Given International stocks have suffered twice as many bear markets than U.S. stocks since 1970, why do people invest in international stocks? In this episode of Stay Wealth San Diego podcast we discuss how come.

Financial Planning

Story People

Recently, I was wasting some time on the Twitternets. I came across the following exchange: Every single academic study ever done has concluded that REITs outperformed private real estate investment. – Dr. Brad Case — Blair H duQuesnay (@BlairHduQuesnay) June 21, 2018 Interesting. Please forward the research Not surprised though. More and more research is […]

Financial Planning Mailbag

You can hear all sorts of great financial planning questions answered on this week’s Stay Wealth San Diego podcast.

Assumptions

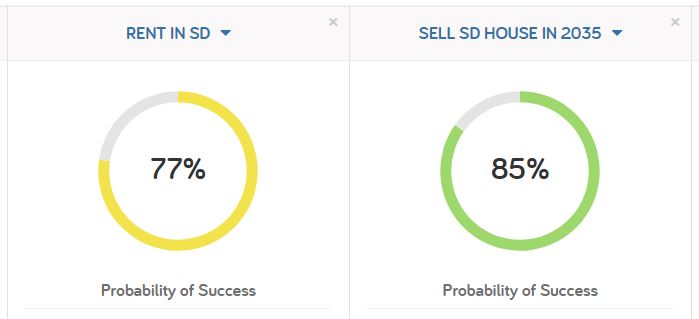

I recently ran the numbers on my own financial plan, using Define Financial‘s software of choice. A snippet of the results follow. I did this exercise because I wanted to know if it made sense to sell our house sooner rather than later. According to the financial planning software, there was a distinction. Apparently, I […]

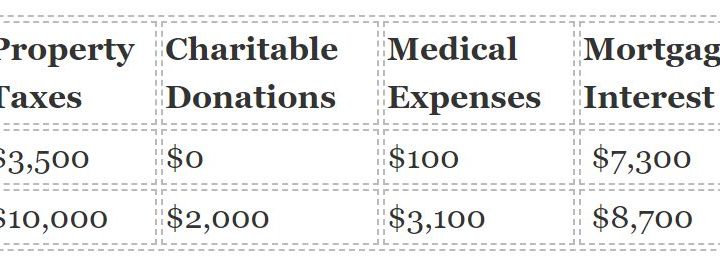

Tax Planning from Sheryl Rowling, CPA, PFS

Sheryl Rowling is a practicing financial advisor, tax ninja, and creator of Total Rebalance Expert (TRX). She gave a summary of the new tax changes at a recent quarterly meeting of the San Diego Financial Planning Association. Here are a few takeaways from her talk. Bunching Deductions in Alternating Years Bunching deductions is certainly not […]

Save More Money with a Roth

Roth vs. Traditional. It’s a debate as old as time. Well, not really – but it’s an important financial planning question. Most of the time, I’m a big advocate for the Roth for most people. How come? With a Roth, you literally save more money. Yes, but Jon, what about the optimal strategy where you […]