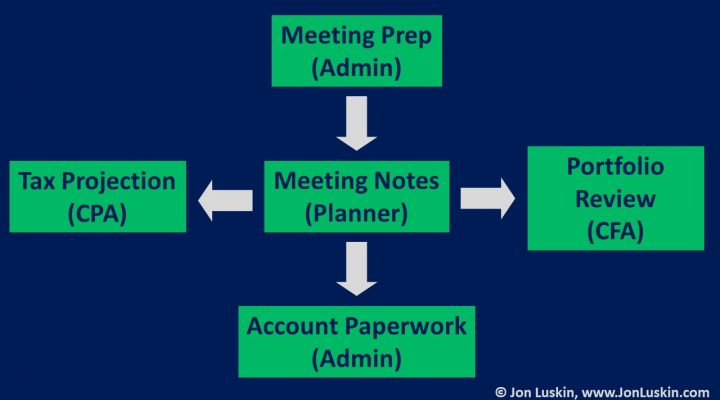

Recently, I was able to connect with a fellow advisor. Our topic of conversation was managing firm processes. “What is the best way to stay on top of a client task?” he asked. That’s an easy answer: a well-implemented customer relationship management (CRM) tool. It doesn’t matter if you’re using JunXure Cloud, Redtail, or even […]

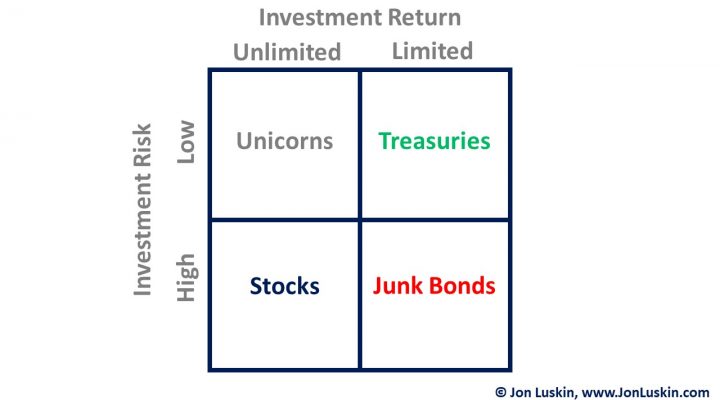

Gambling with Structured Notes

This post posits that structured notes are a bad investment. Fortunately, I have an easy task ahead of me. Why so easy? Because the reason that structured notes are a poor investment is obvious – and easy to understand. We don’t even have to look at any complicated math to understand why. Banks Strive to […]

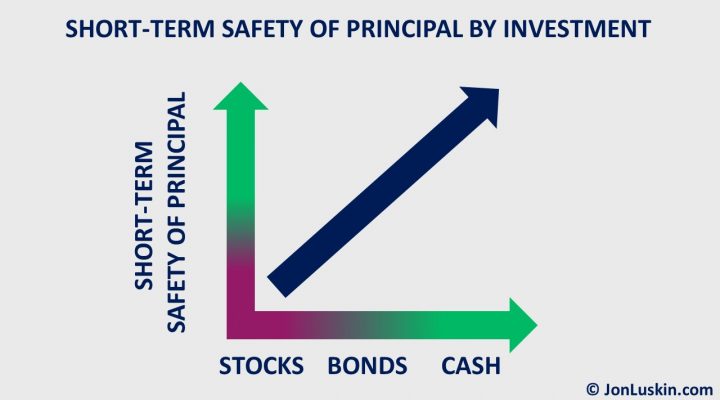

Why Invest in Bonds Today?

What is the case for investing in high-quality fixed-income?

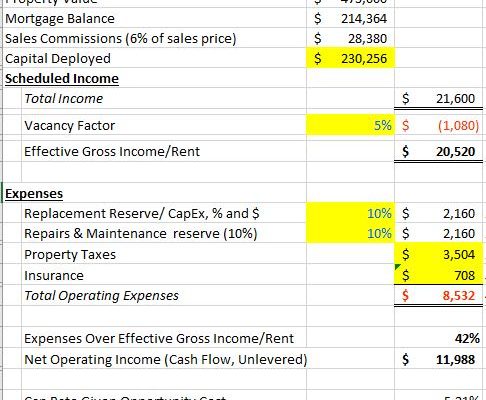

Is My California Rental Property Good for Retirement Income?

Here’s Nabeel’s question about his California rental property: I need some advice on my real estate investment. I have a rental property in a Los Angeles suburb with the following information: Metric $ / Date Original Loan Amount $249,000 Current Principal Balance $214,363 Interest Rate 4.25% Loan Origination Date 12/20/2017 Maturity Date 01/20/2033 Gross Rent, […]

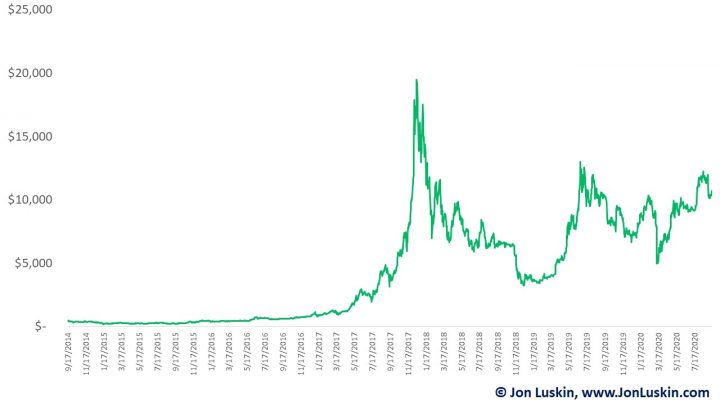

The Cowboy Account

It always good to catch up with old friends. Recently, I got a friend on the phone that I hadn’t spoken to in a while. He had reached out because he had a question about investing. He was considering leveraging his investment portfolio. He sent me the data for his proposition. What did I think […]

Should I Invest in Alternative/Direct Lending (LENDX)?

Having read of two of Larry Swedroe and Kevin Grogan’s books in a row, I have twice been presented with the same argument for using the Stone Ridge Alternative Lending Risk Premium Fund (LENDX). (Swedroe argues for it online, as well.) This is an alternative (direct) lending fund, where investments are made in consumer loans, […]