For my master’s thesis, I explored the investment performance of several multi-million dollar endowment portfolios. In eight case studies, the results consistently showed that a low-cost portfolio outperformed a portfolio paying high fees to access active managers and alternative asset classes. Moreover, risk-adjusted performance showed the low-cost portfolio simply did better. (Previous analysis has shown that a low-cost portfolio outperforms the average endowment.)

But, that was only eight case studies. Why not do more? Enter a series of blog posts evaluating the performance of university endowments.

Ball State University

I first learned about Ball State University and the Ball State University Foundation at the Evidence-Based Investing Conference in Dana Point, California. When Chief Investment Officer Tom Heck explained the foundation’s approach to investing, I knew that there could be a better way.

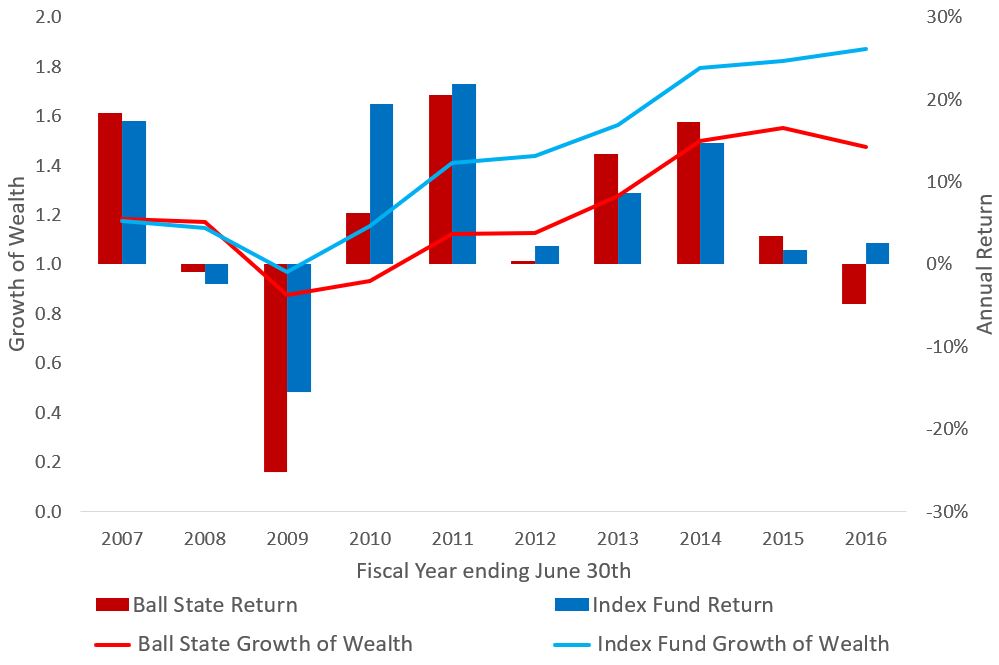

Fortunately, my hunch about the foundation served me correctly. I pulled Ball State Foundation’s annual report to evaluate their numbers, and I created a proxy portfolio as a benchmark. I discovered that utilizing a low-cost investment strategy could have generated the Ball State University Foundation an extra $60,000,000 over the last ten years.

You do not need me to tell you that $60,000,0000 is a lot of money. Given how the foundation designates its assets, $60,000,000 in extra assets would mean an extra $24,000,000 just for student financial assistance alone! That $24,000,000 equates to 257 students being able to attend Ball State University for free – no cost for tuition, not a penny spent on books, nothing for room and board. That’s 257 lives touched – young people who, armed with an education, can go out to make a difference in the world.

Of course, you know that the last 10 years won’t reflect the next ten years. The point here is to showcase the impact of fees – and how reducing those fees could very well mean more people helped.

Bad Benchmarks

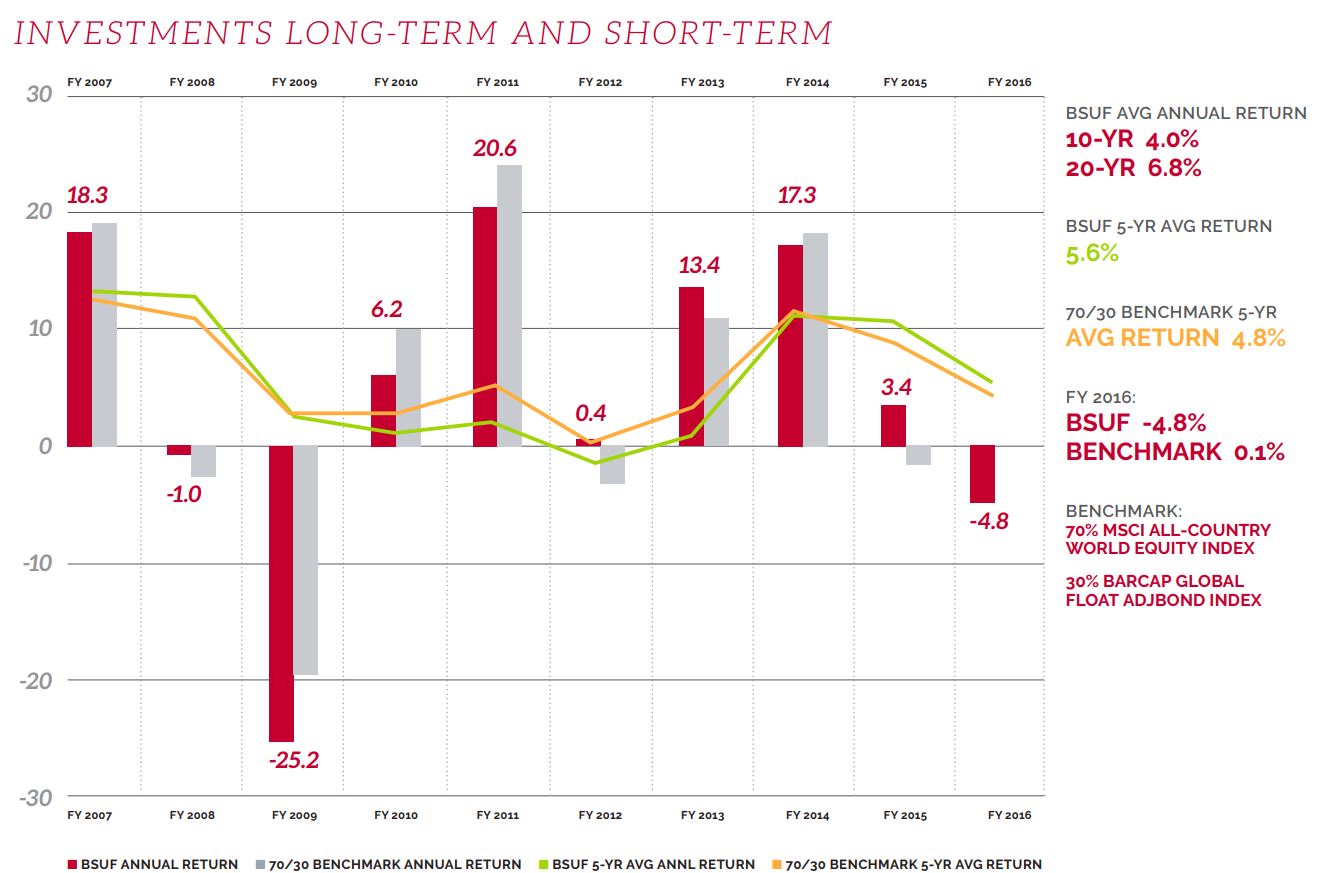

It’s simply undeniable that the performance of the Ball State University Foundation is lacking. However, if you were on an onlooker – and not an investment nerd – you may think that the Ball State University Foundation portfolio is doing just fine. Why’s that? Because the annual report for the Foundation showed a benchmark that performed inline with the foundation’s investment portfolio.

What’s wrong with Ball State University Foundation’s benchmark? Bad bonds. By opting for a global bond index, the bonds considered ran the gamut on quality. And when it comes to bonds, there is only one bond that offers the quality you want in your portfolio: United States Treasuries.

So, while Ball State University Foundation held bonds other than U.S. Treasuries, it shouldn’t have. As such, their performance suffered. And by not considering a United States Treasury Index in reporting, they likely didn’t know just how poorly they were performing.

Leave a Reply