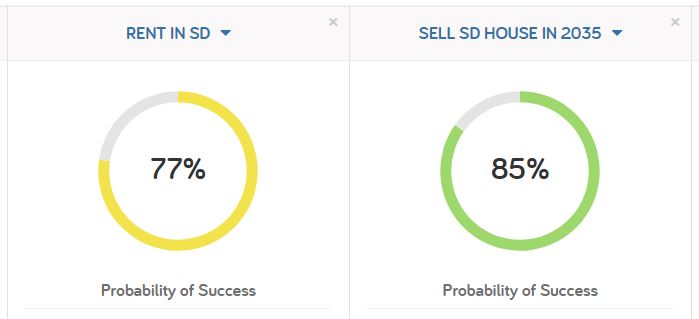

I recently ran the numbers on my own financial plan, using Define Financial‘s software of choice. A snippet of the results follow.

I did this exercise because I wanted to know if it made sense to sell our house sooner rather than later. According to the financial planning software, there was a distinction. Apparently, I could come out ahead if I held onto our current property longer.

When You Make an Assumption . . .

Of course, anyone who has ever tinkered with emX knows that a lot of assumptions goes into the software, such as:

- the rate of inflation (using historical figures)

- no change in tax rates (i.e. no new tax laws will ever pass)

- stock market investment returns (again, historical figures)

That large number of assumptions alone is enough to throw any conclusions entirely out the window. After all, does it make sense to chart a life path that only makes sense if equities return 10% – but not 9%?

Focus on What You Can Control

Sometimes, however, we (myself as no exception) financial planners get distracted; we (I) can forget that assumptions drive our financial planning software. This may happen when a client asks:

Should I “A” or should I “B”?

And it’s challenging not to give our clients (who are paying us a lot of money!) a direct answer. But, our value-add as financial planners is our ability to get clients to focus on the things that really matter: i.e. spend less money. Because regardless of software assumptions, spending less money will always increase the odds of success.

Leave a Reply