Sheryl Rowling is a practicing financial advisor, tax ninja, and creator of Total Rebalance Expert (TRX). She gave a summary of the new tax changes at a recent quarterly meeting of the San Diego Financial Planning Association. Here are a few takeaways from her talk.

Bunching Deductions in Alternating Years

Bunching deductions is certainly not a new strategy. And, despite the recent tax law changes, this strategy is still a great way to save on taxes.

Bunching means pre-paying charitable donations, state and local taxes, an extra mortgage payment every other year, and either delaying or fast-tracking large medical expenses. Of course, this only applies if you are on the cusp of itemized deductions.

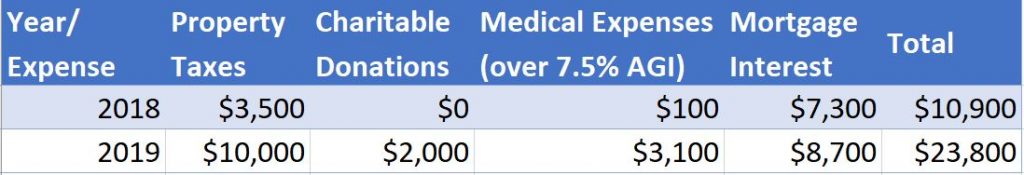

Consider out the following example for a single individual.

This non-married individual can claim the standard deduction of $12,000 in 2018. In 2019, that same person can itemize for a deduction of $23,800. That could mean a tax savings of more than $4,000 in 2019 – assuming the highest federal tax bracket. In short, despite the tax law changes, bunching itemizable expenses every other year can still mean significant tax savings.

Put Appreciated Stock into a Donor Advised Fund (DAF)

Complementary to the bunching strategy is putting appreciated stock shares into a Donor Advised Fund. (i.e. you can make a bigger charitable donation every other year.) Rowling says donating appreciated shares to a DAF is best practice.

Convenience for Client Donors

In addition to the superior tax treatment available when putting shares into a Donor Advised Fund, using a Donor Advised Fund allows donors to donate when they want – without having to consider the tax treatment. This means donors are able to able to continue making regular contributions to their charities of choice on their timeline – and not when they will receive the largest tax break.

Using a Donor Advised Fund has other benefits as well, such as simpler record-keeping. Donors (or their tax-preparers) only ever have to record contributions to the Donor Advised Fund – and not all the individual donations made to a charity of choice. The institution custodying the DAF (i.e. Fidelity, etc.) is responsible for tracking distributions from the DAF, not the donor (or their tax-preparer), said Rowling.

Property & Casualty Insurance, Now More Than Ever

I’ve always been a big proponent of using insurance the right way: insuring for those really big financial losses – like your home, your liability, or an expensive car. Using insurance the right way also means skipping insurance for the small stuff – like cell phone insurance, rental car reimbursement, or sewer back up insurance.

But, enough about insurance! Let’s come back to the 2017 Tax Cuts and Jobs Act. The new tax law dictates that casualty loss deductions are no longer allowed, shared Rowling in her talk. This means that if your house burns down in a fire, you can’t write that off! Holy Toledo! It’s now-more-than-ever important to secure adequate insurance to protect your assets. And encourage your clients to do the same!

2018 Tax Planning Strategies for Financial Planners

In that we’re at the halfway point of 2018, it’s time to start thinking about taxes. Some of the ways that financial planners can help their clients in light of new tax law are via:

- tax planning via bunching itemized deductions in alternating years

- suggesting donations of appreciated stock to a donor-advised fund, if applicable

- reviewing client’s property and casualty policies to ensure that clients are appropriately insured

Nice summary Jon. Thanks!

You’re welcome, Sheryl. Thanks for a great presentation!