Mike Piper, CPA answers questions from the Bogleheads ® on Social Security, investing, and more.

Tax Planning

Bogleheads® Live ep. 6: Dr. Sunil Wahal on hidden mutual fund costs

Dr. Sunil Wahal explains the hidden costs of mutual funds,

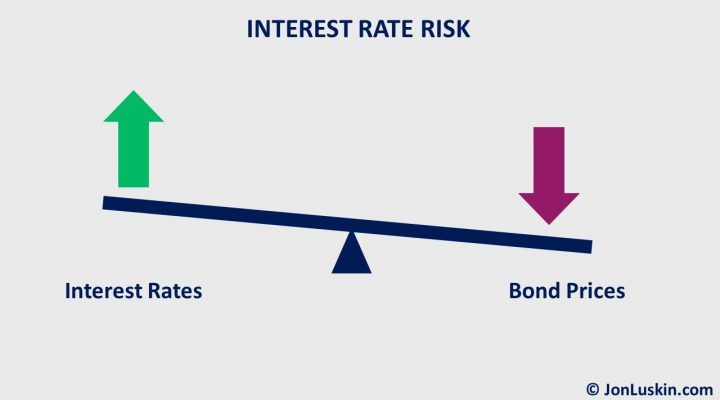

Tax-Loss Harvesting Treasury Bond Index Funds in 2022

Over the last 12 months, Vanguard’s Intermediate-Term Treasury fund (VGIT) has lost more than five percent (5%+) of its value. Long-term investors not phased by this short-term volatility can benefit from tax-loss harvesting.

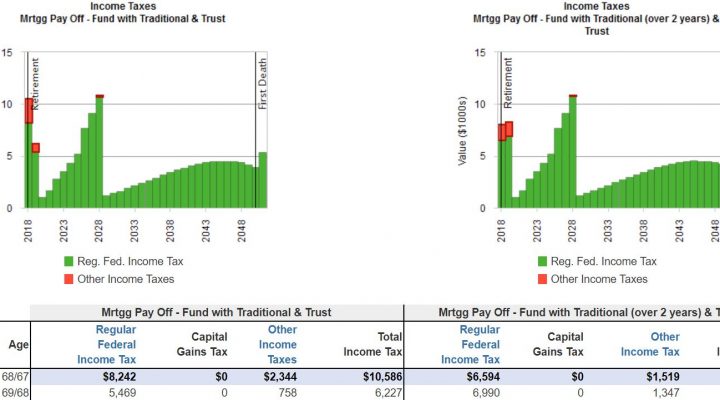

Case Study: Account Distribution Hierarchy for Mortgage Paydown in Retirement

Imagine a retired client. Being 68 years old, he’s managed to save a bit of money over his lifetime. Whatsmore, that money is spread across different types of accounts: His tax-deferred traditional IRA His tax-free Roth IRA The family’s taxable investment account Being that the client is retired – and a good portion of his […]

How to Save on Taxes

No one likes taxes. So, why not strategize on how to save on them? Listen up for a few strategies to decrease your tax bill.

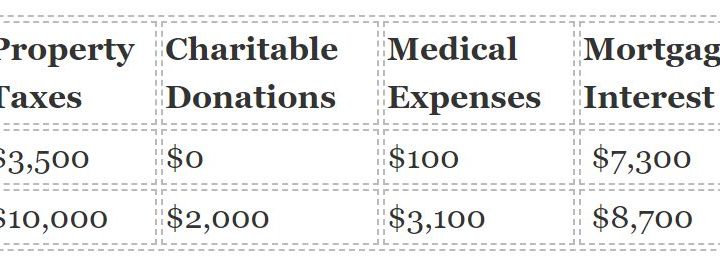

Tax Planning from Sheryl Rowling, CPA, PFS

Sheryl Rowling is a practicing financial advisor, tax ninja, and creator of Total Rebalance Expert (TRX). She gave a summary of the new tax changes at a recent quarterly meeting of the San Diego Financial Planning Association. Here are a few takeaways from her talk. Bunching Deductions in Alternating Years Bunching deductions is certainly not […]