Twice now, clients have shown up for a portfolio review when holding Blackstone’s REIT fund.

Depending on which version of this fund you have, you may pay between 1.25% and 1.50% in annual fees. That outrageous fee is in addition to a 12.5% performance fee for returns over five percent. Said simply: it’s expensive.

Given the high fees, why are my do-it-yourself investor clients showing up with these funds in their accounts? Because asset managers placed my clients into these products.

The pitch for the high-fee fund would have gone something like:

You need diversification, but bonds do nothing. So, we’ve got you invested in our fantabulous REIT fund; an investment in real estate is safe from any stock market crashes.

I’ve written before that there’s a difference between the story around an investment and the numbers behind it. However, as humans, we’re inclined to listen to the story – at the risk of ignoring the numbers. And while the sales pitch above is deceptively simple, the numbers behind it tell something completely different. Let’s dig into those numbers now.

H>High-Quality Bonds Provide Diversification to Stocks

p>We’ll begin by tackling the claim that “bonds do nothing.” Let’s assume “nothing” means bonds provide no income. For most bonds, that’s an exaggeration. Interest rates are indeed low, yet most bonds still pay something.

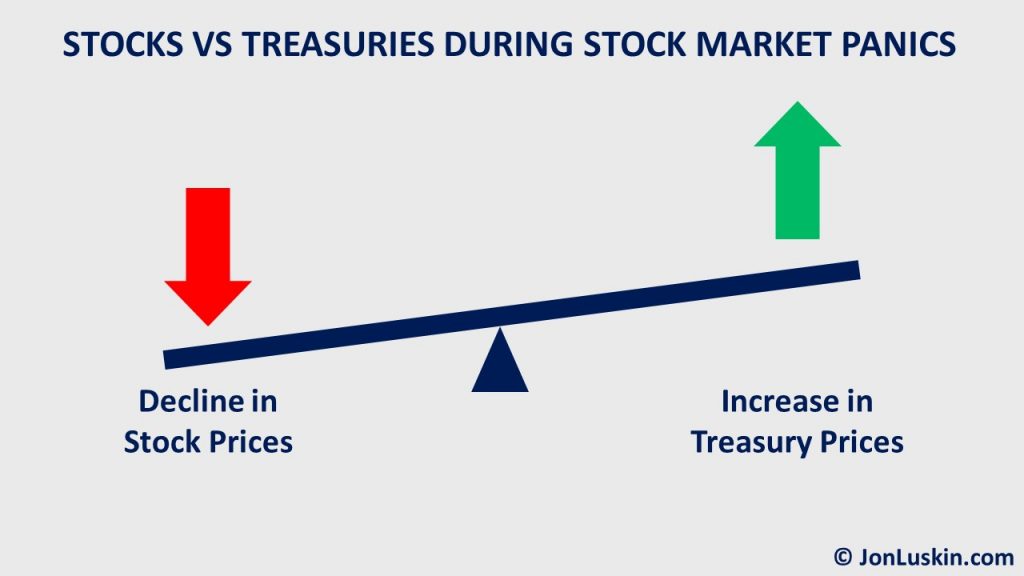

Yet, as investors, we don’t need to look at the interest income provided by bonds in isolation. Instead, we should evaluate the total return of our investment portfolio. That is, we want to examine how our stocks and bonds work together.

The nerdy term for this approach is total return investing: looking at the total return of your portfolio, as opposed to the different sources of investment return in isolation. In using a total return approach, we consider not just income but appreciation too. We examine this income and appreciation for both stocks and bonds.

Once we look at our portfolio’s total return, we see that bonds do quite the opposite of nothing. Adding high-quality bonds – especially Treasuries – to an investment portfolio decreases the risk of investing in stocks. And with that, we’ve debunked the first sales pitch of private REITs. Instead of “doing nothing,” high-quality bonds – especially Treasuries – are a valuable tool for managing stock market risk.

All Real >All Real Estate Is Correlated

wp:paragraph -->Let’s bust the next myth from the private REIT sales pitch:

Real estate is uncorrelated to the stock market.

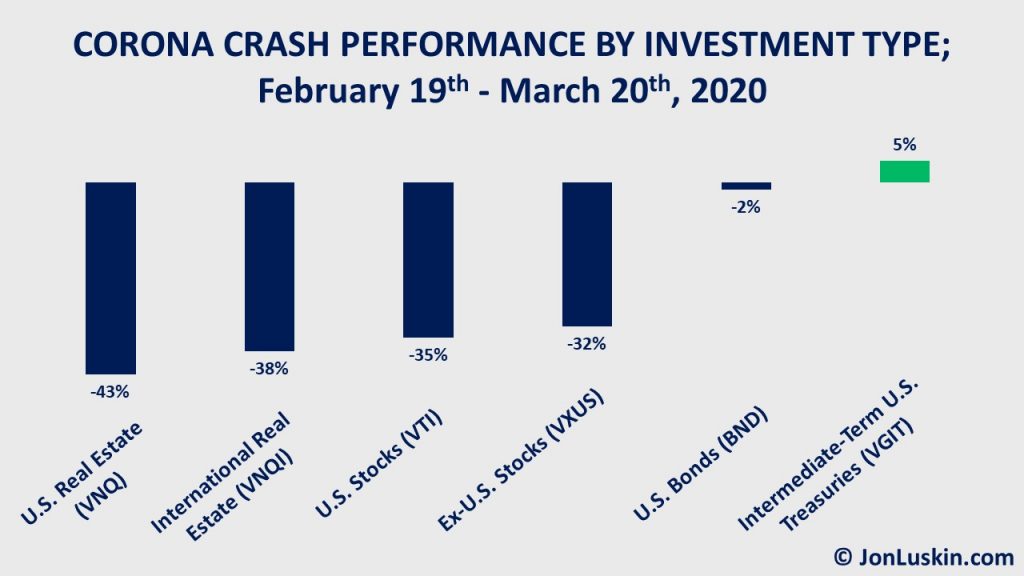

Unless you were in a coma during the financial crisis of 2007-2009, you know that real estate and the stock market simultaneously dropped in value. We saw the same amid the recent corona crash; publicly-traded REITs did even worse than stocks! When examing these crashes, we see that real estate is not a valuable diversifier.

At this point, those private REIT salesmen may be objecting:

But, that speaks to publicly-traded REITs! Blackstone’s super-expensive REIT isn’t correlated to the market.

That above is incorrect.

Real estate is real estate. It doesn’t matter who owns the real estate. It’s buyers of real estate who set market prices. Just because a special someone – like a private REIT fund – owns a piece real estate doesn’t make that piece of real estate exempt from market forces.

All Real Estate Is Real Estate

If you’ve ever bought a house with a mortgage, you know what “comps” are. To qualify for your mortgage, recently sold houses in the same neighborhood are compared to the property you’re purchasing. It’s the price of those previous sales that dictate the value of your future home.

To explain why the owner (private REIT vs. publicly-traded REIT, etc.) of a piece of real estate doesn’t matter, consider a story.

Del Mar Heights is a nice area of San Diego. One road – High Bluff Drive – is home to many business complexes renting out office space. Different addresses have different owners. Some of the complexes are owned by private parties, publicly-traded REITs own some, others by hedge funds, and still others by endowments. Finally, one building is owned by Blackstone’s private REIT fund.

Now, it’s the financial crisis. Investors everywhere are re-assessing their portfolios and panic selling.

The owner of 12544 High Bluff Dr. – a hedge fund – sells their property. The hedge fund is forced to make the sale because of panicky redemption requests by investors. Therefore, the sale comes at quite a loss for the fund. Where the property was valued at $5 million a year ago, now the hedge fund can only find a buyer at a cool million.

Up next is the endowment, which owns the property next door. The endowment’s board is similarly panicked and votes to sell some real estate. The endowment similarly sells their piece of real estate at a significant loss – at least relative to what the property appraised for just one year ago. It’s the same story for the private investor, who – you guessed it – sells at a loss.

Two properties remain on High Bluff Drive that haven’t been sold recently. You might remember that a publicly-traded REIT owns one property, with the other office building being owned by Blackstone’s private REIT.

If the publicly-traded REIT sells its holding, it’s also looking at selling it for less. The same applies to Blackstone’s REIT. Just because Blackstone owns a particular piece of real estate doesn’t mean that real estate is insulated from the rest of the market. It’s still real estate – which is only as valuable as the most a buyer is willing to pay for it.

The Truth about Private REITs,>The Truth about Private REITs, Syndicates, and Other Real Estate Funds

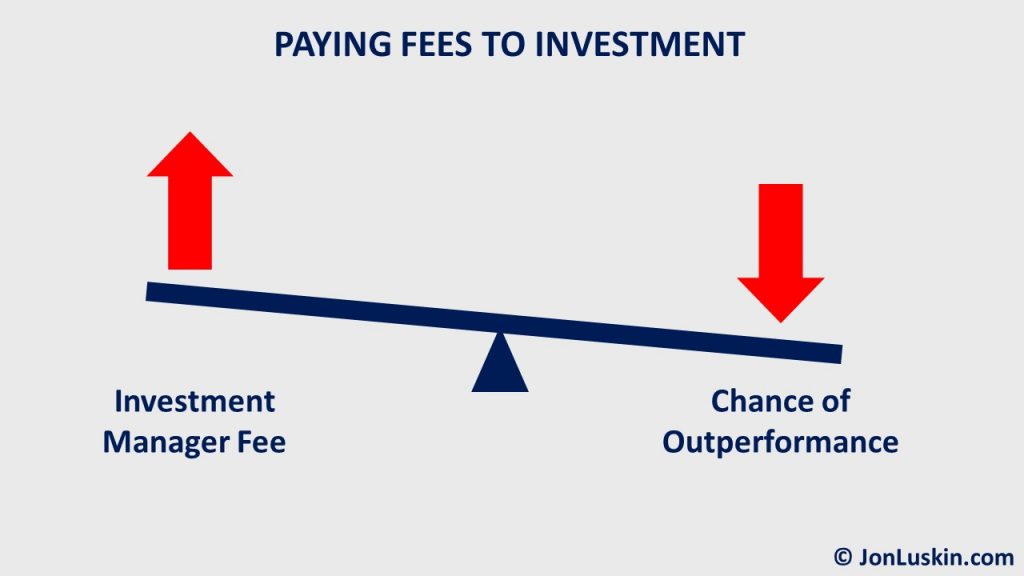

wp:paragraph -->To sum up, the myth about private REITs offering some value to your portfolio is busted. Not only do these products not add value to your portfolio, they subtract value in the form of high fees.

Countless studies show that fees are a big deal, being a main driver of investment returns. While fund managers try to make up for their fees with skill, they usually fail. And the higher the fees, the higher the odds that the manager charging that high fee will underperform.

Real estate investing is no exception to this; fees matter just as much when investing in real estate compared to anything else. One study showed that private real estate funds have underperformed publicly-traded REITs.

In short, when you pay more to invest, you usually lose. It’s that simple. To paraphrase famous Boglehead and advice-only advocate Rick Ferri:

If there is any outperformance, it goes to the investment manager.

So, now you know that the sales pitch of private REITs – touting low correlation – doesn’t make sense. When it comes to investing, the answer is always the same:

Your best bet for successful investing is to keep your costs low.

Armed with this knowledge, you can skip the high-fee private REITs, opting instead for low-cost, broadly diversified index funds.

The Boglehead Approach to Real Estate>The Boglehead Approach to Real Estate Investing

e know that we generally want to avoid high-fee private REITs and their high-fee cousins, real estate syndicates, etc. Sticking with low-cost index funds is an investor’s best bet.Moreover, when you invest in the total stock market, you are already investing in REITs – and therefore

real estate. However, some investors may wish to overweight REITs – to have one’s portfolio better track the economy rather than the stock market. That strategy has historically has led to better long-term investment returns. Yet, past performance is no guarantee of future returns.

Any concentrated investing strategy – overweighting REITs included – can underperform for decades, and possibly forever. For investors comfortable with the risk of lifetime underperformance, then overweighting a portion of a stock portfolio to REITs is reasonable. Rick Ferri suggests investing no more than 10% of your stock exposure in a low-cost REIT fund. Learn more here.

To avoid market timing, know that any strategy to overweight REITs is a lifetime strategy. Said differently, if you choose this approach, maintain this allocation forever.

Alternatively, you may wish to invest in real estate directly yourself, without a middleman.

Thanks Jon for this thoughtful piece. I had an advisor talk me into the former Carey Watermark non-publicly traded REIT, now Watermark Lodging Trust 10 years ago into a tax-free account, which lost 50% of its value at the beginning of the pandemic. I still hold it in the hopes it can bounce back – but even then it’s not a given that we’ll see a liquidation or be able to sell it at some point. It wasn’t my most shining moment in agreeing to this. Bruce

You’re most welcome, Bruce.

It was fun to write – and I topic I ended up explaining often enough that it warranted a post.

For me, I’d be less concerned about any recent performance than the fees. Knowing how much you’re paying can help you evaluate if it’s the right investment for you.

I hope that helps. 🙂

Best wishes,

Jon