I’m surprised at our country’s current state of the coronavirus pandemic. We – as Americans – are obviously doing something very wrong: we’re not wearing masks; we’re not social distancing. Yet those two things are very impactful in slowing the spread of the coronavirus: using masks in public; staying six feet away from others. The […]

Blog

Rental Real Estate Investing Across the United States

Previously, I wrote that stock market investing has historically outperformed rental real estate investing in California. (This is even the case when considering leverage: California rental property underperforms the stock market.) This conclusion applies not just to real estate in California, but anywhere with dense populations. This is because high population density creates a high […]

Reinvest Dividends and Capital Gains Distributions or Not?

In Larry’s Swedroe’s latest book, Your Complete Guide to a Successful and Secure Retirement, he briefly touches on the issue of reinvesting dividends and capital gains distributions. His suggestion? Don’t do it. Here’s his reasoning: Rebalancing. Cash from dividends and capital gains distributions can be used to (partially) rebalance an investment portfolio. This means deploying […]

Review: Kitces.com Member Section for Continuing Education (CE) Credit for Financial Advisors

In a pre-pandemic world, continuing education (CE) credits were easy to acquire. If you attend enough events, conferences, etc., it was impossible to not collect sufficient CE to renew your various certifications. That’s because CE credits to maintain one’s CERTIFIED FINANCIAL PLANNERTM (or other) designation were available at local and national Financial Planning Association (FPA) […]

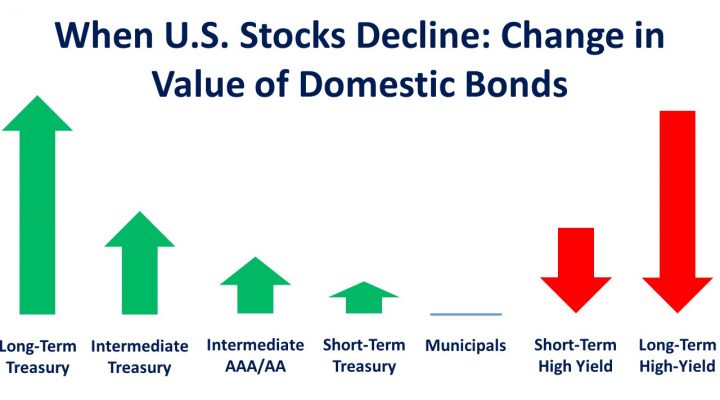

Credit Risk for Interest Rate Risk

I gave a listen to a recent episode of the Stay Wealthy podcast. Investment manager Cullen Roche was the guest for the episode. In the episode, (if I understand his argument correctly) Cullen suggests short-term corporate bonds for one’s fixed income portfolio. He argues that Treasury bonds are currently paying too little to merit the […]

Are Long-Term Treasury Bonds Worth Holding? II

Read Part I of the series on Long-Term Treasury bonds here. Interest rate risk is scaring investors away from longer maturity bonds. And this is the case regardless of issuer quality – whether’s it high-quality U.S. government Treasury bonds, or low-quality emerging market debt. Given today’s low interest rates, long-term bonds are simply […]