Having read of two of Larry Swedroe and Kevin Grogan’s books in a row, I have twice been presented with the same argument for using the Stone Ridge Alternative Lending Risk Premium Fund (LENDX). (Swedroe argues for it online, as well.) This is an alternative (direct) lending fund, where investments are made in consumer loans, small business loans, and student loans.

Table of Contents

Alternative Assets

Investments in alternative lending – be it via the Stone Ridge Alternative Lending Risk Premium Fund (LENDX) or the online peer-to-peer variety – falls into the category of alternative investing. That is, investments in direct lending are outside of the conventional asset classes of stocks, bonds, and cash. Investing in alternatives (direct lending including) have very specific challenges relative to conventional asset classes.

Given the challenges of alternative investments, I would normally not give alternative investments consideration. That’s because much of my understanding of investing comes from Yale’s Cheif Endowment Officer, David Swensen. Swensen suggests that alternative assets be used only by the most elite investors.

Those asset classes that require superior active management results to produce acceptable risk-adjusted returns belong only in the portfolios of the handful of investors with the resources and fortitude to pursue and maintain a high-quality active investment management program.

David F. Swensen, Unconventional Success

Of course, not everyone heeds Swensen’s advice. Retail investors and institutions alike are drawn to alternative assets – often to the detriment of their investment return. More than one analysis has made this observation. Such analyses vindicate Swensen (and others). For most investors, alternative assets should be avoided.

Reconsidering Alternative Lending

Initially, I picked up Swedroe’s work because both Swedroe and my own investment philosophies align in many respects. Like myself, Swedroe champions:

- low-cost investing,

- avoiding gold

- factor investing, and

- the superiority of Treasuries over corporate debt.

Given that my investment philosophy aligns with much of Swedroe’s, I assume that his argument for alternative assets (including the alternative lending fund, Stone Ridge’s LENDX) is worth considering. But before we run the numbers on LENDX and the alternative lending asset class, let’s review some of the fundamental challenges with alternative assets and alternative lending specifically.

Challenges of Alternative Assets

The challenges of investing in alternative assets are numerous. Whatsmore, there are specific issues to the asset class of alternative lending.

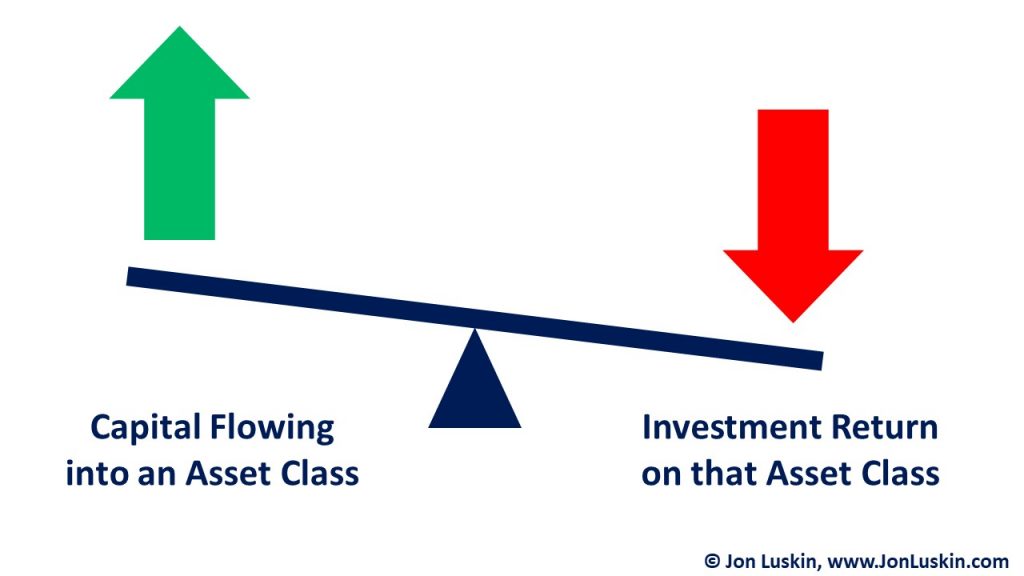

Performance Chasing: You’re Too Late

One problem with an asset class gaining widespread investment is just that: increased capital flows means increased competition for the same investment return. That is, supply and demand dictate a higher price for what’s popular. More dollars crowding into the same asset class drives up asset prices, driving down investment returns.

Commodities being secured into mutual fund form are a perfect example of this; investor interest piqued as investment returns on commodities increased. As is the pattern with a bubble, average prices returned. Those late to the commodity-investing party saw their investments lose money.

This lesson applies not just to commodities, but any investment gaining popularity. This is especially the case with alternative assets – where the combination of high fees and growing demand for specific asset classes drove down returns for portfolios holding alternatives.

Alternative Lending Gains Popularity

Alternative lending is likely not an exception to performance-chasing; one study shows that investing in private credit has grown annually by double digits for the last decade and a half. Said simply, alternative lending is growing in popularity. And, as has been shown with many alternative assets in the past, a now-crowded investing space means that attractive returns once offered are no longer there.

So, like other investments that have witnessed more capital inflows, will the available returns in alternative lending diminish? No one can say for certain.

For what its worth, Stone Ridge’s annual report on its Alternative Lending Risk Premium fund (LENDX) makes on admission on their inception-to-date performance, cautioning investors:

As a result of certain economic incentives received from platforms that may not be available in the future, the Fund’s performance was unusually strong for the period shown and should not be extrapolated for future periods.

Stone Ridge Alternative Lending Risk Premium Fund (LENDX) Annual Report, February 29, 2020

A poster on the Bogleheads forum makes the case:

There are problems with the Alts, the biggest one is the “late to the party” problem. The research and the theory behind the Alt funds that Larry recommends is impeccable but somehow real life is different. Problem is that the hedge funds were all over the Alts before Larry recommended them. Billions of institutional money flowing into these types of investments can alter the markets and ultimately the performance of this investments.

Unfortunately, performance-chasing isn’t the only problem with alternative assets.

Hurdles of Active Management

Another challenge of alternative assets – and therefore alternative lending – is that active management is a requirement. That’s because there is no alternative lending index fund; investors cannot access the alternative lending asset class in a low-cost and diversified manner.

The use of active management comes with its own set of challenges, including (but not limited to) cost management, and alignment of interests between the mutual fund manager and the mutual fund shareholder.

Alignment of Interest: Co-investment

In Pioneering Portfolio Management, Swensen explains – in great detail – what is required to be a successful investor in alternatives (or any investment requiring active management). (Much of this content is similarly covered in Swensen’s book targeted at retail investors, Unconventional Success.)

Successfully using active management, says Swensen, means – in part – finding an asset manager who practices co-investment. This is where the fund manager substantially invests the manager’s own money in the fund. To use Swensen’s words, the manager eats their own cooking. This creates an alignment interest of between the fund manager and the fund shareholders. Without substantial co-investment on the part of the fund manager, the mutual fund could simply function as an asset gatherer – with the fund manager profiting from the annual management fee collected from fund shareholders.

Alignment of Interest: Capital Limitations

Another alignment of interest limits fund capital. Such a provision attempts to mitigate the impact of asset crowding previously mentioned.

At the risk of being redundant, know that success in active management means picking the choicest investments available – and not picking all the investments available. Given a ballooning capital account to invest, fund managers are forced to put capital to work. This means picking not just the best investments available, but – given sufficient capital – the second-best investments available as well. As more capital floods a fund, managers are forced to purchase increasingly less ideal investments. This dilutes the investment return of the fund, harming shareholders.

Setting no limit on fund capital, however, benefits fund managers – as their management fee is collected on each additional dollar invested – regardless of that successive dollar’s investment performance.

Alignment of fund shareholder and fund manager interests are not the only challenges of active management. There is also the impact of fees.

Fees of Stone Ridge’s Alternative Lending Fund (LENDX)

One of the underlying issues with alternative assets – and the reason why investors would frequently be better off with index funds – is cost. As with most alternatives investments, investing in alternatives is not inexpensive. The Stone Ridge alternative lending fund in particular – championed by Swedroe & Grogan – shows an expense ratio of 150 basis points (1.5%). Despite the cost, Swedroe argues for it, saying:

While even 1.5% is not cheap relative to typical mutual funds or ETFs, it is cheap relative to the fees charged by current providers, which Cliffwater found to be about 3%. In addition, investors need to be aware that this is a different type of vehicle/asset class, as you are not investing in public securities.

In addition to the hurdles of active management’s alignment of interest and cost, the asset class of alternative lending has other specific challenges.

Alternative Lending: A Mismatch of Investment Risk & Investment Return

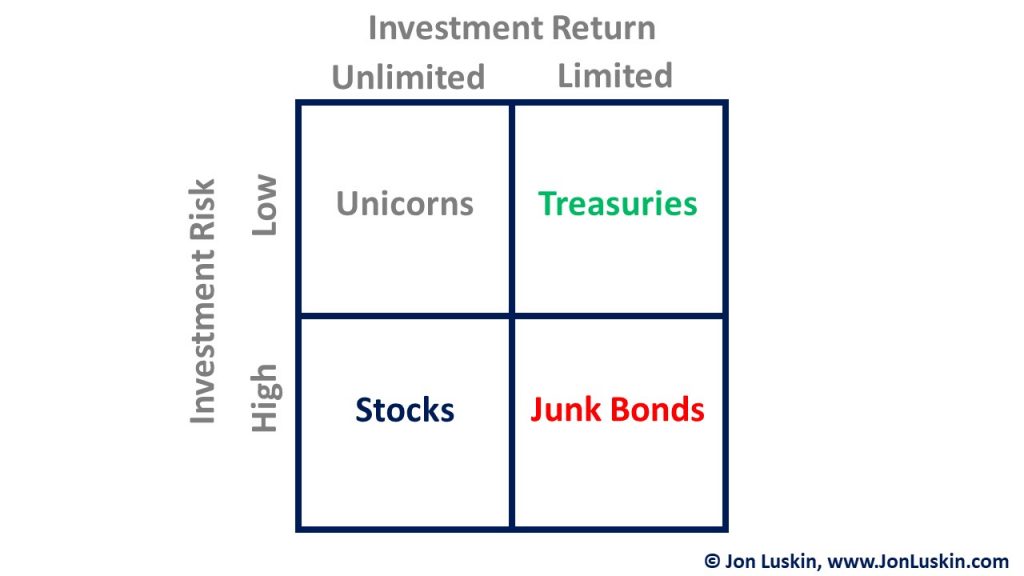

One of Swensen’s investment paradigms prompts investors to consider both the risk and return of a given investment.

Take stocks, for example. Stocks are high risk – but their investment return is potentially unlimited. Earning a potentially unlimited investment return warrants enduring great risk, argues Swensen.

On the other side of the risk/return spectrum are U.S. Treasuries; U.S. Treasuries offer a limited investment return. However, they are one of the safest investments available – with Treasuries performing well amidst U.S. stock market drawdowns. The extreme safety of Treasuries (virtually non-existent risk) is well worth earning a limited return, argues Swensen.

In short, high-risk investments should offer an unlimited return. And investments offering a limited return should be very safe. This is Swensen’s argument.

According to Swensen, this means that all flavors of corporate bonds, from the highest-rated to junk bonds should be excluded from an investment portfolio. This also includes municipal bonds – and those bonds that are non-traded, i.e. direct lending.

Alternative Lending is Illiquid Junk Bonds

Much of the debt in the alternative lending space is floating-rate (adjustable interest rate) debt. A floating-rate note offers an advantage to the lender; it eliminates interest rate risk. But, why would a borrower agree to such unfavorable terms? Because a borrower’s options for securing a fixed-rate note are not favorable, or simply not available. That is, the creditworthiness of such borrowers is so low that they must accept unfavorable terms for securing capital. This means not just paying higher interest rates, but also agree to a floating interest rate as well.

What does this make alternative loans, then? Given the above-described characteristics, alternative lending may be a variety of junk bonds: junk bonds with an added illiquidity premium.

Of Stone Ridge’s alternative lending fund (LENDX), one poster on the internet said it well:

This is a bond fund. They don’t invest in subprime, which is good for security of principal, but they do primarily invest in unrated securities, which are wild cards. Their creditworthiness is untested essentially, there’s no knowing by conventional means how safe these bonds are. In practice, you should treat them as bad or worse than subprime to be safe.

Swedroe normally eschews corporate credit – opting instead for U.S. Treasuries. But, does earning the added illiquidity premium on junk bonds make direct lending an asset class worthy of inclusion in your portfolio? Swedroe thinks so.

(In a successive section of this post, we will run the numbers to determine if he has been right so far.)

Market Timing: Is Alternative Lending Attractive Right Now Because of Low Interest Rates?

Related to investor herd behavior of performance chasing is market timing;

Stone Ridge Alternative Lending Risk Premium Fund inception date is June 1st, of 2016. That is, it was created in midst of a historic interest rate trough.

This should not be a surprising, nor a coincidence; it is not common for risk-averse investors to bear excess risk as the risk-free rate drops, with investors searching for yield (in all the wrong places). Investors jumping into riskier assets as interest rates drop is seen not just with debt, but investors crowding into dividend stocks as well.

Said another way, would Swedroe – or anyone – be interested in alternative lending were we not living with historically low interest rates? Will alternative lending continue to “perform” in the event rates normalize?

With philosophical arguments for alternative assets and the challenges of active management considered, it is time to run the numbers to see exactly how the asset class of alternative lending has performed.

Evaluating the Historical Performance of Stone Ridge’s Alternative Lending Fund (LENDX)

Below is the performance of Stone Ridge’s alternative lending fund, alongside other indices for reference.

| Fund or Index | Annualized Return |

| Stone Ridge Alternative Lending Risk Premium Fund (LENDX) | 6.9% |

| ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | 1.5% |

| ICE BofA US High Yield Index | 6.9% |

| Bloomberg Barclays U.S. High Yield Bond Index 1-3 Year Ba | 4.3% |

| Five-Year US Treasury Notes | 3.9% |

| CRSP Deciles 1-10 Index (market) | 11.6% |

Since the fund’s inception of June 1st, 2016 through February, Stone Ridge’s fund has out-performed the highest quality debt (Treasuries). This is to be expected; in a vacuum and in the absence of equity market volatility, lower-rated debt does outperform higher-rated debt – on average.

Similarly, the fund outperformed cash and a junk-bond index of a shorter maturity than LENDX. This is also to be expected; given fixed interest rates and all else being equal, longer-maturity debt should outperform.

Finally, the fund performed similarly to a high-yield index of greater maturity. Thus, for the short-time period reviewed, Stone Ridge’s fund did offer an illiquidity premium over more liquid junk bonds.

(Unfortunately, figures for standard deviation were not available in Stone Ridge’s documents. Thus, there was no component for volatility in this analysis.)

Evaluating the Historical Performance of Cliffwater Direct Lending Index Data (CDLI)

Cliffwater, LLC – which provides a range of services in the alternative asset space – created a direct lending index. Index data stretches back to September of 2004. With this data, we can run a successive – more robust – analysis of the direct lending asset class.

Correlation of Alternative Lending to Traditional Asset Class

One lure of alternatives is their supposed low correlation to traditional asset classes. In his argument for alternative lending, Swedroe cites the correlation of alternative lending to other indices:

- Public equities: ~0.7

- Barclays 3-5 year Treasuries: ~-0.6

- S&P/LSTA Leveraged Loan Index & Barclays High Yield Index: ~0.7

For a more robust analysis, consider the correlation of five-year U.S. Treasuries to U.S. equities (CRSP 1-10) for the time period that the Cliffwater makes their data available.

| Index | Correlation |

| Five-Year US Treasury Notes | (0.59) |

| One-Month US Treasury Bills | (0.20) |

| Cliffwater Direct Lending Index | 0.73 |

| Bloomberg Barclays U.S. High Yield Bond Index 1-3 Year Ba | 0.66 |

| Bloomberg Barclays U.S. High Yield Bond Index Ba | 0.75 |

| ICE BofA US High Yield Index | 0.80 |

Unsurprising is that illiquid junk bonds (direct lending) would exhibit some correlation to liquid junk bond indices.

Crisis Alpha of Cliffwater’s Direct Lending Index (CDLI)

No analysis would be complete without my favorite metric of all time: crisis alpha. Crisis alpha is a measure of how well an asset performs during a U.S. equity market decline. Crisis alpha is customarily measured as the average monthly excess return of a given asset class over cash (Treasury bills) when U.S. equity markets experience a decline of 5% or more.

Since Cliffwater makes it index data available on a quarterly basis, the below calculates crisis alpha using quarterly figures. See the below table.

| Five-Year US Treasury Notes | Cliffwater Direct Lending Index | Cliffwater Direct Lending Index, Net 1.5% Fee |

| 3.57% | -0.91% | -1.29% |

Portfolio Performance Using Cliffwater’s Direct Lending Index (CDLI)

See the below table. In a vacuum, the performance of the CDLI is not compelling. But, the story changes when the index is added to a portfolio. Given a 10% weighting to the CDLI (including fees), results in a higher risk-adjusted return than a portfolio using only conventional assets (CRSP Deciles 1-10 Index (market) & Five-Year US Treasury Notes).

| Data Series | Annualized Return | Annualized Standard Deviation |

| CRSP Deciles 1-10 Index (stocks) | 9.20% | 15.32% |

| Five-Year US Treasury Notes (bonds) | 3.54% | 3.81% |

| CDLI, Net 1.5% Fees | 1.42% | 7.21% |

| 55 stocks/45 bonds | 7.32% | 9.24% |

| 50 stocks/40 bonds /10 CDLI net fees | 7.39% | 8.86% |

So, what do you think? Should alternative assets be part of client portfolios? Will you be investing in Stone Ridge’s various alternative funds, including LENDX?

This is a great summary of LENDX. I enjoy your writing. I’ve been invested in LENDX for about 6 years. It’s only 2% of my portfolio and it just sits in a solo-401k that I rarely trade in. I figure I’ll give it 10 years, just like I am doing with QSPRX. Keeping these investments forces me to face my decision to buy them in the first place.

I think that was “nedsaid” on the Bogleheads forum with the quote about the “late to the party problem” which is indeed an issue.

As you mentioned the excellent 5-year returns were greatly affected by LENDX selling it’s interests in a couple platforms, so that will not be a part of the returns going forward.