What is the case for investing in high-quality fixed-income? With interest rates at historic lows, many investors are shunning low-yielding United States Treasuries. Is this the right investment move?

It depends.

The case for holding bonds depends on your view of a bond’s role in your investment portfolio.

So, why do we own bonds? I can think of a couple of reasons:

- to generate portfolio income

- to help manage the risk of stocks

Table of Contents

Do We Own Bonds for Income?

One could hold bonds for their income generation. That’s because – STRIPS aside – fixed income investments usually pay a coupon.

Unfortunately, bond coupons have been paltry of late – to the disappointment of bonds-for-income investors. (Of course, with recent interest rate increases, that’s changed some.)

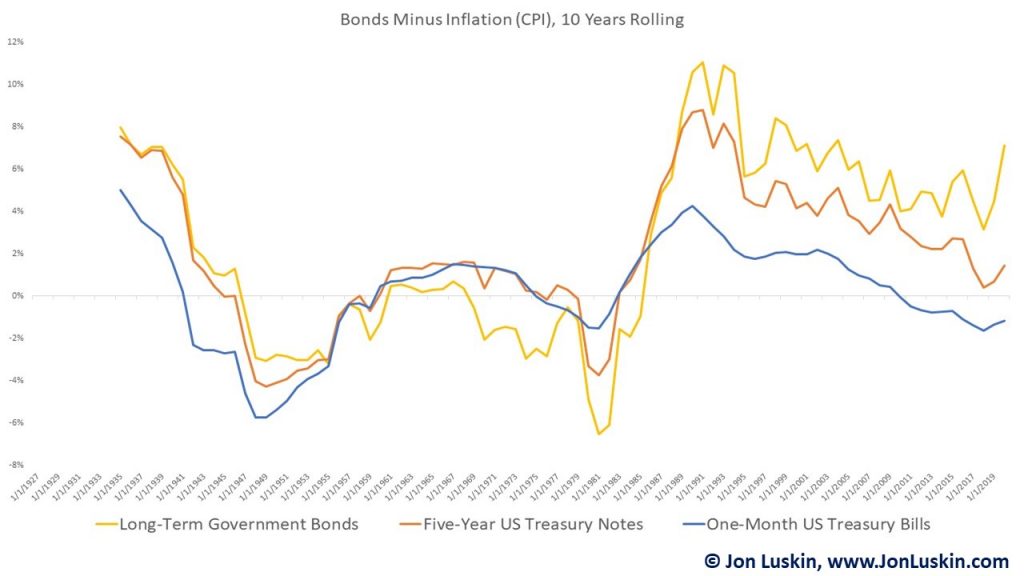

Low interest rates are quite distinct from history. In the time since the senior generation of investment advisors have been practicing, intermediate-term Treasuries have been able to outperform inflation: Treasuries offered a real return. This was because of both a historically-higher coupon and principal appreciation from decreasing interest rates.

That trend may be changing: the real return on bonds has been steadily decreasing since the late 1980s. With interest rates at only now just off their historic lows, bonds offer relatively small coupons and have little room for appreciation. (In fact, depreciation of bonds has been a big concern for investors.)

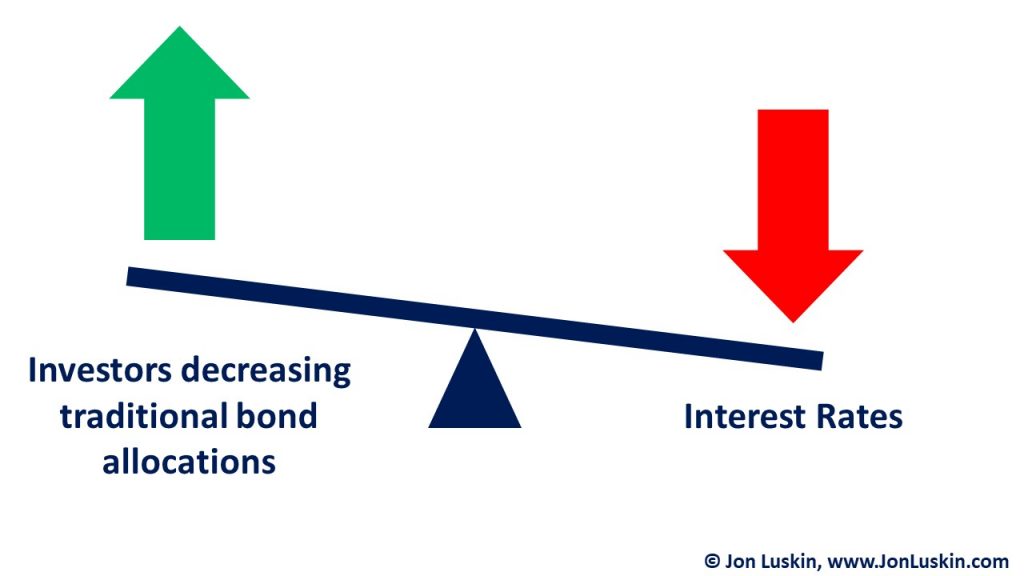

Alternatives to Get Income

In short, bonds are paying less real income than before. Given the decreasing investment returns of bond, investors and advisors alike are re-thinking traditional bond allocations; they are looking elsewhere for income. This has given rise to numerous alternatives to traditional fixed-income allocations, including

- high-yield (i.e. junk) bonds – despite their risk and inferior performance when paired with stocks to create a diversified portfolio;

- increasing a portfolio’s equity allocation (“75/25 is the new 60/40”) – again, risky;

- allocating to dividend-paying stocks – despite the strategy’s fallacy; and

- allocating to alternatives – despite the high fees and inconsistent performance.

In short, it’s hard to make a case for holding bonds based on the income generation feature alone; the income is no longer there.

Income is a Smaller, Less Tax-Efficient, But Stabler Investment Return

Speaking of income, what exactly is “income” anyway? Income is just a type of investment return, albeit (usually) a more stable, but less tax-efficient investment return than what is available with stock appreciation, real estate appreciation, etc. (“Usually,” because sometimes bonds underperform. A bond default can mean no income, and a poor investment return.)

Of course, such stability has a price: it’s no surprise that the investment return available with fixed-income is usually less than what can be had with stock market investing. At least, that’s the case more frequently when on relatively longer timelines. (And of course, the longer the timeline, the greater the frequency of stock market outperformance.)

| Feature/Asset Class | Stocks | Bonds |

| Income Generation | Sometimes | Usually |

| Appreciation | Usually | Sometimes |

| Tax Efficiency | Yes | No |

| Safety of Principal | No | Usually |

So, if we’re solely interested in an investment return – and nothing else – we would own stocks – and not bonds. That’s because stocks are better at providing an investment return than bonds – on average. However, while stocks do it better, bonds may be able to do it more consistently (but – as already mentioned – less tax-efficiently).

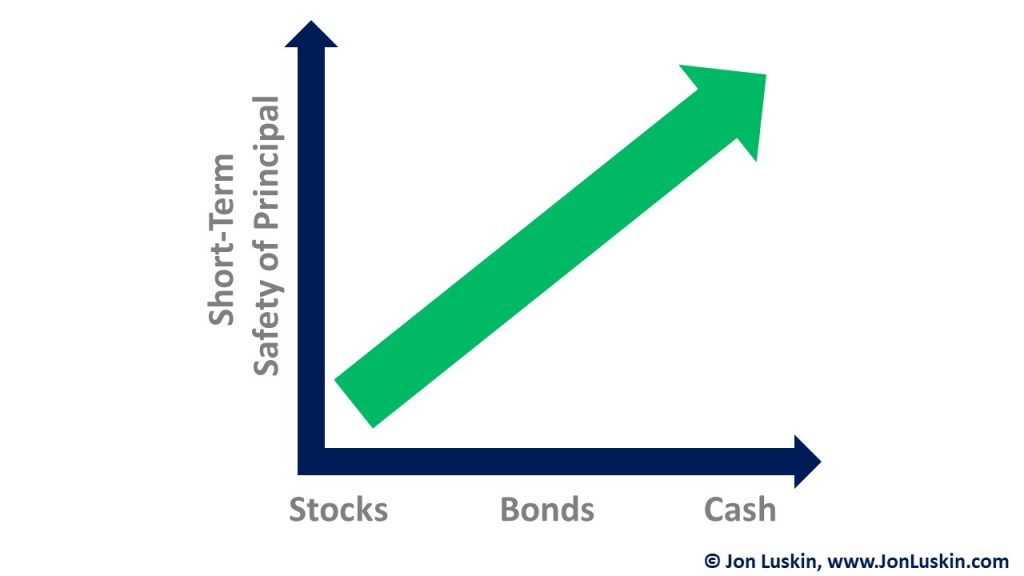

Bonds Offer Better Safety of Principal

You don’t need to read this to know that high-quality bonds – interest rate movements aside – are relatively safer investments than stocks, real estate, or alternatives. Whatsmore, bonds don’t need to generate income to offer that relative safety of principal. (Of course, all else being equal, receiving coupons is arguably better than not – tax inefficiency aside.) But, regardless of the size of the coupon payment, high-quality fixed income better manages the risk of stocks compared to alternatives – or even different types of stocks.

Given all this – that you don’t need interest payments from bonds to benefit from their relatively stability compared to stocks – it could be argued: it’s the relative safety of principal – and not the income – that makes the case for investing in bonds.

The relatively stable investment return (both any now-nominal coupon and relative stability of principal) of high-quality fixed-income exists as a diversifier against other riskier investments (stocks, real estate, or even alternatives). Said another way, just because high-quality bonds no longer pay a real coupon doesn’t mean it doesn’t make sense to still hold bonds! Of course, you still have to believe that high-quality bonds do indeed still offer some safety of principal given today’s interest rates.

Staying Focused on the Role of Bonds

High-quality bonds function as a better store of value than stocks – at least in the relatively shorter term. (Again, this turns a blind eye to the interest rate issue – which I promise I will get to farther down in this post. Just stay with me!) Of course, in the shortest term – where inflation is a non-issue – cash is the best store of value.

The Fallacy of Investing for Income

So, by now it could be argued that it’s quite clear that – as a portfolio diversifier – the value of bonds is in their relative stability of principal and not their coupon payment. Why is the stability of principal so important? To put the value of principal stability into perspective, consider the mindset (already touched on) of investing in dividend-paying stocks for the dividend. That strategy doesn’t work well for the investor who sees their principal investment (the stock price) decrease.

So, while it’s nice to receive a small cash dividend, the value of that dividend is dwarfed by the risk of principal loss. In short, the safety of principal is a big deal – with it having a big impact on total return. Investors who buy dividend-paying stocks for a 2% yield will likely be disappointed when a global pandemic cuts the value of their portfolio by more than 45%!

In short, the logic of investing for a coupon or a dividend – without looking at the safety of principal is short-sighted; that cash distribution is just a small part of the equation.

The Immeasurable Value of Bonds

In The Psychology of Money, Morgan Housel proposes that the true value of an emergency fund is immeasurable – and far beyond the paltry 1% a savings account may be paying. That’s because – he argues – that having cash savings prevents investors from having to sell stocks at a loss. Or, having a cash emergency fund prevents consumers from taking on personal loans at double-digit interest rates. So, while technically the interest rate on a savings account is small, it’s true value in preventing other poor money decisions from being made is immeasurable.

It’s the same with bonds. While yields near 0% or 1% look unattractive, the true value of bonds is immeasurable. That’s because bonds need not be examined in isolation, but in the contribution to – and impact on – the total investment portfolio.

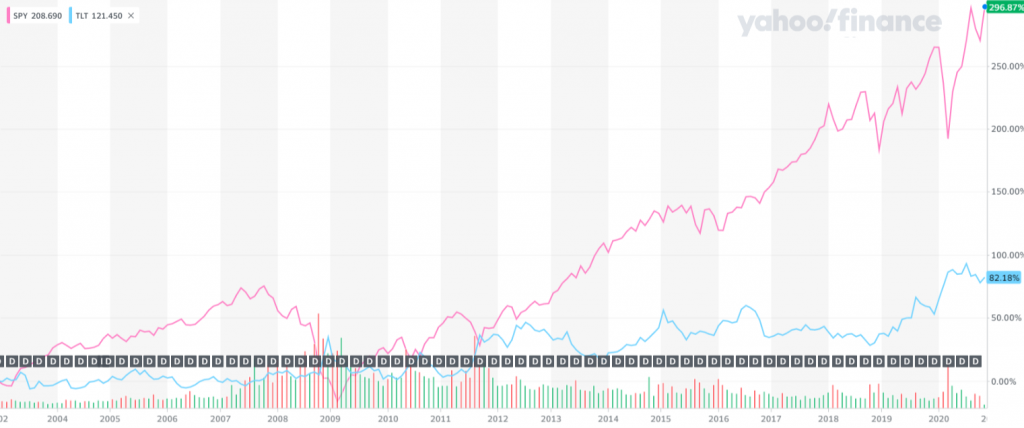

Modern Portfolio Theory

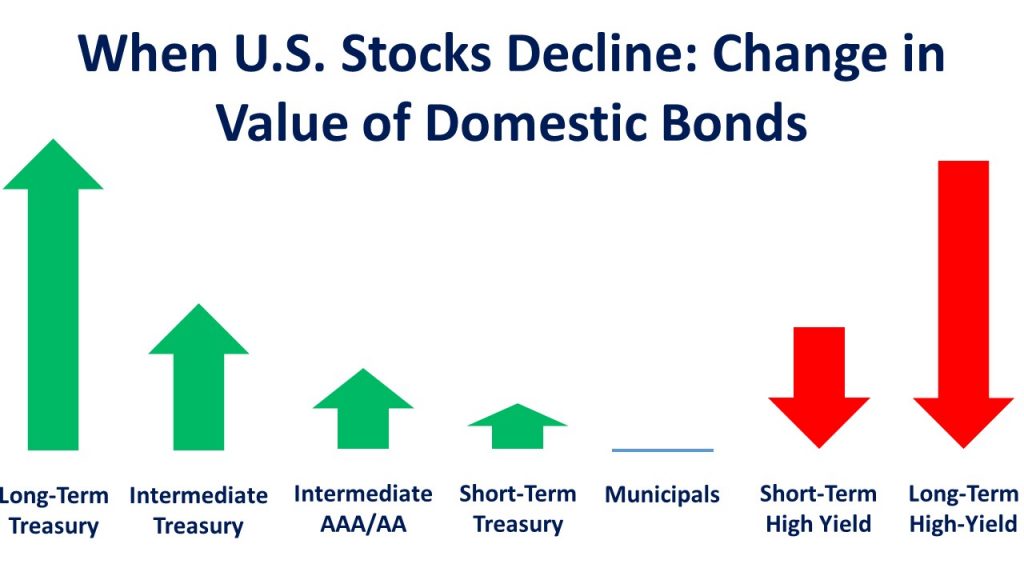

Modern Portfolio Theory (MPT) argues for pairing assets will low correlation to achieve the optimum risk-adjusted portfolio return. And pairing (certain) bonds with stocks does just that! The risk-reducing nature of U.S. Treasuries allows investors to do better when bonds are paired with stocks.

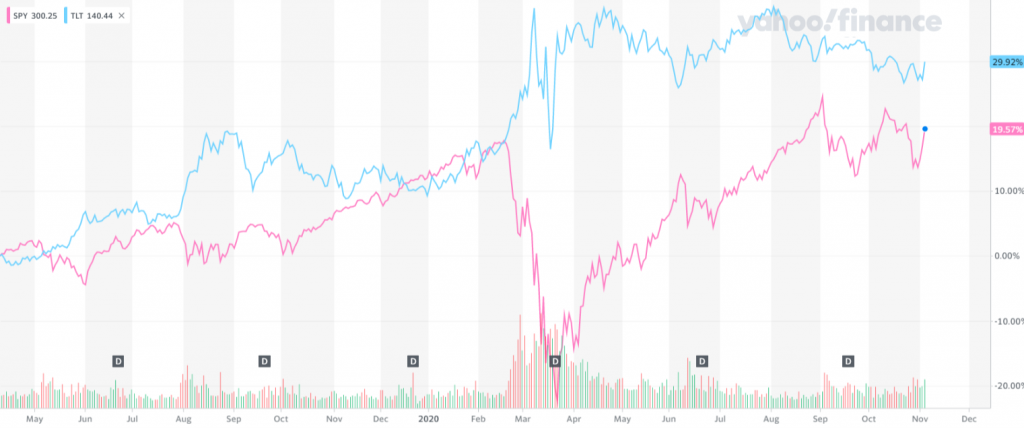

Look no further than the recent COVID-inspired market rout to see this in action: stocks go down, and Treasuries (on average) go up.

So, we could argue that we own bonds not because they offer income, but because they help us construct the best portfolio. Whether or not the income is there, the relative stability of principal is.

By this logic, if bonds – especially Treasury bonds, despite their low yield – still provide valuable protection against stocks, then it still makes sense to own bonds – especially Treasuries – today.

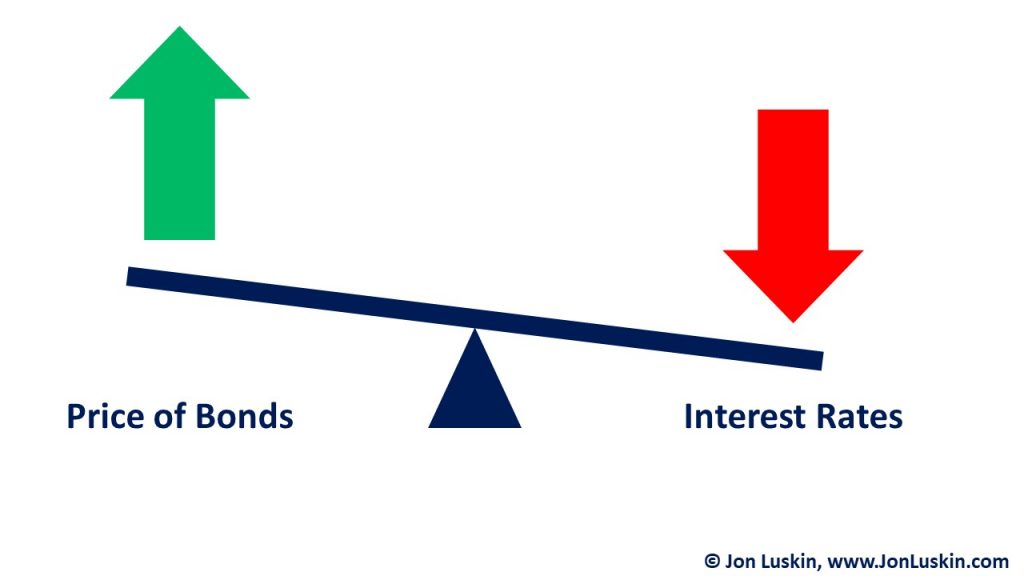

Interest Rate Risk

As promised: no argument for investing in bonds would be complete without touching on both risks of rising interest rates and the risk of inflation.

I’m fortunate enough to have been in the investment management space for seven years. And even since my early days in the field, advisors have been terrified of rising interest rates. Then – as with now – it may be a mistake to shun intermediate-term bonds because of the fear of rising interest rates. Is it really different this time?

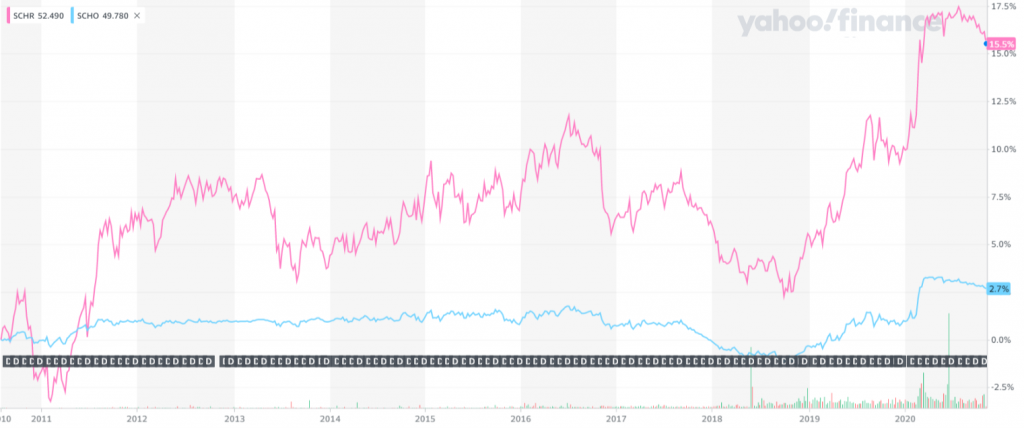

The Risk of Short-Term Bonds

Whatsmore, it’s not just the coupon you’re giving up when forgoing the term premium; investors shunning the term premium give up the pop (from negative correlation) that longer-term Treasuries provide when stock market rout. Shorter-term Treasuries offer diversification against stock market volatility. (If you have a relatively smaller stock allocation – and relatively large allocation to Treasuries – then shorter-term Treasuries may do the job.)

I>Inflation Risk

Could unanticipated inflation eat away at the return of fixed income, especially in today’s interest rate environment, and most especially on the smaller coupons of the higher-quality Treasuries? Of course!

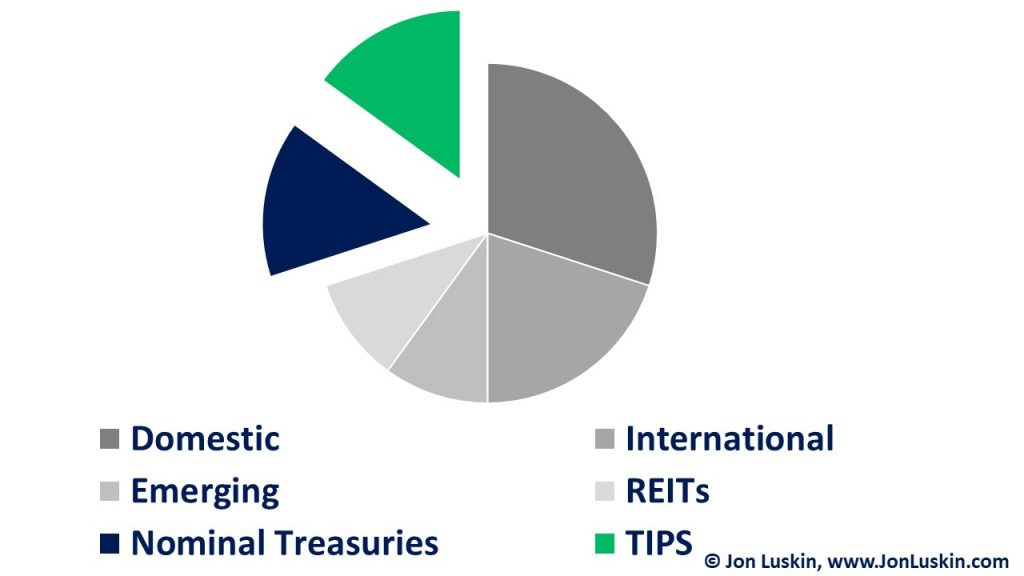

That’s why famed endowment manager David F. Swensen recommends holding not just intermediate nominal Treasury bonds, but Treasury inflation-protected securities (TIPS) as well. A 50/50 mix of nominal Treasuries and Treasury inflation-protected securities (TIPS) for a fixed income allocation allows TIPS to outperform given unexpected inflation, with nominal bonds outperforming if inflation is lower than the market priced into the securities.

This simple 50% nominal Treasuries and 50% TIPS allocation allows investors to hedge their fixed-income portfolios against inflation.

So, what do you think? Do high-quality bonds still deserve a place in your investment portfolio? If so, why – and what type of bonds? If not, why not?

Leave a Reply