I gave a listen to a recent episode of the Stay Wealthy podcast. Investment manager Cullen Roche was the guest for the episode. In the episode, (if I understand his argument correctly) Cullen suggests short-term corporate bonds for one’s fixed income portfolio. He argues that Treasury bonds are currently paying too little to merit the […]

Investing

Are Long-Term Treasury Bonds Worth Holding? II

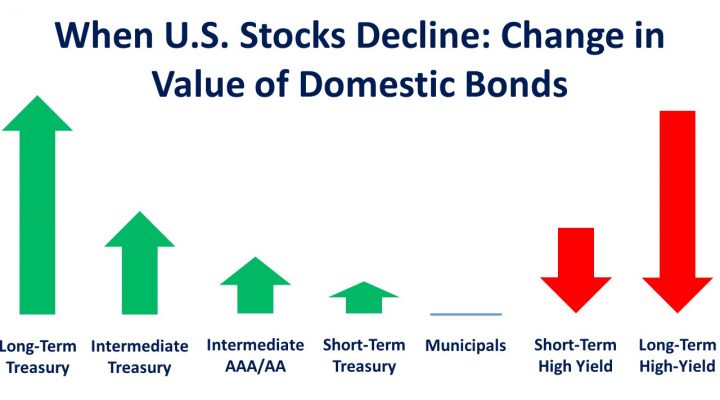

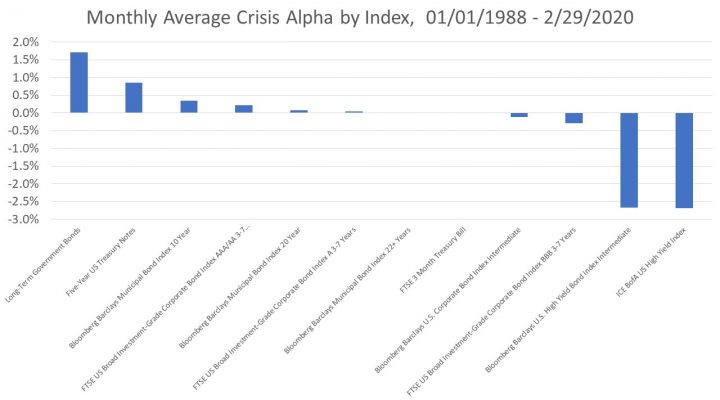

Read Part I of the series on Long-Term Treasury bonds here. Interest rate risk is scaring investors away from longer maturity bonds. And this is the case regardless of issuer quality – whether’s it high-quality U.S. government Treasury bonds, or low-quality emerging market debt. Given today’s low interest rates, long-term bonds are simply […]

Are Long-Term Treasury Bonds Worth Holding?

Ah, bonds. They’re quite the investment instrument. In a world of volatile stocks, bonds offer safety of principal – at least if you’re doing it right. That means shunning corporate bonds in favor of Treasury bonds, which includes shunning high-yield bonds. Yes, Treasury bonds are where the safe portion of your investments should lay – […]

Why California Rental Property is Not a (Historically) Great Investment

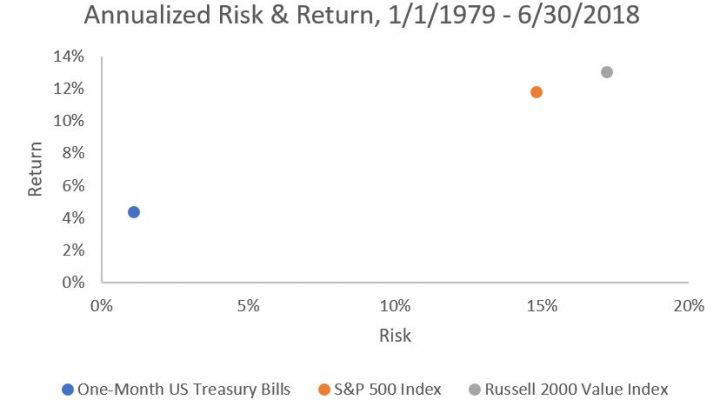

EXECUTIVE SUMMARY Investors in illiquid real estate should be compensated with investment returns above what U.S. stock market investors receive. This is because real estate is illiquid – whereas U.S. large cap stocks are highly liquid. Historically, U.S. stocks market investors received an investment return of roughly 10% per year. Therefore, investors in illiquid real estate should […]

Story People

Recently, I was wasting some time on the Twitternets. I came across the following exchange: Every single academic study ever done has concluded that REITs outperformed private real estate investment. – Dr. Brad Case — Blair H duQuesnay (@BlairHduQuesnay) June 21, 2018 Interesting. Please forward the research Not surprised though. More and more research is […]

Just Say “No” to Dividend Investing

Getting cash payments from your investments makes a great story. But, when it comes to focusing on dividend-paying stocks, the numbers simply aren’t there. There are better investments available, offering: Higher investment returns Greater diversification Lower cost Fewer taxes More flexibility In this episode of the Stay Wealthy retirement podcast we talk about all of the […]