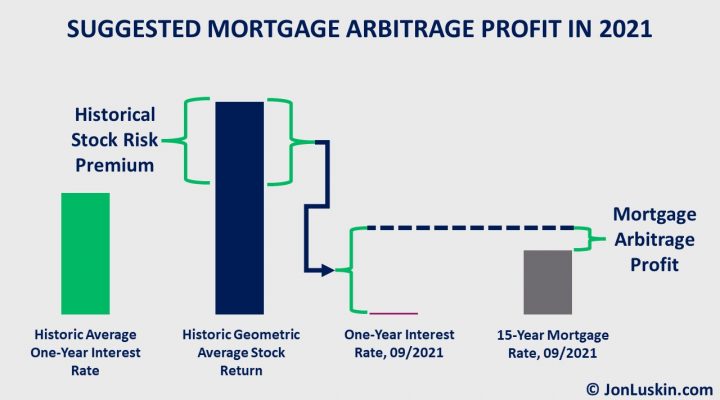

SUMMARY: Pay off debt if bonds make up any part of your investment portfolio. Even with a portfolio as aggressive as 90% stocks and just 10% bonds, anything with a non-zero interest rate should be paid off. This idea – to prepay debt if investing in bonds – comes as a surprise to those investors […]

Investing

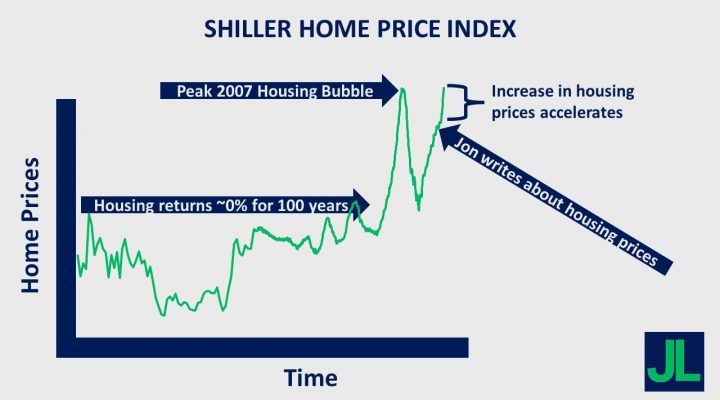

Future Housing Returns are Stark

In the June 2021 issue of the Financial Planning Association’s Journal of Financial Planning, I wrote a short piece on housing. In the article, I pointed to the rise in prices. I argued that while housing has done well over the last couple of decades, that trend may not continue. Given that uncertainty, funding retirement […]

Just Buy Value

I’ve had a couple of conversations with some lay investors of late. Both times, friends approached me with questions about investing. They were looking to profit off the pandemic, intrigued by the opportunity to buy certain stocks on the cheap. Travel and tourism stocks – they reasoned – were ripe for recovery (once the impacts […]

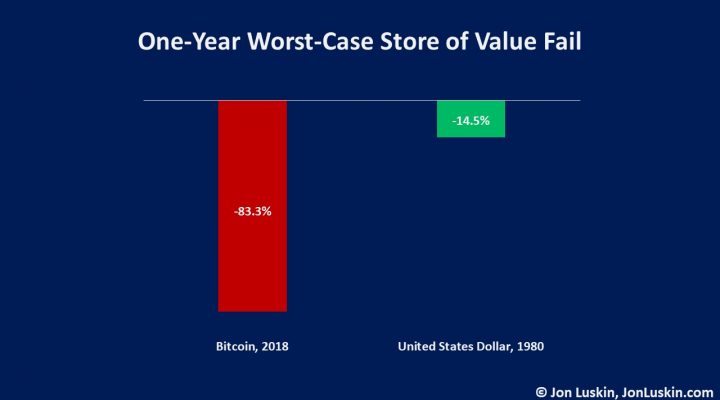

Intangible Beanie Babies

I wrote a piece about Bitcoin a few years back. Since then, Bitcoin mania has waxed, waned, and waxed again. Given its new record high and accompanying successive round of mania, it’s time to return to the subject of Bitcoin. Why Bitcoin Fails Firstly, Bitcoin a terrible store of value. Compare Bitcoin to cash, specifically […]

Gambling with Structured Notes

This post posits that structured notes are a bad investment. Fortunately, I have an easy task ahead of me. Why so easy? Because the reason that structured notes are a poor investment is obvious – and easy to understand. We don’t even have to look at any complicated math to understand why. Banks Strive to […]

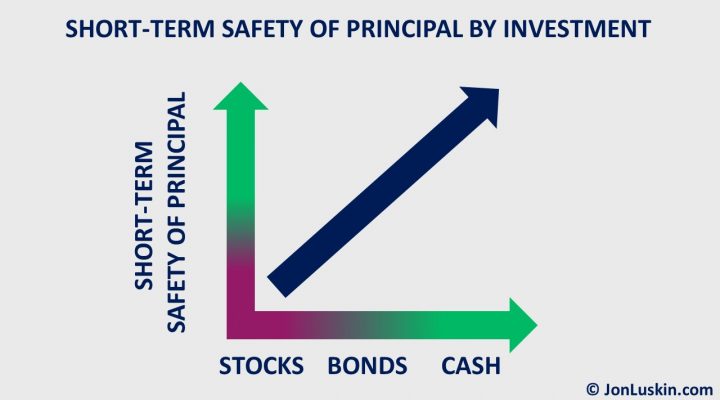

Why Invest in Bonds Today?

What is the case for investing in high-quality fixed-income?