As a fee-only financial adviser and fiduciary, much of what I do at Define Financial involves unwinding new clients from the garbage they were previously sold by commissioned salespeople. (Naturally, I have a strong opinion about this!) Sometimes, this means trying to figure out how to get a client out of a non-traded REIT. Other […]

Blog

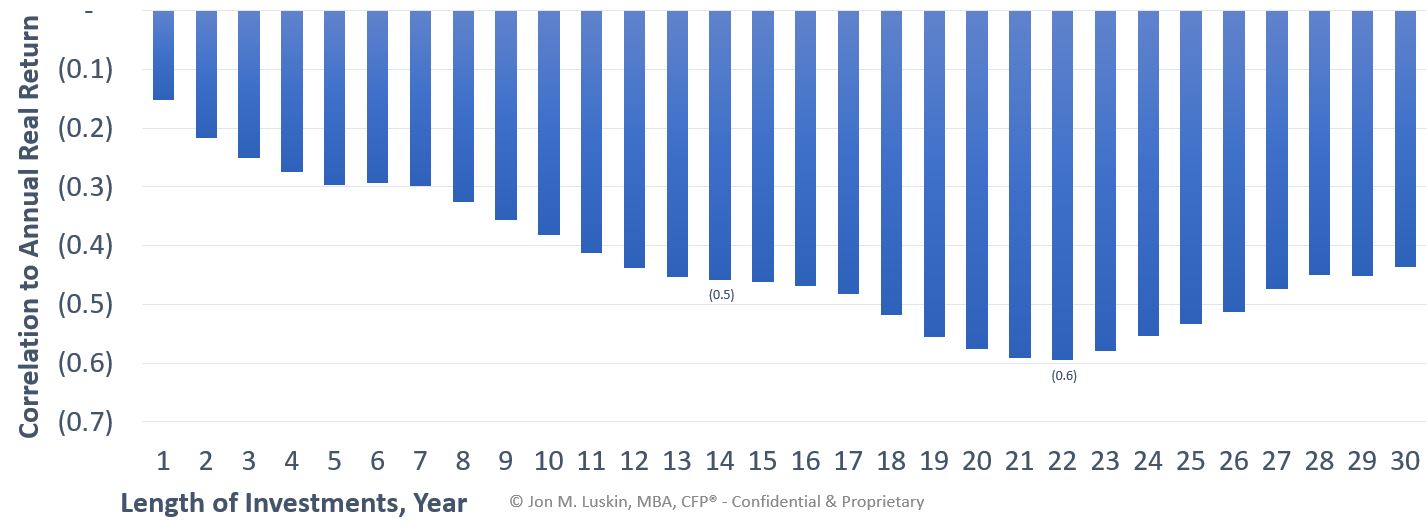

Follow-up to my Article on Dollar-Cost Averaging & CAPE in the FPA’s Journal of Financial Planning

I had an article published in the Journal of Financial Planning on dollar-cost averaging. You can read it here. You can also download a Powerpoint presentation version of it here. I have received the same questions from advisers over and over again, both in person at presentations, and via email from those who had read […]

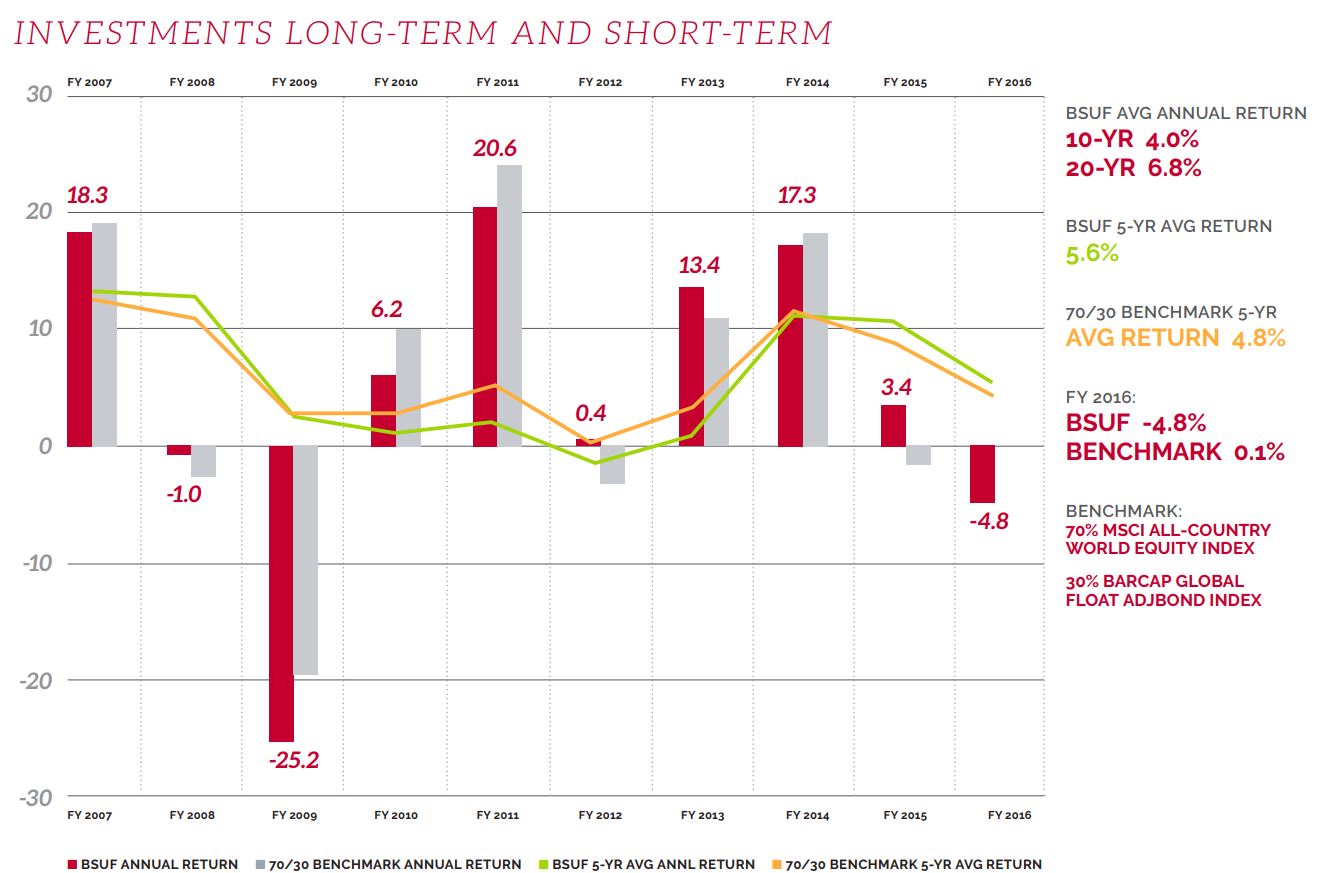

Endowment Investing Case Study: Ball State University

For my master’s thesis, I explored the investment performance of several multi-million dollar endowment portfolios. In eight case studies, the results consistently showed that a low-cost portfolio outperformed a portfolio paying high fees to access active managers and alternative asset classes. Moreover, risk-adjusted performance showed the low-cost portfolio simply did better. (Previous analysis has shown […]

Clark Howard’s Secret to Success

I’m a huge fan of Clark Howard. (I’ve been listening to his podcast for years.) And it’s not just the fact that he dispenses invaluable financial advice. Of course, that’s great. But the thing that’s really awesome about Clark Howard is how genuine he is. He really wants to help people. He really wants to do […]

How Many Times Do You Ask the Same Question?

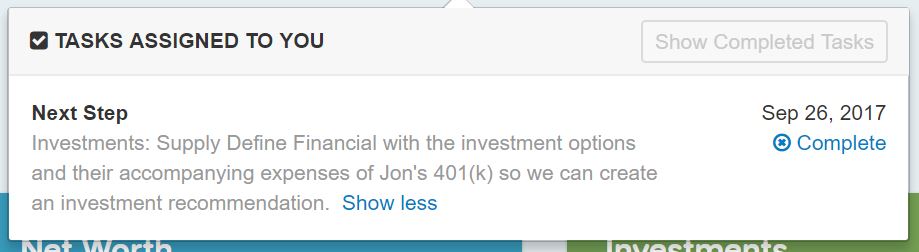

Recently, we had a local financial planner solicit our financial planning services. We were honored by the request. You may be wondering: Why would a financial planner outsource their personal financial planning?

Setting Fees for Financial Planning

Two recent episodes in setting financial planning fees merit sharing, and both have the same ultimate take-away: don’t think you’re not worth it – because the right clients think you are.