Prepaying a mortgage may no longer make sense. That’s because the Federal Reserve recently voted to raise interest rates, with further increases planned for later this year.

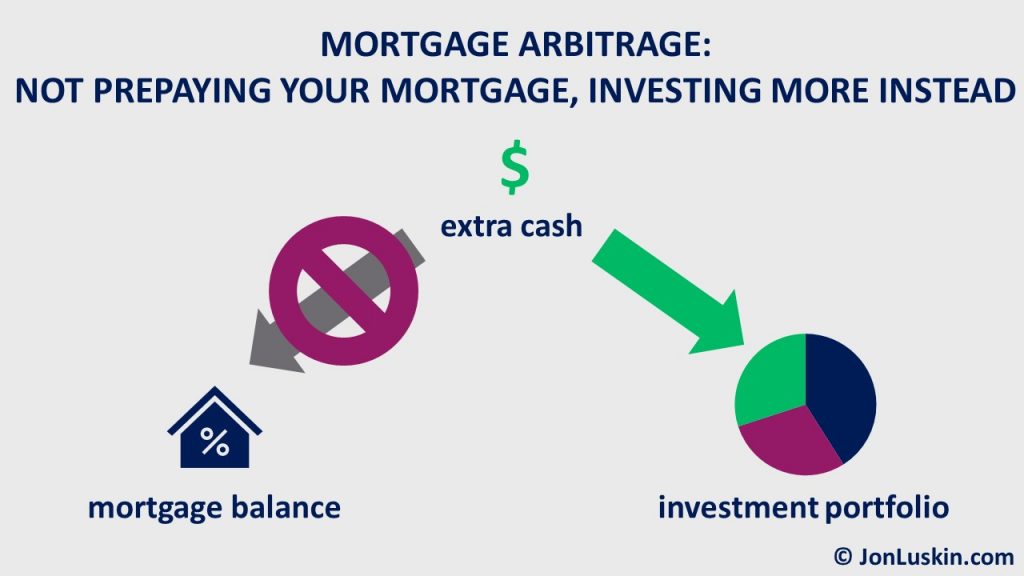

With increasing interest rates, investors might be able to profit from historically low mortgage rates. Yet, calculations are required to determine if mortgage arbitrage – making money by not prepaying a mortgage, but using extra cash to invest more instead – would be profitable.

Table of Contents

Mortgage Arbitrage During Rising Interest Rates

Interest rate increases add a wrinkle to the argument of prepaying debt—at least for those with bonds in their investment portfolio. Previously, the case for prepaying debt was simple: the interest rate paid on one’s mortgage was higher than the interest rate earned by investing in bonds.

Therefore, prepaying one’s mortgage in 2021 made sense. Otherwise, those investors would borrow at a higher interest rate (their mortgage rate) and then invest that money at a lower rate (when investing in high-quality intermediate-term bonds). That results in a negative guaranteed investment return, something no investor wants.

Sidebar: In this post, as elaborated in the following section, I compare mortgage rates to bond interest rates. To understand why I’m not comparing the mortgage rate to one’s total portfolio return, read this post on mortgage arbitrage, which explains the stock risk premium and risk-adjusted returns.

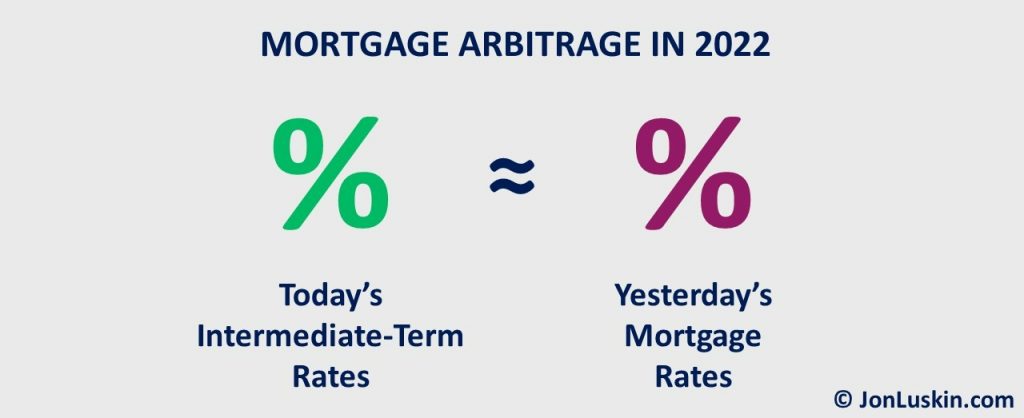

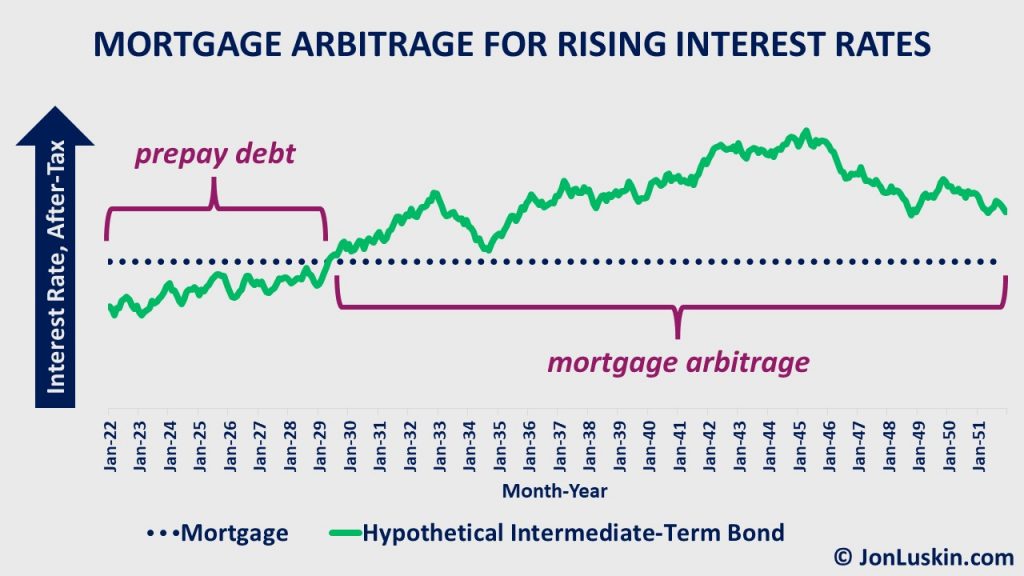

In 2022, the math of prepaying mortgage debt changes with changing interest rates. That’s because mortgage rates are (generally) fixed, yet bond rates can change daily.

Therefore, an investor who locked in an ultra-low fixed-rate mortgage yesterday may have a mortgage rate similar to what bonds are paying today. Those investors may be able to do mortgage arbitrage profitably – earning the difference between yesterday’s mortgage rates and today’s intermediate-term bonds.

Arbitrage Interest Rates—Don’t Take Credit Risk

Any investor doing arbitrage needs to be thoughtful about credit risk. (Credit risk is what you get when you invest in low-quality bonds). To be clear: the opportunity—and the subject of this post—is capturing the difference between yesterday’s long-term rates and today’s intermediate-term rates.

While investors might earn more when arbitraging with low-quality bonds, they’d be bearing credit risk. Moreover, the risk-adjusted return suggests that may not make sense.

Calculating the Value of Mortgage Arbitrage

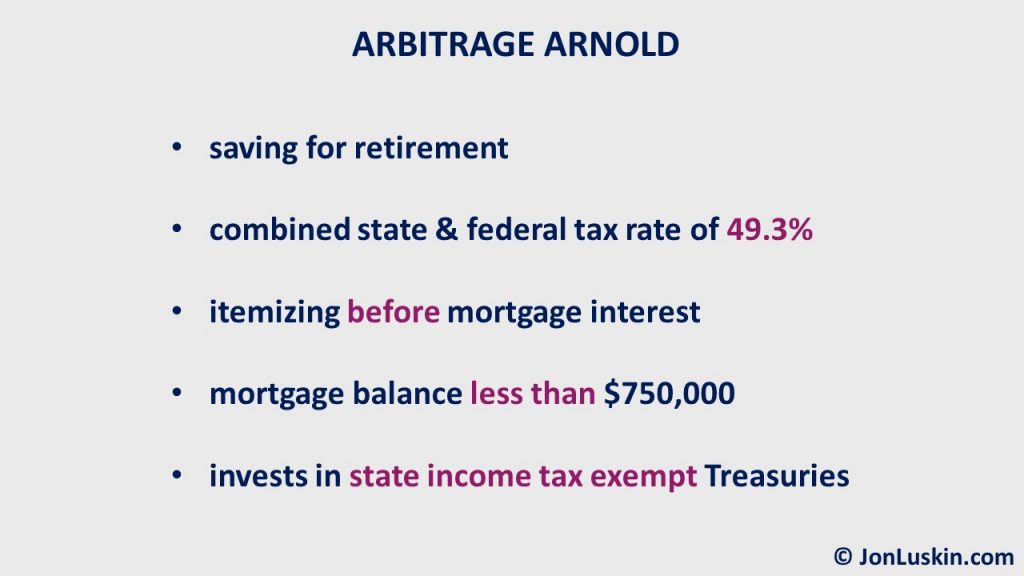

Consider an example: Arbitrage Arnold is saving money for retirement, continually adding to his investment accounts. He scored a 15-year mortgage rate of 2.15% in August 2021. Arnold is in the highest tax bracket in California, with a combined state and federal tax rate of 49.3%!

Given significant charitable deductions and state and local taxes, he’s already itemizing before deducting mortgage interest. His mortgage balance is less than $750,000. Because of Arnold’s circumstances above (already itemizing, etc.), he deducts every cent of mortgage interest paid on his taxes. Therefore, his post-tax mortgage rate is just 1.09%!

Of course, if Arnold’s mortgage interest is tax-deductible, then his bond interest is taxable. But if he invests in Treasury bonds, his interest income is exempt from California’s state income tax. (Interest from Treasuries is exempt from state and local taxes.)

As of this writing, Vanguard’s intermediate-term Treasury fund shows a 30-day SEC yield of 2.34%. After paying federal income tax of 37%, Arnold’s post-tax investment return is 1.47%. Ignoring the principal changes in a bond fund’s value, that yields an investment return of more than 1/3 of a percent (0.38%).

In short, Arnold’s after-tax record-low mortgage interest rate is less than his after-tax investment return on high-quality intermediate-term bonds. After taxes, Arnold can generate more cash by not prepaying his mortgage.

As noted above, the calculation assumes no further interest rate changes. With rates increasing, any bonds today will lose value. Yet, those investors holding their bonds long enough (generally longer than the duration of the bond fund) can make back that principal loss and then some by earning the higher interest rates on re-invested interest and principal. For Vanguard’s intermediate Treasury fund, that’s less than six years. Learn more here, here, here, here, and here (summarized here).

Should You Prepay Your Mortgage?

The above strategy works because Arnold:

- is making new contributions to his accounts,

- is itemizing before deducting mortgage interest, and

- scored a record-low mortgage rate

For Accumulators Only, Those Not in Retirement

Mortgage arbitrage generally only makes sense for accumulators, not those taking money out of their portfolios for living expenses. That’s because volatility (changes to an investment’s value) impacts one’s investment return if making distributions. Specifically, withdrawing from a portfolio during a market decline negatively impacts the investment return. In nerdspeak, that’s called sequence of returns risk, or sequence risk.

The Math on Mortgage Arbitrage: A Fully Tax-Deductible, Record-Low Mortgage Rate

Were Arnold not itemizing, this strategy would put him in the red. Similarly, if he’d obtained a record-low 30-year (not 15-year) mortgage, he would not have come out ahead.

Arnold has ideal circumstances for mortgage arbitrage. Yet, those circumstances won’t apply to most. For them, not prepaying their mortgages likely still generates a guaranteed negative investment return.

Waiting for Interest Rates to Increase for Mortgage Arbitrage

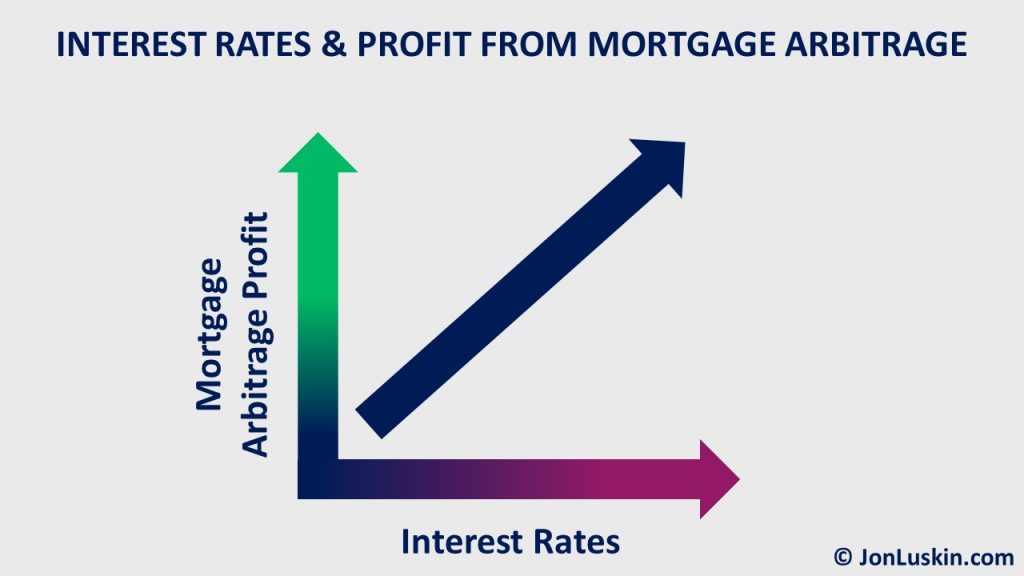

The Federal Reserve intends to increase interest rates further. This could mean that investors who cannot do mortgage arbitrage profitably today (because rates aren’t high enough) may eventually be able to. Said differently, if interest rates continue to increase, investors with less favorable circumstances (than those of Arbitrage Arnold) may still profit by not prepaying their mortgages in the future.

Future Interest Rate Increases Are Not Guaranteed

Delaying mortgage prepayments while waiting for further rate increases for mortgage arbitrage is speculative. Though interest rates are slated to increase, it’s not guaranteed.

Remember, the future is unpredictable. Consider that no one expected interest rates to decrease in 2020. In fact, for years, they were expected to increase. We can’t know for sure what will happen with future interest rates—especially given yet another COVID variant (BA.2).

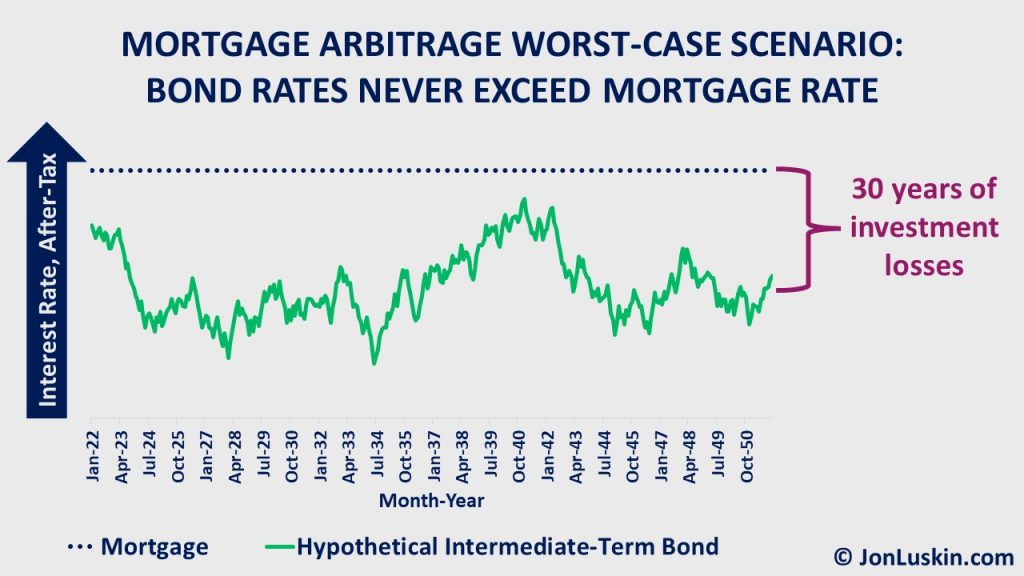

Moreover, not prepaying debt today in anticipation of increasing rates means losing money between now and whenever mortgage arbitrage becomes profitable. If rates never increase enough, it could lead to a negative investment return for the life of a 30-year mortgage!

A Mortgage-Paydown Strategy for 2022

Since we can’t know what will happen, those with mortgage debt and bonds in their portfolio (many investors) should run the numbers; spreadsheet out their after-tax mortgage rate and investment return on bonds.

In determining your after-tax mortgage rate, calculate the deductibility of your mortgage interest. If you’re not already itemizing before mortgage interest, pro-rate the deduction. (Some won’t be itemizing even after mortgage interest, given the doubling of the standard deduction under the Tax Cuts and Jobs Act.)

Consider federal, state, and local taxes in deducting your mortgage interest. Do the same for the investment return on the bond portion of your portfolio, accounting for federal, state, and local income tax. (If you’re investing in Treasuries, state and local income tax is a non-issue.)

Having made those calculations, if you can profit from not prepaying debt today, that argues for mortgage arbitrage. However, if you calculate that you’re still in the red after doing the math, prepaying a mortgage can still make sense.

You can re-run the numbers each time interest rates increase. If, in the future, you find that not prepaying is profitable given a further increase in interest rates, then making only the minimum payments might make sense.

Prepaying Debt is OK

Lastly, just because you might be able to get ahead by not prepaying debt doesn’t mean you have to do that. Prepaying a mortgage is more than reasonable. Prepaying debt not only guarantees an investment return equal to your mortgage rate, but also provides significant peace of mind. That peace of mind can be well worth any potential quarter-percent investment return.

For education and entertainment purposes only. Not specific investment advice. Confer with your tax and investment professionals before making any decisions.

Jon, I just discovered your great blog from Mike Piper. I liked your analysis of mortgage prepayment. I have an adjustable rate mortgage (5/1, 30 year) with intial rate of 2.2%. Annual max readjustment increase of 2 % with lifetime max increase of 6%. How do I go about analyzing the prepayment question with an ARM?

Hi Frank,

Thanks for your kind words.

In updating the framework above, mortgage arbitrages with an ARM will have two moving pieces (the investment return on bonds *and* a mortgage rate) – instead of just one moving piece, their investment return on bonds.

As always, this is for education and entertainment purposes only. Confer with your tax and investment professionals before making any decisions.

Best wishes,

Jon