Here’s Nabeel’s question about his California rental property:

I need some advice on my real estate investment. I have a rental property in a Los Angeles suburb with the following information:

| Metric | $ / Date |

| Original Loan Amount | $249,000 |

| Current Principal Balance | $214,363 |

| Interest Rate | 4.25% |

| Loan Origination Date | 12/20/2017 |

| Maturity Date | 01/20/2033 |

| Gross Rent, Monthly | ~$1,920 |

| Property Management, Monthly | ~$120 |

| Property Value | $473,000 |

My monthly payments are $2,200. I lose around $400 a month.

I’m 42 right now, and I hope to retire by 60. I was thinking once it’s paid off, I will have extra income of $2,200 per month.

Do you think this is the right investment?

Case Study of California Rental Real Estate

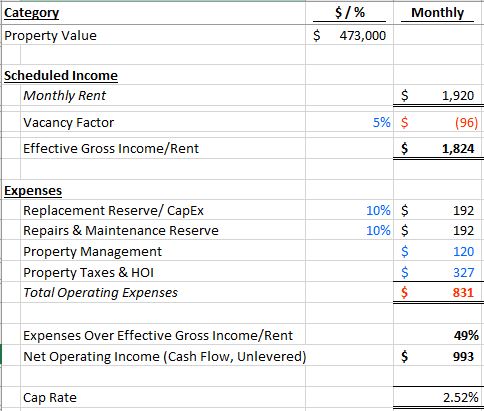

I plugged Nabeel’s numbers into a spreadsheet (below) that I use for evaluating real estate rental investments across the country. I filled in a few small gaps where applicable; I also assumed that the tenant pays for all utilities. Lastly, property taxes and insurance were backed out from the total monthly payment of $2,200.

SideBar: Including a Property Management Fee when Evaluating a Rental Property’s Investment Return

At this point, I’m sure some do-it-yourselfers may be up in arms at the inclusion of a property management fee in the calculation.

“I can manage it myself and save money!”Of course, you can! But, we’re evaluating the merit of a stand-alone passive investment. More importantly, we’re evaluating the opportunity cost of this particular California rental property relative to other investments. That is, if you’re investing outside of your neighborhood, you’re going to have to pay for property management. And if you’re investing in publicly-traded stocks, you’re paying company management to run the business on your behalf.

Fun fact: self-managing this particular rental property increased the cap rate by roughly 30 basis points, or 0.3%. In short, self-management does not change the ROI much – but it will keep the real-estate-investor-property-manager busy!

Optimizing the Investment Return on Nabeel’s California Rental Property

With the cap rate calculated, three things jump out when evaluating this investment:

- Nabeel’s math

- Negative cash flow

- High borrowing costs

Math

Be it homeowners or real estate investors, people often confuse mortgage payments (or PITI) with the actual ongoing costs of owning real estate. (This is especially the case for those shopping for a residence, who compare the cost of monthly rent to a mortgage payment.) Put simply, your mortgage payment and the cost to own real estate are simply not the same things.

These very real costs of property ownership that Nabeel missed in his calculations are:

- routine repairs (estimated as 10% of gross rent)

- capital expenditures (estimated as 10% of gross rent)

According to my spreadsheet above, Nabeel can expect to clear almost $1,000 a month – once the mortgage is paid off and after including the other various expenses of real estate ownership mentioned above. This ~$1,000 is a far cry from Nabeel’s presumption of $2,200 in monthly income.

Again, this figure of $1,000/month assumes that his mortgage is paid off. Currently, it is not. When including the mortgage and the other factors above, Nabeel isn’t truly negative cash-flowing $400 month, but closer to negative $900 a month. (Assuming self-management, the property is cash-flowing negative $760/month.)

Of course, this figure of negative ~$900/month isn’t wholly salient – but it will be whenever the property needs a new roof or other large capital expenditure.

Negative Cash-flow on California Rental Property

It should come as little surprise that Nabeel’s investment is not cash-flowing. That’s because this is a California rental property; the amount one can rent a property for in California – relative to its purchase price – is relatively small.

| City/Metric | Lakewood, CA | Marion, IN | Independence, MO |

| Home Price | $473,000 | $29,500 | $60,000 |

| Rent, Monthly | $1,800 | $650 | $850 |

Given that Nabeel’s California rental property is negative cash-flowing by high triple digits monthly, he needs to prepare for a worst-case scenario.

Have a Rainy Day Fund for Your Negative Cash-Flowing Rental Property

The solution – and one that many folks have learned of late – is to have a (big) rainy day fund. A rainy day fund is very important given Nabeel’s scenario, and not just because of potential vacancies.

It’s the previously-mentioned capital expenditures and routine maintenance that weren’t factored into Nabeel’s calculations. Given the non-trivial size of these expenses, Nabeel needs a non-trivial sized rainy day fund to cover these inevitable costs.

High-Borrowing Costs

If you’ve been paying attention, you know that interest rates are at historic lows. This presents the opportunity for Nabeel to refinance into a lower interest rate. So as to not extend the life of the loan (restarting the clock on his 15-year mortgage), Nabeel could shop for a 10-year loan.

Alternatively, restarting the clock – by getting a 15-year mortgage at a lower interest rate – could help Nabeel with his negative cash-flow situation. Of course, a 30-year mortgage is an option, too; with a smaller monthly mortgage payment, Nabeel should be able to decrease the size of his critically-needed rainy day fund.

California Rental Property for Retirement Income

Now that we’ve nerded-out on the numbers, let’s return to Nabeel’s question:

Do you think this is the right investment?

Nabeel – if I understand him correctly – is looking for passive income in retirement. And while his California rental property will certainly cash flow once it’s paid off – at a ~2.5% cap rate. Consider that by the time the rental property is paid off in over a decade’s time, a savings account could very well be yielding more than ~2.5%!

To be clear, I’m not saying that all California real estate is a bad investment; California real estate certainly can – and has – appreciated well. But again, Nabeel appears to be looking for retirement income. He can’t use appreciation – outside of financing – to provide that income.

For retirement income, Nabeel may best be served by investing in real estate out of state – where properties may offer less appreciation, but can provide greater cash-flow. Whatsmore, he can invest in a diversified portfolio of stocks and bonds that may be able to provide sustainable distributions of at least 3%.

Alternatively, Nabeel can hold the property until he needs income in retirement. At that time, he can realize the appreciation of the property – reinvesting the proceeds into investments that generate a higher distribution rate. The challenge of this last option is that he’ll need to shovel close to $900 (on average) into the property every month!

So, what do you think? Do you think this California rental property is accomplishing Nabeel’s goals? What would you advise Nabeel?

Disclaimer: This article is for entertainment purposes only. Speak with your financial advisor before making any investment decisions.

Leave a Reply