It always good to catch up with old friends.

Recently, I got a friend on the phone that I hadn’t spoken to in a while. He had reached out because he had a question about investing.

He was considering leveraging his investment portfolio. He sent me the data for his proposition. What did I think about it?

Leveraging the entirety of one’s investment portfolio is most certainly a risky proposition. And, I told him as such: don’t bet the farm.

Cowboy Account

Of course, I’m no stranger to risky propositions. I’m an investment manager, after all. I’ve fielded all kinds of risky propositions from clients.

Some of these investing propositions are absolutely hilarious – with hilarity being manifest with just a brief review of the prospectus: sales commissions; guarantee of a (short-term) intentionally unprofitable enterprise; and current indebtitude to local government agencies for failure to pay taxes. Of course, had the client read the prospectus, they could have enjoyed discovering such hilarity themselves.

But then, there are more sophisticated proposals. Real estate investing. Crypto-currency. And of course, stock picking.

So, how does a financial advisor advise his client when it comes to this? If the investment idea isn’t too inane, suggest a Cowboy Account.

A cowboy account is where you get to live out your wildest investing fantasies. It’s where you play with money that you can afford to lose.

I Love My Cowboy Account

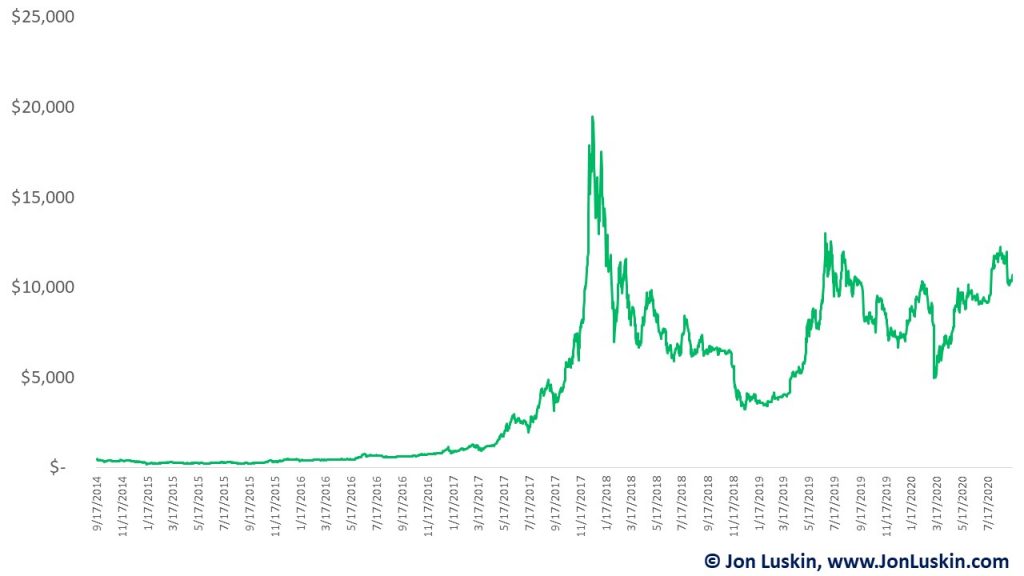

Everybody remembers Bitcoin, right? In the Bitcoin heyday, I got in on the action. Enter one of my first cowboy accounts: cryptocurrency. I put all of $400 into Bitcoin, Litecoin, and Ethereum.

How much is it worth today? I couldn’t even tell you – because I’m locked out of my Coinbase account! But, given that I got in at the run-up of the mania, I’m quite confident that it’s not worth a small fortune.

At the time, I was pretty excited about Bitcoin. But, despite the enthusiasm, I limited my wager to 400 bones. That’s because if I lost it all, I wouldn’t lose any sleep at night. For me, $400 was a perfectly reasonable loss – given my financial circumstances.

My next cowboy account was a little bit bigger. At the time, I was looking at buying our first rental property. This would cost far more than $400. The rental property would represent about 10% of our net worth, with our Southern California home and our index funds being the other 90%. I figured that if a crazy, untested out-of-state-buy-and-hold-rental-property investing strategy blew up, we wouldn’t be financially destitute. We could handle the financial loss. (That’s not to say that we’d enjoy it.)

Indeed, putting capital into a new, labor-intensive asset class was risky. But, it was a manageable risk – even in a worst-case scenario.

Fortunately, the real estate venture has been successful so far. (It’s done a lot better than the Bitcoin, I’m sure.) With each real estate investing success, I put more capital into the venture.

Of late, I’ve been trading options. This too started with a small amount, and has been profitable so far. And as with the real estate, with success comes more capital. And just like with the real estate venture, I started trading options with a small amount.

Call me biased, but I think this is a good strategy: limiting investment capital in new, untested ventures. I believe I shall call this unheard-of idea diversification.

Di-worse-ification

Any number of successful real estate investors scoff at the idea.

The stock market is for suckers!

The worst thing you can do is put money in your 401(k) account.

But, I’ve done OK with it. And millions of other Americans have too. That, real estate, and small business is where the middle class holds their wealth.

Sure, you very well likely could make a larger fortune quicker with leveraged real estate than with index funds. But, that requires skill and drive (and maybe even a bit of luck).

Not everybody can do that. Not everyone has that skillset. And those who don’t have the recipe for success but try anyway could blow themselves up – if you lever yourself and put it all on the line. Dave Ramsey will you about that all day long.

Low-cost set-it-and-forget-it target-date funds make for an easy way to grow and preserve wealth. Of course, you don’t have to start with low-cost buy-and-hold index funds. But, it’s not a bad place to start; it works great!

And once you’ve done that and you’ve got an investment itch you can’t scratch, you can always take whatever you can afford to lose to scratch that itch.

Use a Cowboy Account for Whatever You Can Afford to Lose

Maybe the next thing investment scheme I’ll try in my cowboy account is the leveraged investment portfolio. But when I do do it, I’ll only do it with whatever I can afford to lose – and not cause me to lose sleep at night.

Hi Jon. Good post to keep things in perspective, and only play with a small part of you portfolio; not the whole thing.

A massive thread (actually it continued to Part II) at Bogleheads has me considering putting some play money (ROTH IRA) into Hedgefundie’s Excellent Adventure. Basically, 55% in UPRO – ProShares UltraPro S&P500 (a 3x leveraged S&P 500 index) and 45% in TMF – Direxion Daily 20+ Year Treasury Bull 3X Shares. Have you heard about this?

If you look at the backtesting, it takes advantage of risk parity resulting in a better Sharpe and Sortino ratio than the S&P 500. I’d love to hear your input on this.

B

It sounds like the perfect thing for a cowboy account.

Yeehaw!