Imagine a retired client. Being 68 years old, he’s managed to save a bit of money over his lifetime. Whatsmore, that money is spread across different types of accounts:

- His tax-deferred traditional IRA

- His tax-free Roth IRA

- The family’s taxable investment account

Being that the client is retired – and a good portion of his wealth is in his investment portfolio, the client and his financial advisor have opted for a relatively conservative portfolio – an investment portfolio composed of more bonds than stocks.

Mortgage Balance in Retirement

The client – like many clients today – has carried a mortgage balance into retirement. Given the relatively conservative nature of the client’s investments, carrying a mortgage balance may not necessarily make sense. This is the case for two reasons:

- The anticipated investment return on the investment portfolio may struggle to outperform the interest rate on the mortgage (i.e. the inability to successfully commit mortgage arbitrage)

- Holding both a mortgage and a relatively conservative portfolio impacts the client’s total balance sheet.

For the combination of a conservative portfolio and a mortgage balance, the financial planning solution is simple:

Pay off the mortgage with money from the investment accounts.

But, this begs the question:

Which accounts should the client use to pay off a mortgage?

- Traditional tax-deferred money?

- Tax-free Roth money

- Taxable trust money?

Let’s run the numbers to find out!

Hierarchy of Account Distributions for Mortgage Paydown in Retirement

The inspiration for this post comes from a real-life financial planning client. As such, there are countless variables to consider. Here are just some of them:

- Mortgage Balance: ~$180,000

- Traditional IRA Account Balance: ~$400,000

- Roth IRA Account Balance: ~$100,000

- Trust Account Balance: ~$140,000, with a cost basis of ~$140,000

- Client age: 68 husband/67 wife

- Social Security claiming age: 70

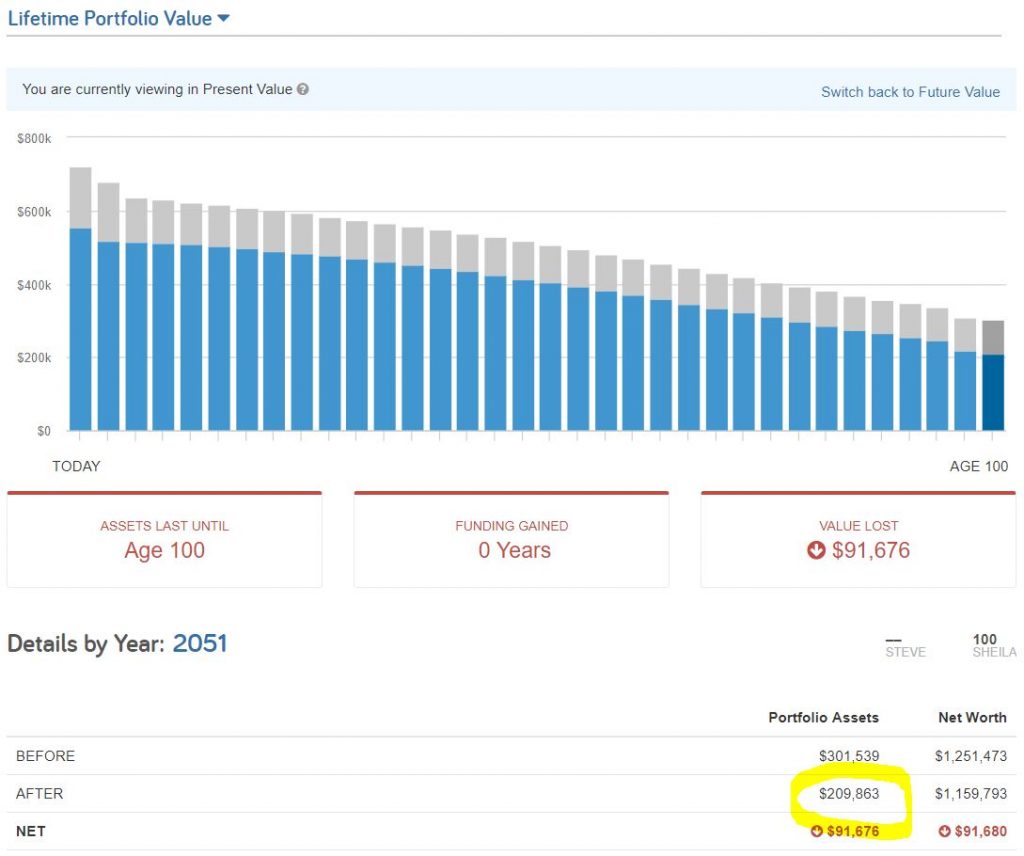

To help with accounting for the variables in the client’s life, I utilized eMoney Advisor to do the number crunching. The metric of choice (or how I’ll judge which solution is best) is terminal client wealth: how much money the client has when the spouse was simulated to pass at age 100. Said another way, terminal wealth is a proxy for plan success rate.

Tax-Free Distributions to Pay-Off a Mortgage Balance in Retirement

The first option tested used trust account and Roth account distributions. The trust ($~140,000) was emptied, with Roth distributions filling in the shortfall (~$40,000). This strategy allowed the client to pay the mortgage relatively tax-free. eMoney Advisor declared terminal wealth to be roughly $200,000 for this scenario.

Without looking at the other strategies, we can’t know if terminal wealth of ~$200,000 for this particular client is subpar or superior. So, let’s look at other mortgage downpayment strategies next.

Tax-Deferred Accounts Distributions for Mortgage Paydowns

Initially, the previously-discussed strategy of using tax-free distributions to pay-off a mortgage seems appealing. In a vacuum, paying no taxes means having more wealth than the alternative. But, sometimes paying taxes can make sense. (The existence of the Roth IRA conversion proves this.)

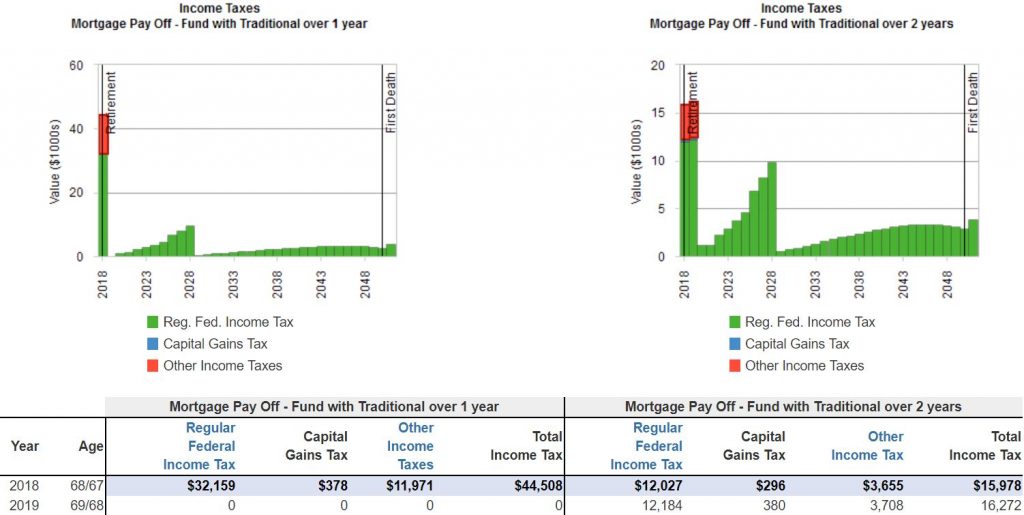

The next scenario simulated paying the entire balance via traditional IRA distributions. The result is terminal wealth of roughly $270,000. That’s not a small difference ($70,000) relative to the previous strategy (of using tax-free) taxable trust and account and tax-free distributions.

But, big distributions from a traditional IRA account can have big tax impacts. So, what if we spread the traditional IRA distributions over two years (to lower the tax bill)? eMoney Advisor determines terminal wealth to be roughly the same. But, the amount of tax paid over two years for each scenario is wholly different; with a one-year distribution, there is a tax bill of roughly $44,000 over two years. When distributions are spread across two years, the total tax bill is $31,000.

Trust and Tax-Deferred Account Distributions

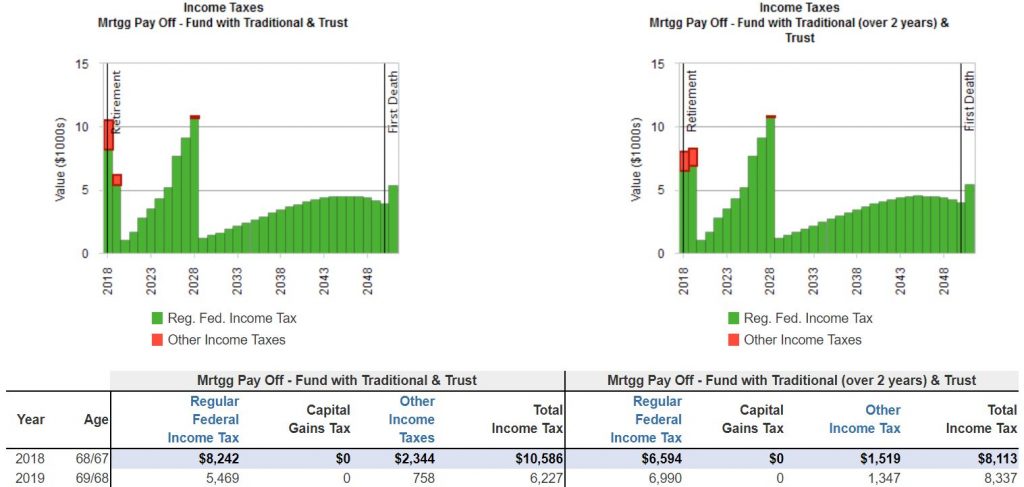

If a combination of tax-free (Roth and trust account) distributions to pay off a mortgage underperformed a strategy of using exclusively distributions from tax-deferred accounts, what about a mix of tax-deferred and taxable (trust) account distributions? A scenario of emptying the trust account ($140,000) first and supplementing that with traditional IRA account distributions ($40,000) results in terminal wealth of roughly $280,000.

Why does this strategy outperform the other mortgage paydown strategies? Likely because the Roth account isn’t raided – allowing the coveted Roth dollars to grow tax-free for a long time (i.e. 30+ years). Using the trust account – which has a low tax-basis but less growth potential – means fewer taxes paid now, and fewer benefits are given up in the future (because the Roth account is kept in place).

Is there value in spacing out the relatively smaller $40,000 traditional account distribution over time (to lower the tax bill)? No. In this final scenario tested, the tax treatment is surprisingly similar over the two years. Why? Because money is sourced from the traditional IRA account either way – either to pay for the mortgage in a two-year distribution strategy – or to pay for living expenses in year two, since the proceeds from the trust account are no more! (This is the case since the client is two years out from claiming Social Security.) With a trust account raided, living expenses must come from the traditional IRA account – and that means paying taxes on tradional IRA account distributions.

The Optimal Distribution Strategy for Mortgage Paydown in Retirement

While the verdict for this particular case study is clear, the same results may not necessarily apply to any other client. The mortgage balance, timeline, income streams, and accounts balances were all very specific. Fortunately, eMoney Advisor offers a very robust platform to help find the ideal distribution strategy for your client.

Leave a Reply