In Larry’s Swedroe’s latest book, Your Complete Guide to a Successful and Secure Retirement, he briefly touches on the issue of reinvesting dividends and capital gains distributions. His suggestion? Don’t do it. Here’s his reasoning:

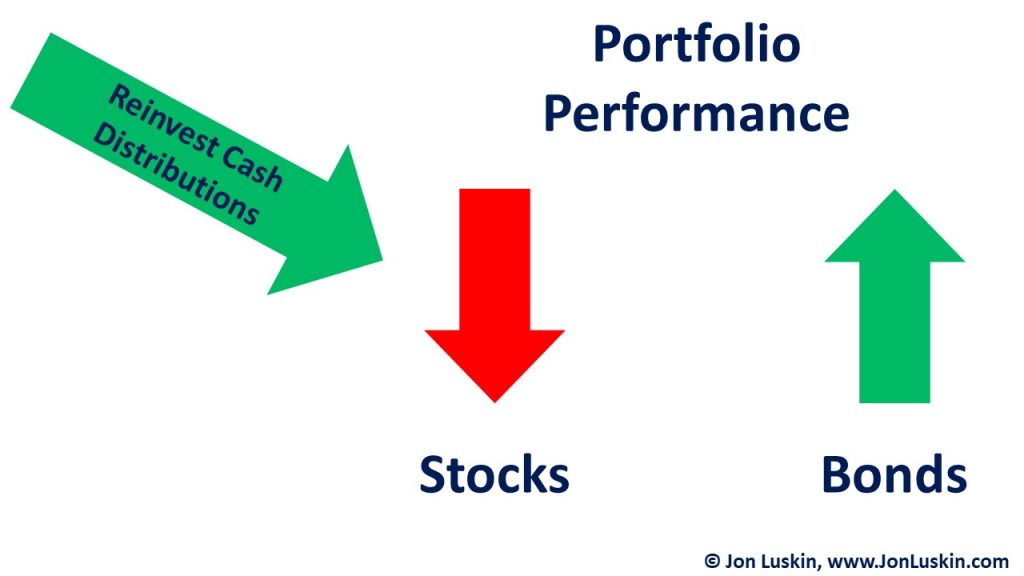

- Rebalancing. Cash from dividends and capital gains distributions can be used to (partially) rebalance an investment portfolio. This means deploying cash from dividends and capital gains distributions to buy portfolio positions that saw the greatest relative declines, or the portfolio positions that saw the smallest relative increases in value.

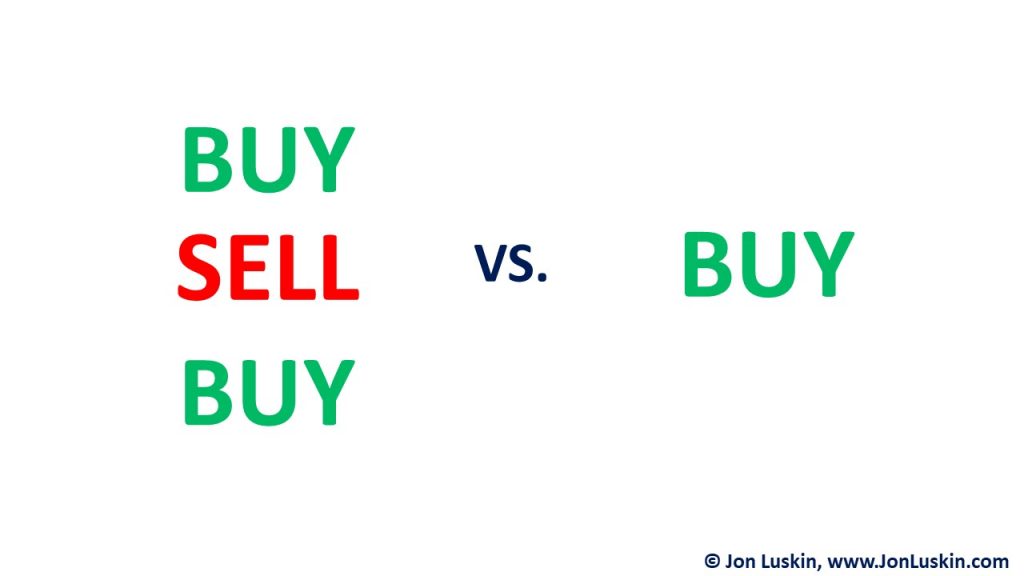

- Reducing transaction costs. Using cash fund distributions could eliminate redundant transactions. This could be the case were a portfolio asset that saw the greatest relative increase had a distribution re-invested into it. Later, that re-invested distribution would have to be sold and then re-invested elsewhere (when the portfolio is eventually rebalanced). That is, it costs more to buy something, and later sell that same thing to buy something else than it does to simply buy that something else in the first place.

- Reducing Taxes. In the event that a reinvested cash distribution is re-invested into a portfolio’s asset that has seen the greatest relative appreciation – it will have to be sold at a successive rebalance. This results in an avoidable tax bill.

As with most things in life, there are trade-offs to a strategy that does not automatically reinvest dividends and capital gains distributions. Below, some of those trade-offs are discussed.

Possible Additional Transaction Costs

Does automated reinvestment of cash distributions increase transaction costs? It depends. It can certainly mean bridging (i.e. paying) the bid/ask spread more times than necessary. Bridging that spread more times than not can certainly negatively impact one’s investment return.

Cash Drag / Excessive Rebalancing

If rebalancing is performed annually, setting dividends and capital distributions to be disbursed as cash means adding a cash drag to the portfolio – albeit small. In the time between the cash is distributed from the fund – and the portfolio is ultimately rebalanced – that cash distribution will sit in the portfolio, doing little.

The alternative is to (at least partially) rebalance a portfolio each time there are dividends or capital gains distributions. For many equity funds, this means rebalancing quarterly. For certain bond funds, this could mean rebalancing monthly. Monthly rebalancing (or re-investing of cash distributions) presents two challenges. Firstly, it’s time-consuming.

Secondly, frequent (partial) rebalancing via fund distributions results in less portfolio drift. This means less of an opportunity to buy low(er). That is, it isn’t optimal to (at least partially) rebalance portfolios so frequently. In fact, Vanguard even suggests rebalancing an investment portfolio as infrequently as between two and five years.

Leave a Reply