely-populated areas).

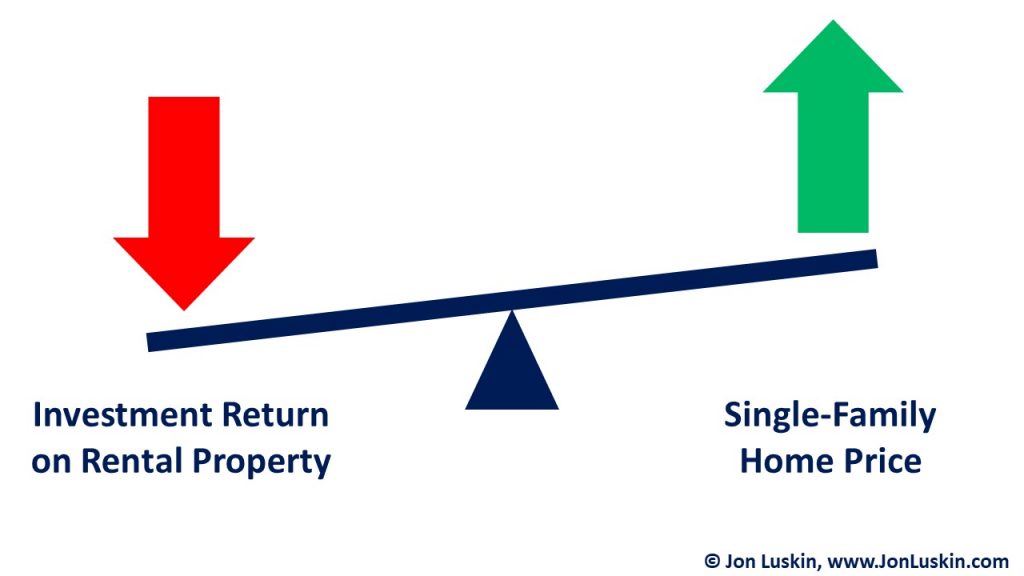

This increased demand for housing pushes up real estate prices. All else being equal, higher housing prices drive down the investment return available on area rental real estate. (The investment return calculation (%) of a rental property uses the property acquisition price as the denominator.)

The above does consider that increased rent can be had in more populous areas. However, while rent is indeed higher for more expensive properties, rent prices do not increase proportionally with the cost of real estate in larger cities. Said technically: across the country, the standard deviation in rent is less than the standard deviation of the prices of single-family homes. Rent prices lag property prices.

Let’s use an example to drive the point home: consider that while a single-family home in San Diego, California can cost twenty times that of a single-family home in Marion, Indiana, you cannot charge 20 times in rent for the San Diego home. One could not even charge half that – ten times. Considering only cash flow – and not appreciation – this means that the return on your California rental will be (relatively) less profitable.

| City/Metric | San Diego, CA | Marion, IN |

| Home Price | ~$550,000 | ~$26,500 |

| Rent, Monthly | ~$3,300 | ~$650 |

Thus, we’ve now argued that not only is California rental real estate less profitable than stock market investing (even when including leverage), but higher-priced rental properties are also less profitable than less expensive rental real estate in other parts of the country – where single-family homes can be had for less money.

Quick Tangent

Why do home prices vary so dramatically over rent prices? Leverage. One cannot take out a loan to pay rent – but they certainly can to buy a home. With leverage, individuals can buy things they otherwise could not afford. This means homes can be sold for more. Were mortgages not a thing, housing prices would come crashing down. Imagine how inexpensive homes would have to be if all buyers had to pay cash! Without a way to finance rent, rent is only as high as tenants have cash flow for it.

So, what do you think? Where are your real estate investments? How do you advise your clients on real estate investing?

Leave a Reply