Ah, bonds. They’re quite the investment instrument. In a world of volatile stocks, bonds offer safety of principal – at least if you’re doing it right. That means shunning corporate bonds in favor of Treasury bonds, which includes shunning high-yield bonds.

Yes, Treasury bonds are where the safe portion of your investments should lay – with the optimal duration of the Treasury bonds varying with your particular portfolio’s equity weighting. Consider: Do you have a lot of stocks in your portfolio? Then, intermediate Treasury bonds may be right for you. Do you have a lot of bonds, then consider a large chunk of those Treasury bonds being short-term.

Crisis Alpha of Long-Term Treasury Bonds

As I understand it, both short-term and intermediate-term bonds have (historically) had a place in a well-thought-out investment portfolio. However, the interest risk inherent in long-term Treasury bonds shows that they can create for portfolio underperformance relative to intermediate and short-term bonds during historical interest rate drops. Yet, there is one absolutely fascinating feature of long-term Treasury bonds that cannot be ignored: crisis alpha.

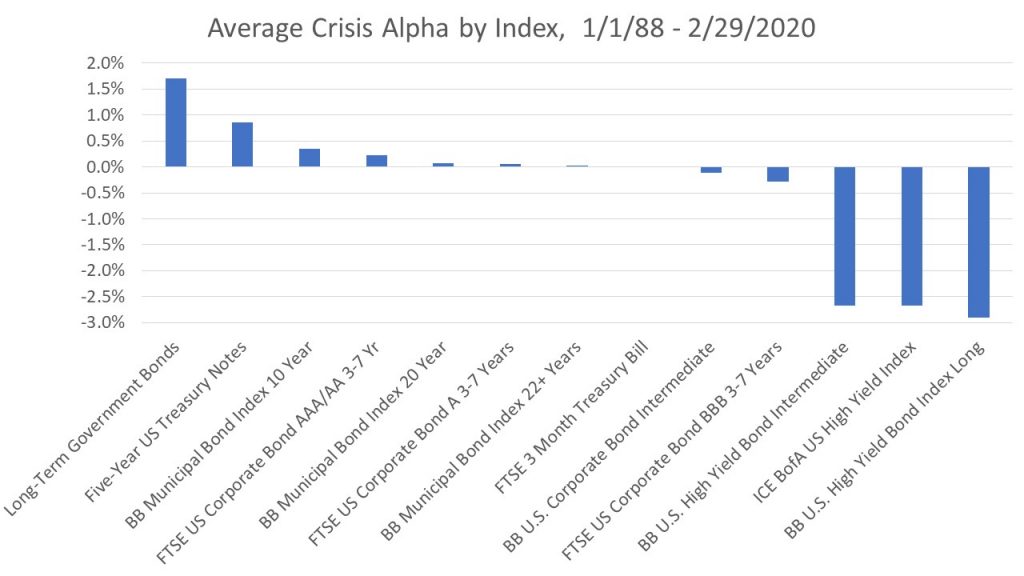

This feature of Treasury bonds – relative to other bonds – that make them so gosh darn great is their crisis alpha. (“Crisis alpha” is the excess return offered over cash for those months in which equity markets witnessed a decline of 5 percent or more.)

When U.S. equity markets decline, you want an asset class that not only has low correlation, but negative correlation to U.S. markets. In today’s global markets, correlation predictably goes to 1 during a market crisis. If U.S. stocks are down, likely are also international stocks, emerging market stocks, REITs, and sometimes corporate bonds. The market’s recent reaction to global coronavirus is the perfect example of this.

Treasury bonds are the most frequent exception to this correlation of 1 – gaining value when equity markets decline. Whatsmore, the longer maturity of the Treasury bonds, usually the greater the appreciation of this safe-haven investments. That is, long-term Treasury bonds – over short- and intermediate-term Treasury bonds – offer the greatest amount of crisis alpha.

Interest Rate Risk of Long-Term Bonds

There is a catch, however. If you want the superior crisis alpha offered by long-term Treasury bonds, you are going to have to stomach some extreme interest rate risk. Risk and return – or at least in this instance, interest rate risk and the return from crisis alpha – are correlated.

And – at least for the moment – taking on the extreme interest rate risk of long-term bonds – especially long-term Treasury bonds, which pay even less than bonds of poorer quality – is not something many investors are willing to do.

Disclaimer: This article is for entertainment purposes only. None of this is to be considered investment advice. Before doing anything, speak with a qualified investment professional.

Leave a Reply