If buying a book of business from retiring advisor interests you, know that there are many stages in the Exit planning process: Prospecting for your target acquisition (i.e. go find an advisor looking to retire!) Agreeing to the terms of the sale structure Executing the terms of the deal (i.e. bringing the new clients into […]

Blog

Advice for New Financial Planners

I could never do as good a job as Michael Kitces, so I’ll just link his article on this very same subject here. I won’t bother to repeat the points he already made. I’ll just share something I wish someone had told me when I got into the field of financial planning. The Job Description […]

Exit Planning Case Study: Ian Kutner

Continuing with the theme I’ve covered previously of interviewing professionals experienced in succession planning, I recently spoke with Ian Kutner. Now retired after having sold his financial planning practice to a San Diego wealth management firm, Ian shared some interesting details about how his transaction unfolded. Working within an acquiring wealth management firm Following a […]

Endowment Investing Case Study: The San Diego Foundation

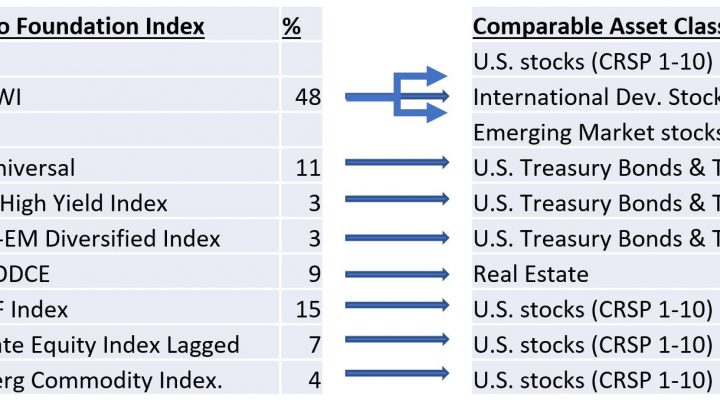

The San Diego Foundation bills itself as grantmaking for San Diego nonprofits and our community. As a San Diego resident, I can’t help but like that mission statement. In fact, I’m even disposed to help the Foundation achieve its mission. How? With a portfolio analysis, of course! The Theoretical Problem with San Diego Foundation Endowment […]

Why Drawdown Correlation Is a Metric Worth Considering

Why is Drawdown Correlation a metric worth considering? More than that, what is Drawdown Correlation? If correlation measures the performance of one investment relative to another over time, then drawdown correlation makes that measurement only when that first investment is in decline. (Full disclosure: I had not yet found a term that describes correlation exclusively […]

John Turner of Live Oak Bank on Succession & Exit Planning

What Is Live Oak Bank? John Turner is the senior lending advisor for Investment Advisory Vertical (Industry) at Live Oak Bank. (If you haven’t heard of Live Oak Bank, you’ve likely never used Succession Link, where Live Oak’s ads are plastered everywhere.) Live Oak bank specializes in financing financial advisory business succession plans. What quantifies specialization? Last […]