Getting cash payments from your investments makes a great story. But, when it comes to focusing on dividend-paying stocks, the numbers simply aren’t there. There are better investments available, offering: Higher investment returns Greater diversification Lower cost Fewer taxes More flexibility In this episode of the Stay Wealthy retirement podcast we talk about all of the […]

FPA NexGen Gathering is a Must

All young financial planners need to go to the Financial Planning Association (FPA) NexGen Gathering. That’s just my opinion. But, bear in mind, I’ve been to a handful of conferences: Bogleheads® Conference Ritholtz’s Evidence-Based Investing (EBI) West FinCon FPA Minnesota Symposium JunXure’s conference many Dimensional Fund Advisors (DFA) events a handful of Fidelity events the […]

Tax Planning from Sheryl Rowling, CPA, PFS

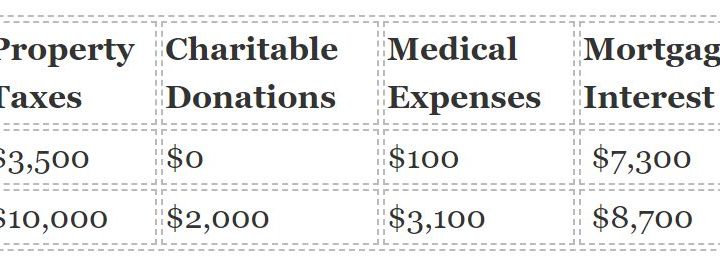

Sheryl Rowling is a practicing financial advisor, tax ninja, and creator of Total Rebalance Expert (TRX). She gave a summary of the new tax changes at a recent quarterly meeting of the San Diego Financial Planning Association. Here are a few takeaways from her talk. Bunching Deductions in Alternating Years Bunching deductions is certainly not […]

Save More Money with a Roth

Roth vs. Traditional. It’s a debate as old as time. Well, not really – but it’s an important financial planning question. Most of the time, I’m a big advocate for the Roth for most people. How come? With a Roth, you literally save more money. Yes, but Jon, what about the optimal strategy where you […]

There’s So Much Good Information Out There

You know you’ve made it when you’re on a podcast. I say this joking, as I now have the pleasure of announcing my new role as co-host on the Stay Wealth San Diego podcast. You can check out the episode below: As I was reviewing the episode (you’re allowed to listen to your own podcast, right?), it […]

Spend Less or Save More?

I was sitting in on a presentation by Nobel Laurette Robert Merton who made the comment that not saving enough money (insufficient savings) is the same thing as spending too much money. Given a fixed income, saving more money means spending less money. And spending less means saving more. Income = Spending + Savings So, telling […]