I remember when I was first learning about investing. I was having a conversation with another advisor about high-yield bonds. His approach went something like this:

Live off the coupon! If you hold the high-yield bonds forever, who cares if the bonds fluctuate in value!?

Don’t Evaluate Assets in Isolation

The above logic is rife with problems. Most obviously, high-yield bonds do far more than fluctuate in value. They can (and tend to) outright default. (This means you lose your entire investment, forever!)

Also, high-yield bonds love to sink in value at the same time stocks lose money – making high-yield bonds a poor diversifier against equities.

But, another massive fail in this line of reasoning for high-yield bonds – and the subject of this post – is that it makes no sense to evaluate the performance of high-yield bonds (or any investment) in insolation of your other investments. Since this is so important – and the subject of this blog post – let’s say it again:

Consider all your investments together – and not each investment in isolation.

A nerd once asked, “Are corporate bonds better than U.S. government bonds?” It doesn’t matter. That’s because no one puts 100% of their money into any single investment! (Or at least they shouldn’t!)

Evaluating Performance of an Investment in Isolation Yields the Wrong Answer

What happens when you evaluate an investment on its own merits – and not when combined with other investments to create a diversified portfolio? You get a misleading answer.

Let’s use high-yield bonds as an example. Compare high-yield bonds to Treasury bonds. Of course, high-yield bonds offer more money than Treasuries. As an investor, you have historically been rewarded with a greater investment return by enduring the greater risk of high-yield bonds over Treasuries. (If you’re a nerd, the greater risk in exchange for the greater return of lower-rated bonds is called the “credit premium” or “default premium.”)

| Index, 1/1/1984-12/31/2017 | Return,

Yearly |

| Bloomberg Barclays U.S. High Yield Bond Index Intermediate | 8.62% |

| Bloomberg Barclays U.S. Treasury Bond Index Intermediate | 7.30% |

Evaluate Investments on their Inclusion in a Diversified Portfolio

So, if you’re looking to juice the investment return of your portfolio, you should opt for high-yield bonds, right? Not quite.

Though junk bonds may offer a higher investment return than Treasuries, most investors don’t invest in bonds in a vacuum. Normally, bonds are used as part of a diversified portfolio of stocks and bonds.

So, what happens when you add both types of these two distinct bonds to U.S. stocks to create a diversified portfolio?

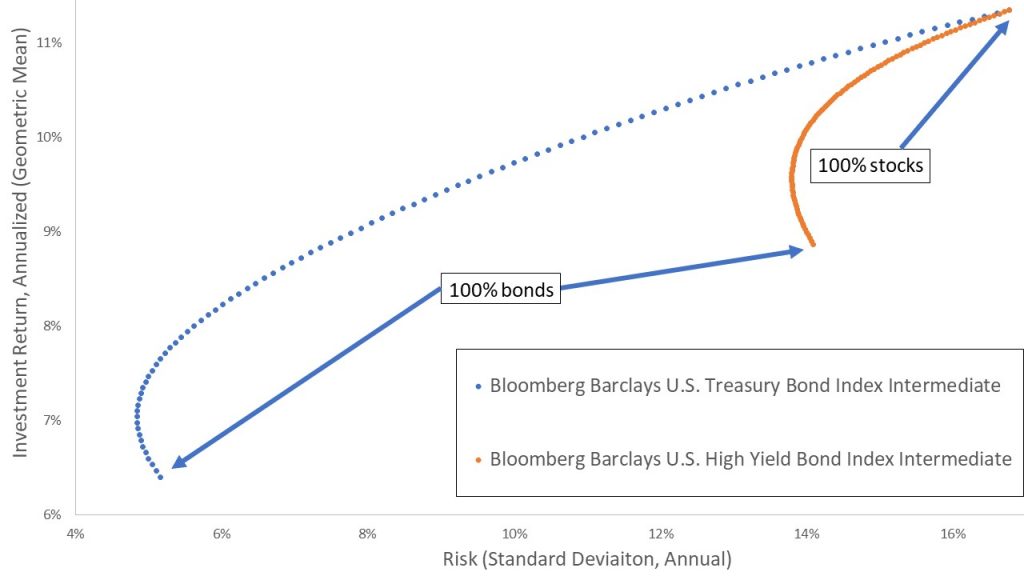

See spiffy-looking pretty chart above. The performance of a portfolio holding both U.S. stocks and high-yield bonds (in orange) is plotted below and to the right of a similar portfolio using Treasuries bonds (in blue). Or said another way, when you use Treasuries instead of high-yield bonds, you can get a higher return while enduring less risk (or at least that has been the case historically). In short, using high-yield bonds when paired with stocks to create a diversified portfolio may be a poor decision – at least if the goal is to generate a superior risk-adjusted return (and it should be!).

Look at Investments as Part of a Diversified Portfolio

The lesson is this: the next time you’re considering the merit of an investment (be it junk bonds, cryptocurrency, marijuana stocks, the newest hedge fund, or any new-nesss), consider not just the investment itself. Evaluate how that investment’s performance impacts the total of all your investments. This is modern portfolio theory at work!

(Disclaimer: This is not investment advice. The blog post is for entertainment purposes only.)

Leave a Reply