Nobel laureate Dr. William Sharpe answers questions on investing.

endowment investing

Endowment Investing Case Study: The San Diego Foundation

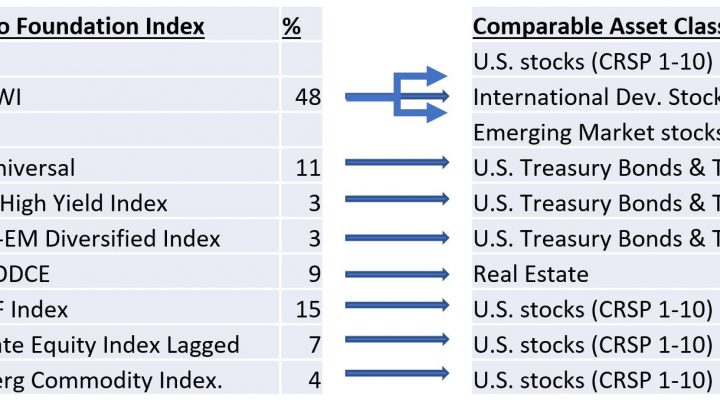

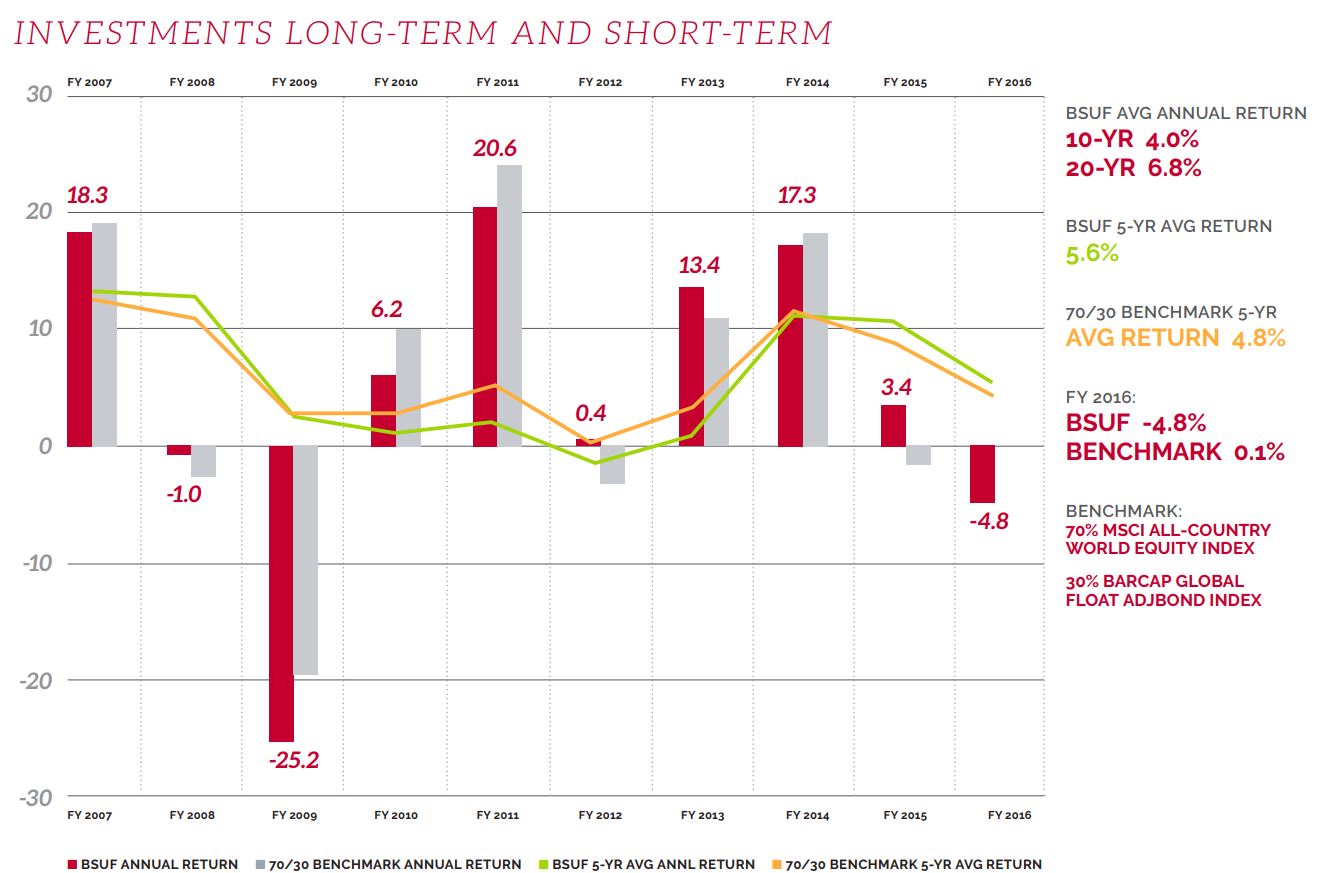

The San Diego Foundation bills itself as grantmaking for San Diego nonprofits and our community. As a San Diego resident, I can’t help but like that mission statement. In fact, I’m even disposed to help the Foundation achieve its mission. How? With a portfolio analysis, of course! The Theoretical Problem with San Diego Foundation Endowment […]

Endowment Investing Case Study: Ball State University

For my master’s thesis, I explored the investment performance of several multi-million dollar endowment portfolios. In eight case studies, the results consistently showed that a low-cost portfolio outperformed a portfolio paying high fees to access active managers and alternative asset classes. Moreover, risk-adjusted performance showed the low-cost portfolio simply did better. (Previous analysis has shown […]