You know you’ve made it when you’re on a podcast. I say this joking, as I now have the pleasure of announcing my new role as co-host on the Stay Wealth San Diego podcast. You can check out the episode below: As I was reviewing the episode (you’re allowed to listen to your own podcast, right?), it […]

Investing

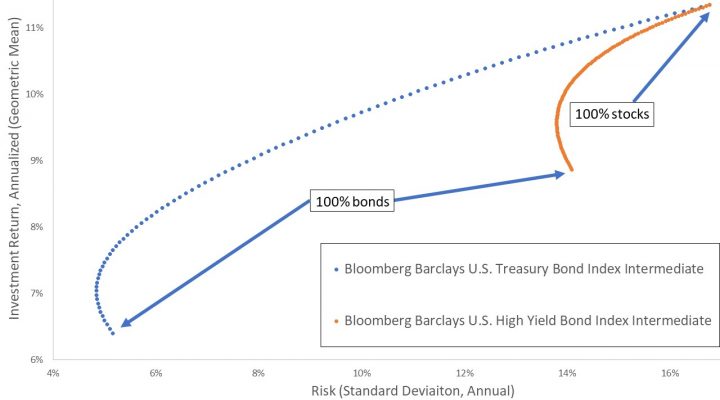

Why High-Yield Bonds Don’t Make Sense

I remember when I was first learning about investing. I was having a conversation with another advisor about high-yield bonds. His approach went something like this: Live off the coupon! If you hold the high-yield bonds forever, who cares if the bonds fluctuate in value!? Don’t Evaluate Assets in Isolation The above logic is rife […]

When Should You Take Your RMD?

Recently, a client asked if they should be taking their RMDs at the beginning of the year. Given the market’s recent upward performance, a market correction is due, thought the client. By that logic, it should make sense to take the RMD sooner rather than later, right? Perhaps, let’s see what the numbers say. I […]

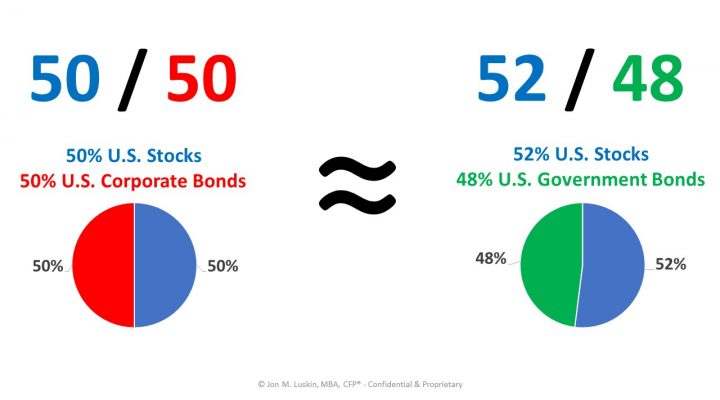

Corporate Bonds vs. U.S. Government Bonds

If you haven’t already, please go ahead and put yourself to sleep by reviewing my latest paper in the Journal of Financial Planning. In it, I discuss bond investing – specifically what happens when you pit United States government bonds against corporate bonds. Don’t want to read the paper? I don’t blame you. Here are […]

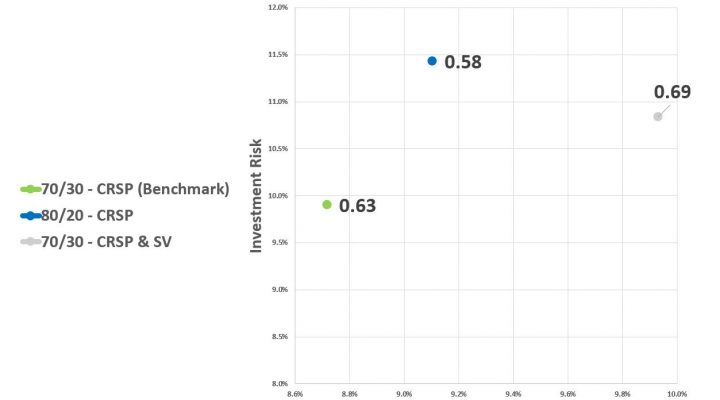

Should You Seek Out the Small Value Premium if You Hold Bonds?

Dimensional Fund Advisors was one of the first vehicles that gave investors access to the small and value premiums. These premiums enabled investors to earn a higher investment return. But, in investing there is rarely a free lunch – with Modern Portfolio Theory being the rare exception. It was only by bearing the greater risk of […]

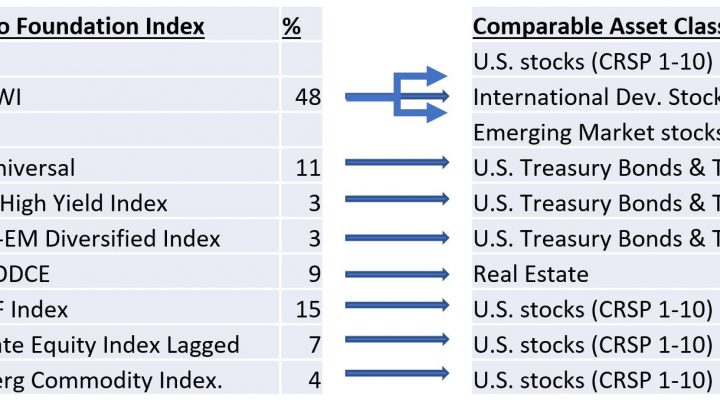

Endowment Investing Case Study: The San Diego Foundation

The San Diego Foundation bills itself as grantmaking for San Diego nonprofits and our community. As a San Diego resident, I can’t help but like that mission statement. In fact, I’m even disposed to help the Foundation achieve its mission. How? With a portfolio analysis, of course! The Theoretical Problem with San Diego Foundation Endowment […]