What is the case for investing in high-quality fixed-income?

Bonds

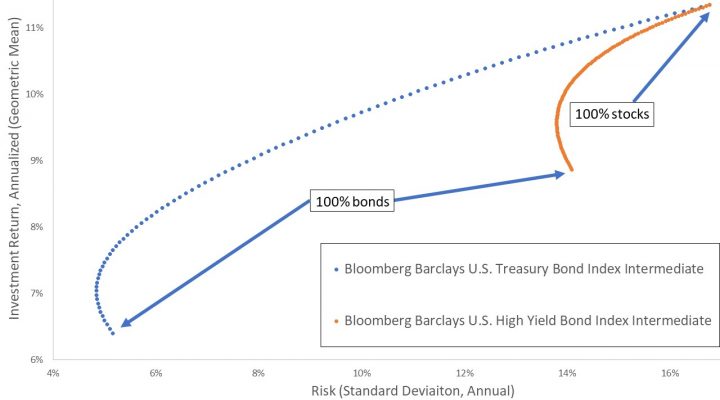

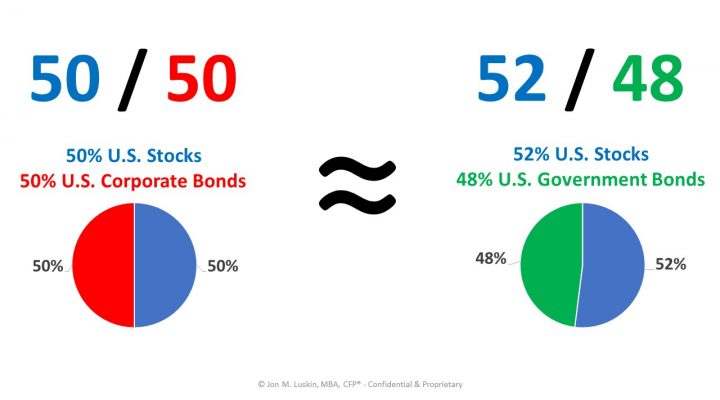

Credit Risk for Interest Rate Risk

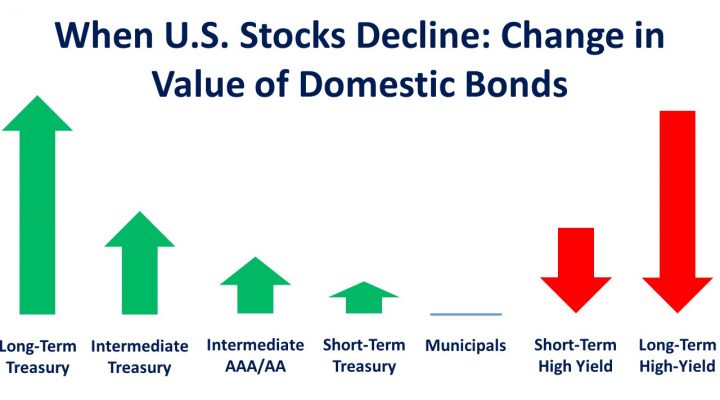

I gave a listen to a recent episode of the Stay Wealthy podcast. Investment manager Cullen Roche was the guest for the episode. In the episode, (if I understand his argument correctly) Cullen suggests short-term corporate bonds for one’s fixed income portfolio. He argues that Treasury bonds are currently paying too little to merit the […]

Are Long-Term Treasury Bonds Worth Holding? II

Read Part I of the series on Long-Term Treasury bonds here. Interest rate risk is scaring investors away from longer maturity bonds. And this is the case regardless of issuer quality – whether’s it high-quality U.S. government Treasury bonds, or low-quality emerging market debt. Given today’s low interest rates, long-term bonds are simply […]

Are Long-Term Treasury Bonds Worth Holding?

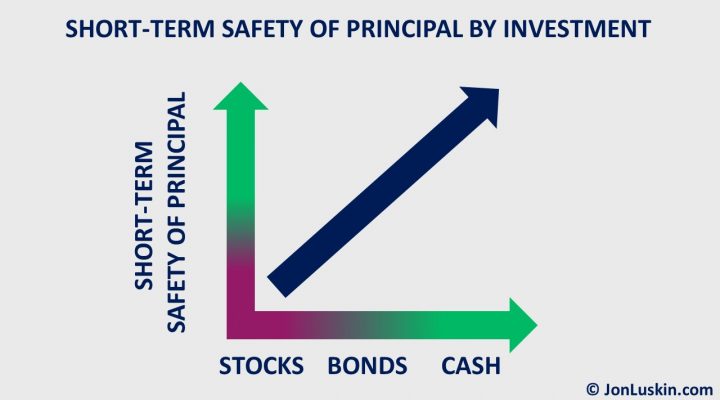

Ah, bonds. They’re quite the investment instrument. In a world of volatile stocks, bonds offer safety of principal – at least if you’re doing it right. That means shunning corporate bonds in favor of Treasury bonds, which includes shunning high-yield bonds. Yes, Treasury bonds are where the safe portion of your investments should lay – […]

Why High-Yield Bonds Don’t Make Sense

I remember when I was first learning about investing. I was having a conversation with another advisor about high-yield bonds. His approach went something like this: Live off the coupon! If you hold the high-yield bonds forever, who cares if the bonds fluctuate in value!? Don’t Evaluate Assets in Isolation The above logic is rife […]

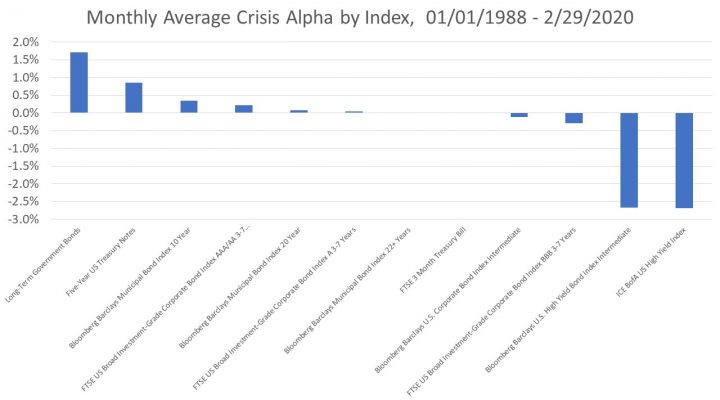

Corporate Bonds vs. U.S. Government Bonds

If you haven’t already, please go ahead and put yourself to sleep by reviewing my latest paper in the Journal of Financial Planning. In it, I discuss bond investing – specifically what happens when you pit United States government bonds against corporate bonds. Don’t want to read the paper? I don’t blame you. Here are […]