In a previous post, I discussed how stock market investing was superior to California real estate investing. This conclusion was based on the investment returns available with each strategy; in a flat out annualized returns vs. annualized returns comparison, the stock market outperformed. (Even in a successive analysis that considered leverage, stock market investing was still declared the higher-returning investment strategy).

| U.S. Equity Total Return | California Rental Total Return, Leveraged |

| ~10% | ~8% |

9.80% from 1/1/1926 – 4/30/2020 as calculated DFA Returns Web.

That’s the case for California, and other densely-populated areas. Despite this historic underperformance relative to stock market investing, real estate in less densely-populated areas may have a significant advantage over equities.

Table of Contents

Drivers of Stock Market Returns

This is because of the drivers of the investment returns of these distinct investments: stock market investment returns are mostly driven by the appreciation in share prices. Real estate investments in less densely-populated areas can have their investment returns driven strictly by income.

Stock Market Volatility

Stock prices are volatile. Dividend payments, bond coupon payments, and bond prices are less volatile. However, the vast majority of investment returns are driven by stock price appreciation and not dividends, bond coupons, and bond prices.

| Investment | Standard Deviation |

| CRSP Deciles 1-10 Index (market) | 18.3% |

| Five-Year US Treasury Notes | 4.3% |

| 50/50 Portfolio | 9.4% |

It is the volatility of stock prices that require investors to settle for a distribution rate that is substantially lower than the annualized return of a given portfolio. That is, while a 50/50 stocks/bond portfolio has returned a roughly 8% annualized return since 1926, investors are not able to seize upon a distribution rate anywhere near that; sustainable distribution rates vary by study, ranging from 3% to 4%.

Stocks & Bond Portfolio Sustainable Distribution Rates

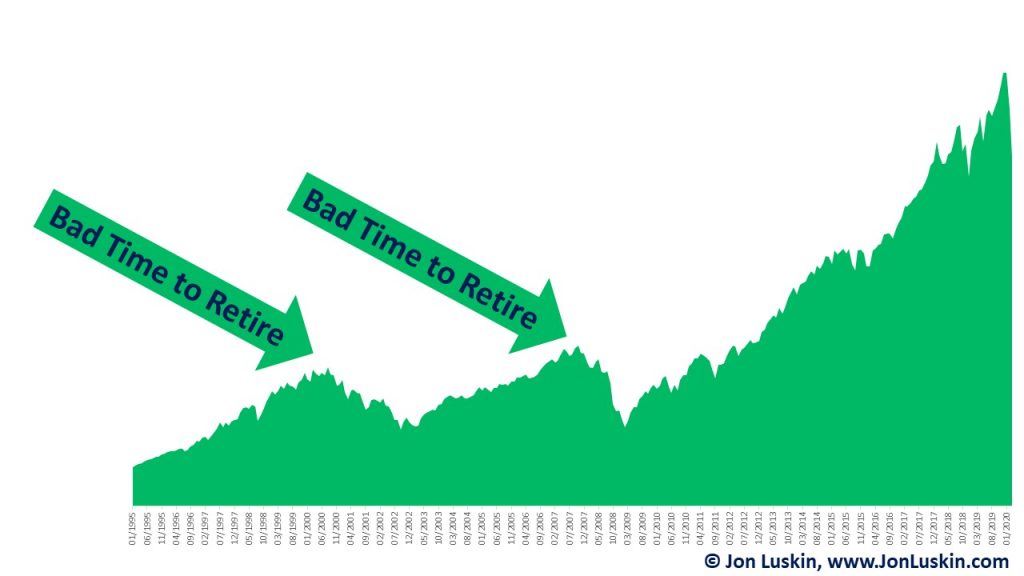

Why such a low distribution rate for stock and bond portfolios? Sequence risk! Sequence risk is the risk that the bad investment returns show up before the goods ones do. This is a very real risk for retirees using the stock market as their sole vehicle for retirement income.

Consider a retiree on their first day of retirement. If the stock market loses 22% of its value on Day One of retirement, that retiree is likely looking at a lower standard of living in the near future. (This assumes dynamic withdrawal rates.) Either that, or the retiree’s initial distribution rate is so low anyway – such as 3.0% net of fees – that adjusting portfolio distributions need not be a consideration. (Alternatively, the retiree may choose delay retirement entirely!)

| Historic Return, 50/50 Portfolio | Safe Withdrawal Rate, 50/50 Portfolio |

| ~8.0% | ~3.0% |

Consider this 3.0% sustainable distribution rate relative to the historic returns of a 50/50 portfolio: ~8.0%. While your portfolio provides an annualized 8% investment return, you can only eat 3% of that each year (if you expect that portfolio to survive in the worst of circumstances). This is the challenge of making ongoing distributions from a portfolio of stocks and bonds.

Direct Real Estate Investing for Cashflow

If stock market investing is driven mostly by stock price appreciation, then distinct real investments can be driven by either:

- price appreciation (i.e. densely-populated areas, such as San Diego, CA), or

- cash flow (i.e. properties in less densely-populated areas).

Appreciation-Driven Real Estate Investing

Areas with expensive real estate – such as California – are inappropriate investments for those needing cash flow (i.e. retirees). This is because the investment returns of real estate in population-dense areas usually do not cash flow well. In the examples used in my previous post on California real estate, investors may be able to expect between 1.5% (using a real-life client example) and 3% (using a hypothetical example, with less concrete figures) cash-on-cash return.

Cash-flow Driven Rental Real Estate

However, rental property investment opportunities do exist where the investment return is driven by income, and not appreciation. Such is the case with those rental properties matching the 2% rule of thumb for real estate investing, where an investor can collect monthly rent that is up to 2% of a property’s acquisition price. (The acquisition price is the cost to purchase a property and then successively rehab it, getting it rent-ready for tenants.)

As an example of the 2% rule, an investor can purchase a property for $30,000 – and rent it for $600/month. A similar “1% rule” exists – where an investors purchases a property for $100,000 and rents it for $1,000/month. These calculations assume that 50% of gross rents go to expenses, such as property taxes, management fees, vacancies, utilities, and a budget for rehabs and repairs.

High Distribution Rates on Rental Properties

If the investment return of a rental property is driven by income and not appreciation (such as those properties lining up with the 1% (or 2%) rule), then the real estate investor with the cash-flowing rental property may have a higher distribution rate than the stock market investor. That is, a 6% (or 12%) cash return (on direct real estate) is orders of magnitude greater than the 3% total return distribution rate available with a stock and bond portfolio.

Direct Real Estate vs. a Stock & Bond Portfolio: Distributions on $1,000,000 by Asset Class

Percentages aside, let’s run the numbers on these two investment strategies to drive this point home. One strategy uses a diversified portfolio of U.S. large-cap stocks (averaging ~10% per year) and U.S. Treasury bonds. That investor may be looking at a sustainable distribution rate between 3.0% and 4.0%. On a million-dollar portfolio, that investor may be able to live on $30,000 a year in perpetuity. Portfolio distributions are increased annually with inflation.

| Safe Withdrawal Rate, 50/50 Portfolio | Real Estate ROI, (1%) Rule |

| 3.0% – 4.0% | 6% |

Alternatively, imagine that investor purchases a million dollars of various rental properties. Every property invested in abides by the 1% rule. This suggests an annual cash flow of $60,000 for the real estate investor. Like the stock market investor, this figure of $60,000 increases annually for inflation each year (as rents are raised with inflation).

Moreover, that 6% distribution rate calculation ignores the appreciation of a property. Only income is being distributed – not principal. That is, there are no cash-out mortgages or HELOCs taken out on the property.

So, while the stock market investor can have cash flow for 30 or 45 years (as they are distributing both principal and growth), the real estate investor will enjoy cash flow in perpetuity.

Due to the distinct drivers of investment returns for these two distinct investments (cash distributions for certain real estate, vs. appreciation for equities for a stock and bond portfolio), the real estate investor is able to enjoy a superior distribution rate.

Different Investments for Different Life Stages

As mentioned, it is the volatility of stock market investing – and the downward impact of sequence risk on a sustainable portfolio distribution rate – that makes a portfolio of stocks arguably not ideal for retirees (at least relative to high cash-flowing direct real estate). When it comes to stock market investing, it is the sequence risk that makes for distribution rates far removed from a portfolio’s annualized return.

Stocks for Accumulation

For those not in retirement, stock market volatility is a nonissue. For those in the accumulation phase (those young and actively contributing towards retirement savings), this volatility is a boon; volatility makes for a buying opportunity. (Buy the dip!) Given that the goal of the accumulation phase is the highest return available, volatility doesn’t matter. To the contrary, it’s welcome.

Direct High Cash-Flowing Real Estate for Distribution

Given that stocks are great for accumulation but arguably poor for decumulation (given their inherent volatility and thus downward impact on sustainable distribution rates) – and that certain real estate is only fair at accumulation but great for distribution, perhaps the solution is this: During the accumulation phase, invest in equities. In the distribution phase (i.e. retirement), invest in high cash-flowing real estate. Such an approach allows (younger) investors who are able to capitalize on the higher rates of return and volatility to do so. That’s because – for them – sustainable distribution rates are a non-issue.

Challenges of a Direct Real Estate Portfolio

Have young investors pour their money in the stock market. Upon retirement, switch those them to cash-flowing direct real estate. If only it were that simple!

Costs Matter: The High Cost of Active Management

Direct real estate investing isn’t as simple as finding a property that abides by the 1% rule in investing. There’s a little bit of work involved (speaking from personal experience).

But, you can just outsource that, right? After all, there is an increasing number of companies offering to get you in on the direct real estate game!

If you plan to outsource the project of acquiring direct real estate to a third party, you should reconsider. That’s because of the high fees of intermediaries may make (in)direct real estate investing a nonstarter.

Of course, this is the case for any investments, direct real estate included – most especially “alternative” assets. If you pay a manager high fees to invest on your behalf, you are directly reducing your investment return by the amount of those fees! After considering the impact of those fees, you are likely better off investing in a low-cost (REIT?) index fund.

Timeline for Implementation on a Direct Real Estate Portfolio

Given the above-mentioned impact of fees on investing, the need for a self-directed real estate portfolio is clear (if you have decided that direct real estate is for you.) If that’s the case, enter a second challenge of using stocks for accumulation and high cash-flowing direct real estate for deaccumulation: finding good real estate investment properties takes time (speaking from personal experience).

If you’re looking to put a million dollars into rental properties abiding by the 1% rule before retirement, it may not be prudent to wait until retirement to get this real estate project started. That is, it may likely take a few years to assemble a high cash-flowing direct real estate portfolio. This is especially the case for the novice direct real estate investor. That’s because there can be quite a learning curve! (Did I mention that I’m speaking from personal experience?)

This begs the following questions for those looking to transition an investment portfolio of stocks (and bonds) to a portfolio of direct real estate:

- How much time does it take for a (novice) investor to construct a direct real estate portfolio?

- How many years from retirement should an investor liquidate their securities portfolio in favor of direct real estate?

- For an investor looking to transition their securities portfolio to direct real estate, how should their stock/bond (cash?) change over time to meet this distribution (liquidation) need?

I won’t be answering the above questions in those post here. But, they are certainly things worth considering.

Coupling Direct Real Estate and a Securities Portfolio

Consider that when it comes to stocks-vs-direct-real-estate, it may not have to be an either/or proposition. That is, those looking to meet cash flow needs can have those needs met from a combination of stock portfolio withdrawals and high cash-flowing direct real estate. (And, many retirees do this already, entering into retirement with both a portfolio of stocks and bonds, and a portfolio of direct real estate!)

Given the time requirements of constructing a direct real estate portfolio yourself, having both a stock and bond portfolio and a direct real estate portfolio is likely the scenario anyway for those looking to transition to a cash-flowing rental property portfolio for retirement. That is, an investor may not be able to transition all of their stock and bond portfolio to direct real estate by the first day of retirement – especially given that direct real estate can be a time-intensive project with a learning curve – which means someone working full-time (i.e. not yet retired) may not be able to pull it off before they stop working.

Alternating Between a Securities Portfolio Distributions and Cash from Direct Real Estate

If an investor has both a portfolio of stocks and bonds, and a portfolio of direct real estate, consider a retirement distribution strategy: assuming a non-perfect correlation of securities and direct real estate, distributions can be sourced from the investment enjoying superior recent performance. Consider:

- Did the stock market have a great year? Make a larger distribution from your securities portfolio – and perhaps even inject some capital (for renovations and/or repairs) into your direct real estate portfolio.

- Has the next stock market correction manifested? Make a smaller distribution from your securities portfolio. And if given enough cash from your real estate portfolio, even buy more stocks!

Note that I cannot take credit for the above; the ideas of spending less from your stock and bond portfolio during bad years, and using real estate to supplement portfolio withdrawals during bad years (and even buy more stocks during bad years!) has been previously demonstrated.

So, what’s your take? Do you advocate for direct real estate as an asset class? Is your advocation for direct real estate a function of an investor’s life stage? Is direct real estate something that can be cost-effectively outsourced?

As late-comers to investing and a shorter window to retirement, direct real estate investing was the decision we came to as well. We should be able to cash-flow our retirement in about five years, leaving all of our other investments intact and just sitting there growing.

Hello Wendy!

Thanks for your comment!

It certainly is hard to argue with the numbers on certain direct real estate investments. Whatsmore, it’s hard to argue with the value of diversifying across distinct asset classes – and not simply for diversification for diversification’s sake, but diversification across asset classes that have historically robust investment returns.

Of course, those investment returns are best achieved with self-management for direct real estate. This means being your own direct real estate portfolio manager (not to be confused with being a property, which should likely be outsourced!). While being your own direct real estate portfolio manager is time consuming, it will likely be the most financially-rewarding avenue – especially after crawling up the direct real estate investing learning curve!